Insights

Sustainable Investments: New Markets and Structures for Raising Capital

August 21, 2023

Sustainable managers, particularly those focused on illiquid alternative strategies, often seek out sources of permanent or semi-permanent capital. There are new markets for raising capital and trends in product structure that alternative asset managers may wish to consider. While these opportunities are not always widely known, they are already being utilized by a number of US sustainable managers to raise capital. One is the interval fund market in the US. A second is the London-listed fund market in the UK.

Kimberly Flynn, Managing Director of Alternative Investments at XA Investments, explained, "There are many advantages to both the London-listed fund and US interval fund for sustainable strategies. We spend a lot of time talking to asset managers about the pros and cons of each of these fund structures. A number of funds have launched in the US interval market which invest in sustainable infrastructure, real assets, or impact strategies."

XA Investments recently organized an event hosted by the London Stock Exchange Group (LSEG) at its New York Customer Center on July 25th, 2023, exploring these capital raising pathways for US sustainable managers. In an afternoon marked by extreme, violent storms battering New York - a sign of climate change? - Flynn was joined by panelists who have first-hand experience with these product structures and markets:

- • Wendy Huang, Senior Business Development Manager, Primary Markets Americas at LSEG

- • Kate Moore, Managing Director and Chief Operating Officer at TortoiseEcofin

- • Bob Zimardo, Partner, Investor Relations and Operations at International Farming

Panelists agreed that investor demand for sustainable strategies is growing, and managers are finding new ways to offer these strategies to investors. Yet both a London listing and launching a US interval fund involve nuances and complexities, which managers need to consider, and which require specialized expertise.

The London-listed fund market

The US-listed closed-end fund market is dominated by traditional asset classes and large managers, and IPOs are controlled by a syndicate of four large wirehouse firms. The London Stock Exchange (LSE), in contrast, is "a vibrant and robust market for smaller and middle market companies. We don't directly compete with the NYSE," said Wendy Huang of LSEG. "Companies are able to go public on the LSE at an early stage of growth, typically with lower cost, and under a more flexible regulatory regime."

The investor base differs between the two markets as well, with the investor base for UK closed-end funds being primarily institutional rather than retail, as it is in the US. Pre-IPO test marketing is also permitted in the UK. There are approximately 15 UK broker firms, and the target raise is smaller than that of a US-listed CEF. The appetite for sustainable strategies in the UK is well ahead of that in the US. "Over the last decade, the majority of new listings on the markets have been for alts, and nearly half of these involved sustainable strategies," Huang said. LSEG itself is supportive of sustainable strategies and is spearheading numerous initiatives related to financing the climate transition, including its Green Economy Mark and the creation of the Voluntary Carbon Market.

Kate Moore, COO of TortoiseEcofin, discussed her experience launching two London-listed funds and several US-listed closed-end funds. The manager's sustainable strategies are housed under the Ecofin brand, which is focused on three themes: climate, water, and social impact. Ecofin's first London fund is focused on listed infrastructure, and the more recent 2020-launched fund is focused on middle market, private equity investments in U.S. renewable energy assets. It aims to enable decarbonization efforts required for the energy transition by investing in long-lived renewable assets, such as wind and solar projects.

"When you put alternative and sustainable investments together, it made sense to explore a London listing," said Moore. She found that listing in London was less resource intensive than listing a fund in New York, requiring fewer people and meetings. Test marketing was useful too, providing helpful feedback prior to IPO.

Moore also found that the UK was further along the sustainability journey than the US. Placing private assets in a closed-end fund structure was well understood by the market, upfront expenses were lower in the UK, and growth in assets could take place via follow-on equity raises. And because the London market isn't dominated by a consortium of brokers, "we had more of a say in our destiny in terms of choosing a broker to get to market," Moore said.

TortoiseEcofin maintains a London office. "This is helpful to meet UK institutional demand but is not a requirement," Moore explained. "A lot of investors ask about your commitment level. They want to know your firm is engaged and value facetime with portfolio managers."

International Farming has also been exploring the London-listed fund opportunity. The firm is a specialist real asset manager focused on farmland and agribusiness, based in North Carolina and founded by a seventh-generation farming family. Bob Zimardo, Partner, Investor Relations and Operations at International Farming, said, "Farmland is a nearly $4 trillion industry which is only 1% institutionally owned. Farm families are aging out and the next generation isn't as interested in farming. The opportunity is a massive natural turnover in land. We need the ability to partner with farmers to secure food responsibly for a growing population and do so in a sustainable manner. Our thesis is to bring our expertise to that strategy and provide that opportunity for the investment community."

International Farming already offers private commingled funds but wanted to bring its investment strategies to a broader investment audience, Zimardo said, hence London. "Through conversations with XAI and other market participants we learned there was an opportunity to scale our farmland strategy. We are making an investment on the assumption of being a London market participant for the long term through an eventual IPO."

Listing in London brings with it an entire set of required new partners from brokers to legal to public relations. Zimardo said, "We relied heavily on XAI with respect to selecting the best partners. We spent a lot of time on upfront due diligence when deciding whom we would partner with. Without an advisor we would have had zero chance with our existing resources." (Both International Farming and TortoiseEcofin have used XAI's consulting services.)

The US interval fund market

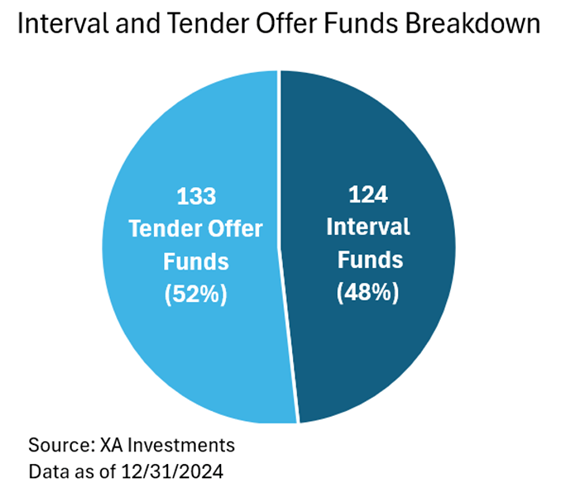

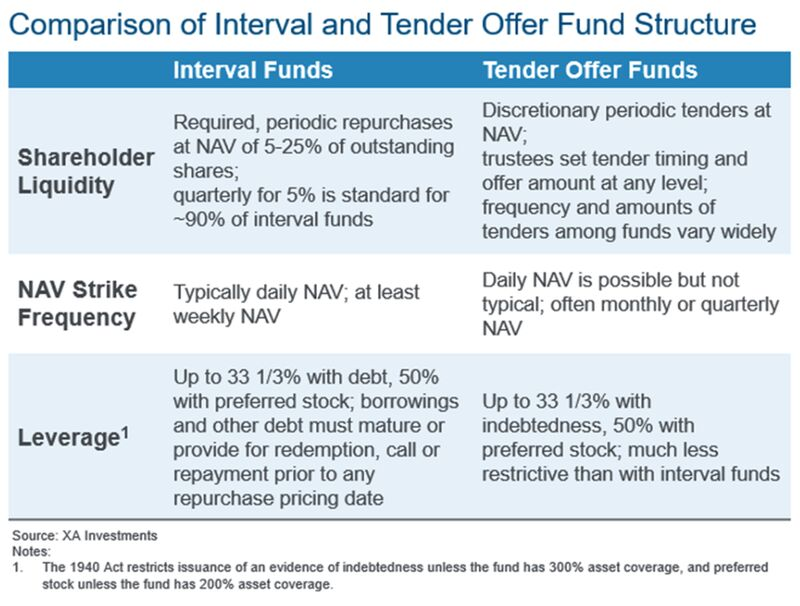

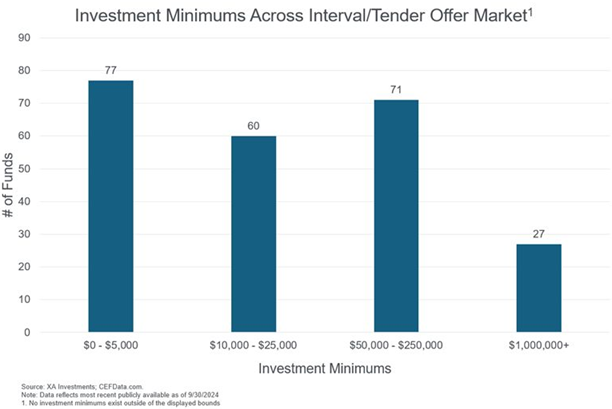

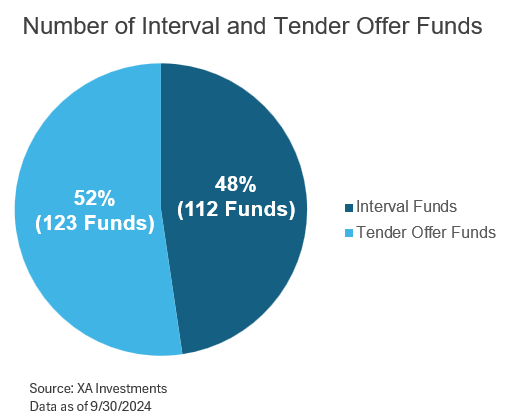

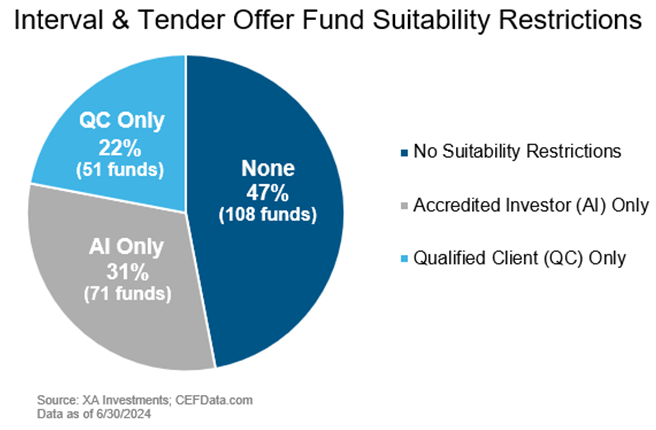

US interval funds are another promising pathway for sustainable managers to raise capital. The fund structure is well-suited to illiquid strategies which cannot be housed in mutual funds. The investor base tends to consist of RIAs, family offices, and smaller institutions. Investors receive liquidity via a quarterly tender, unlike listed closed-end funds, which are exchange traded.

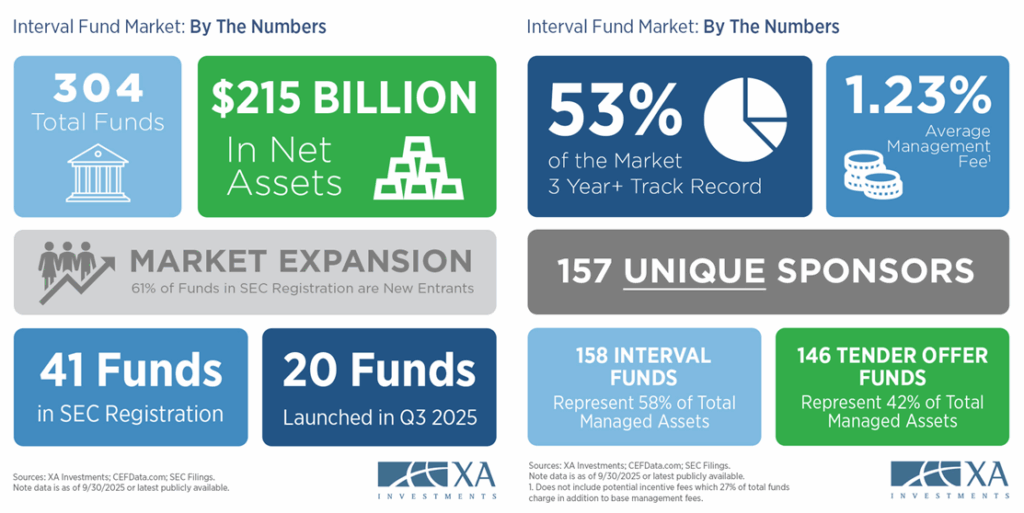

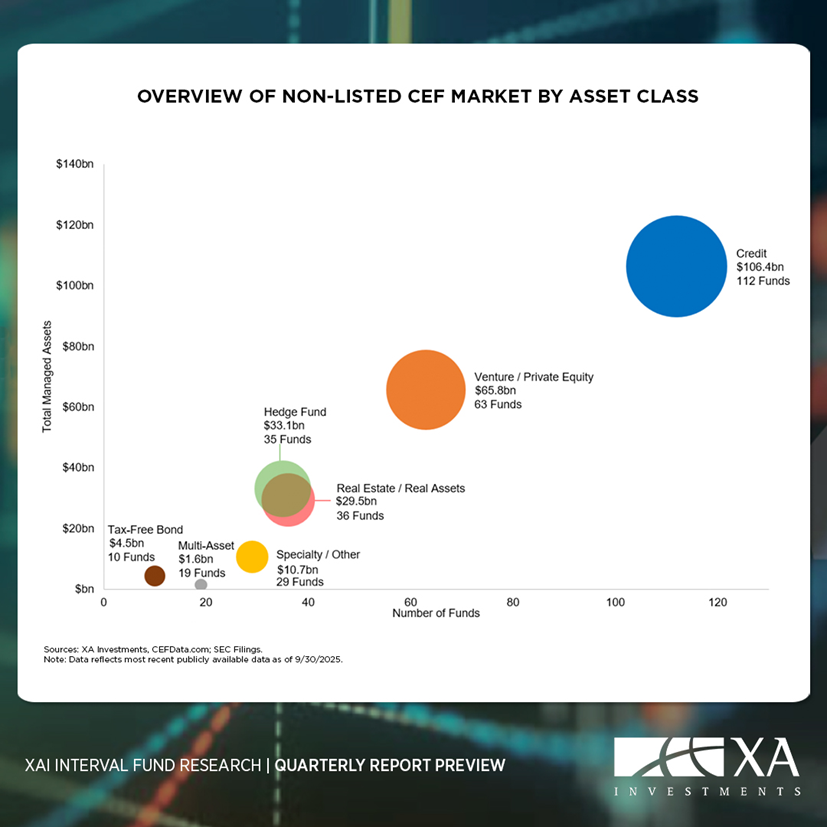

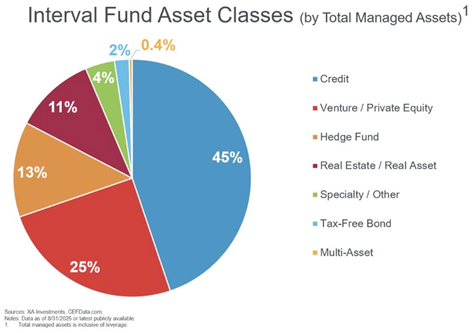

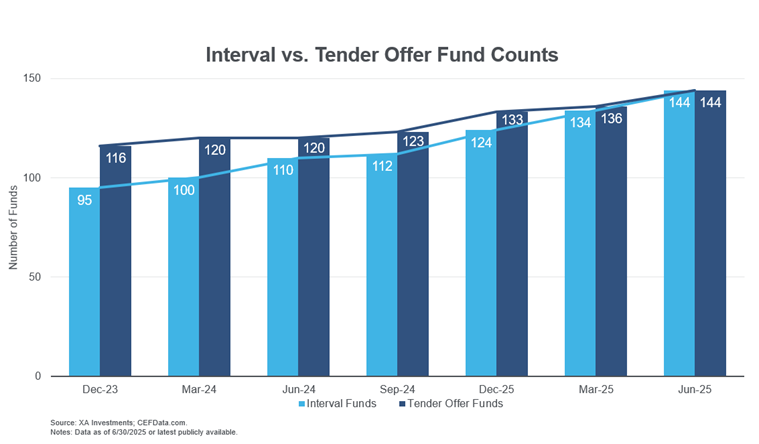

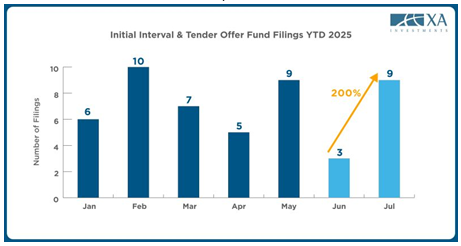

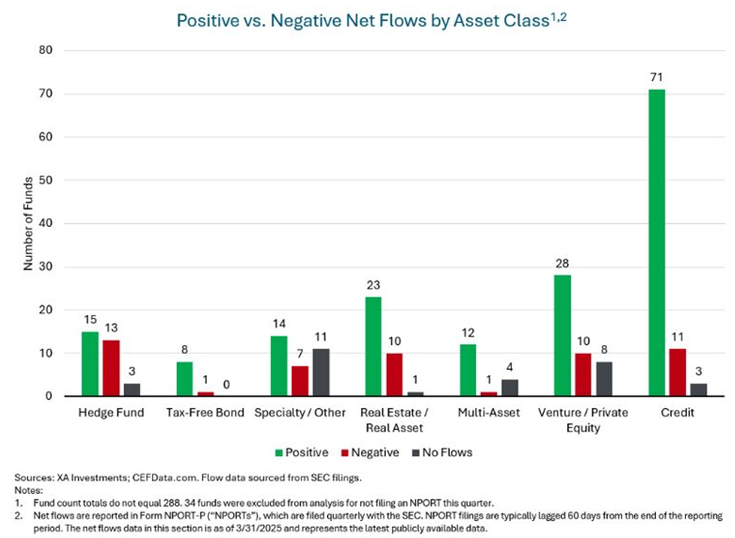

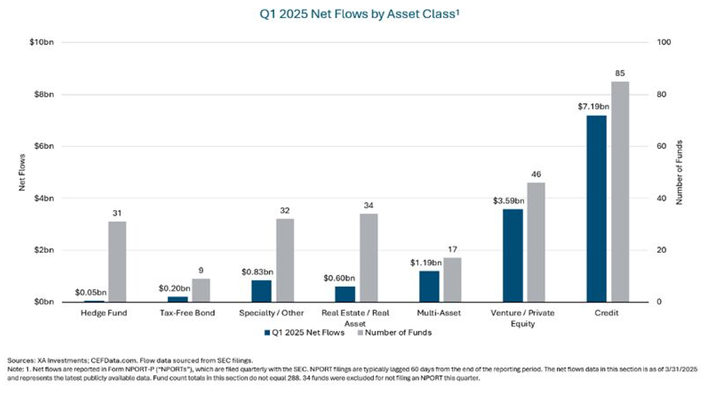

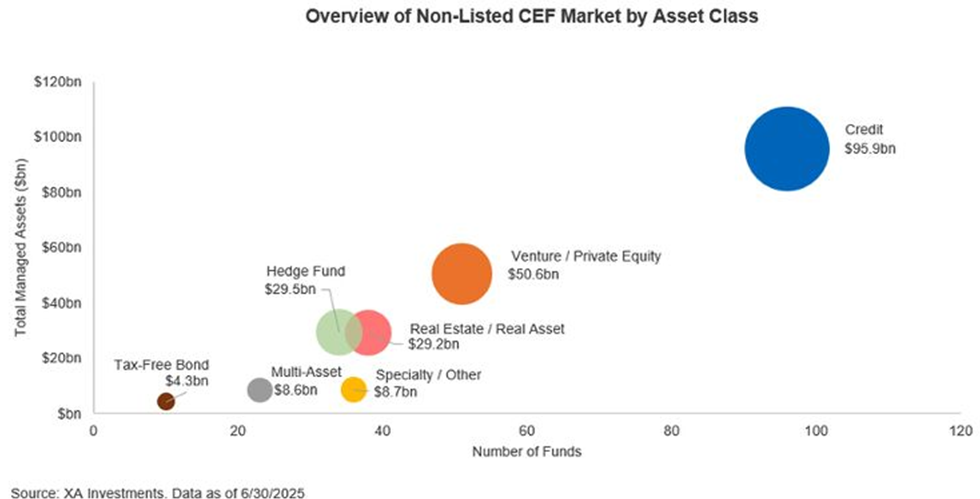

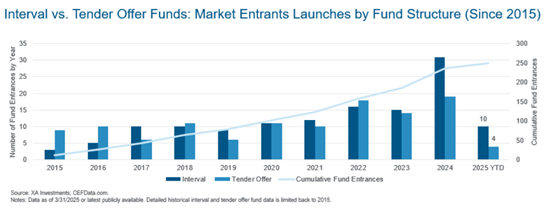

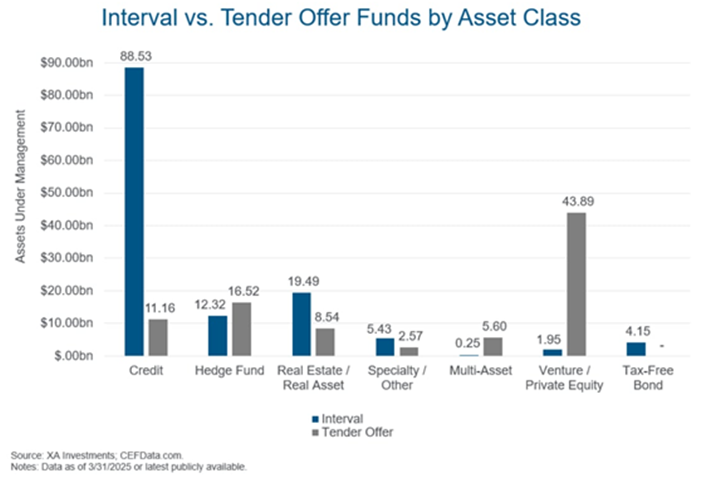

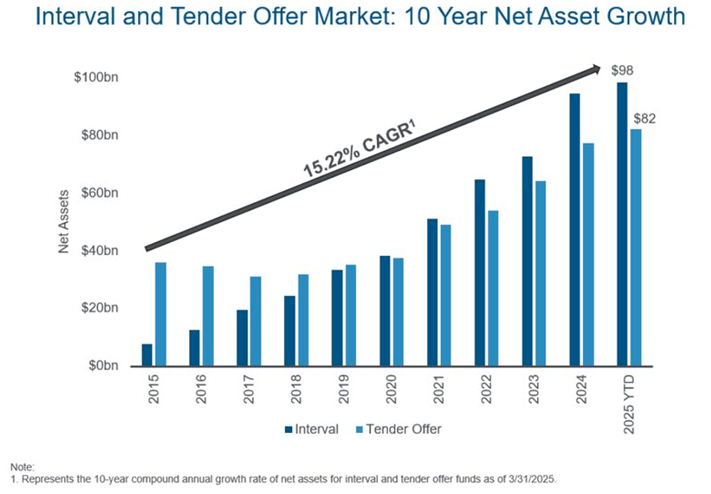

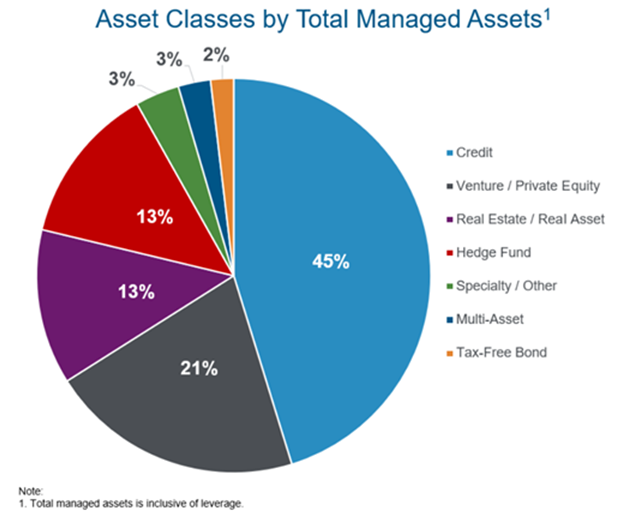

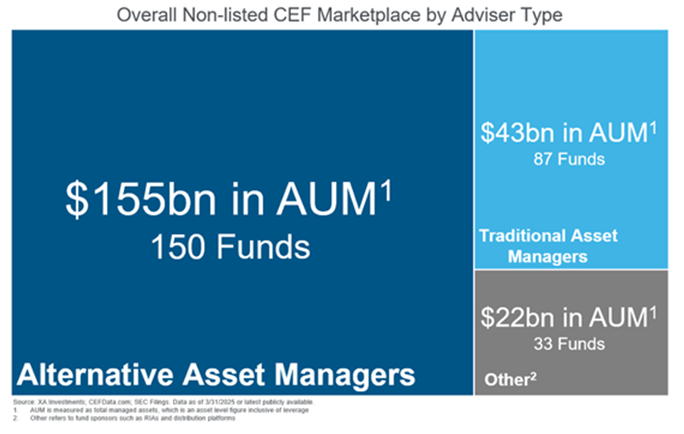

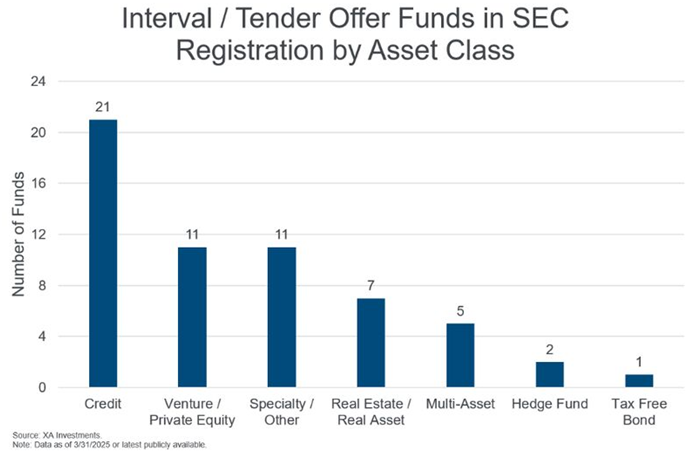

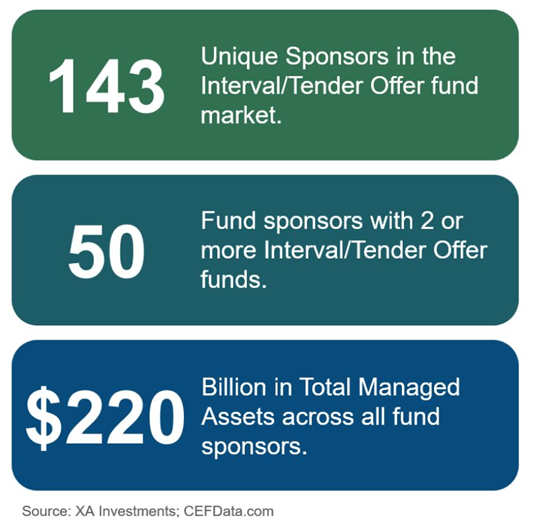

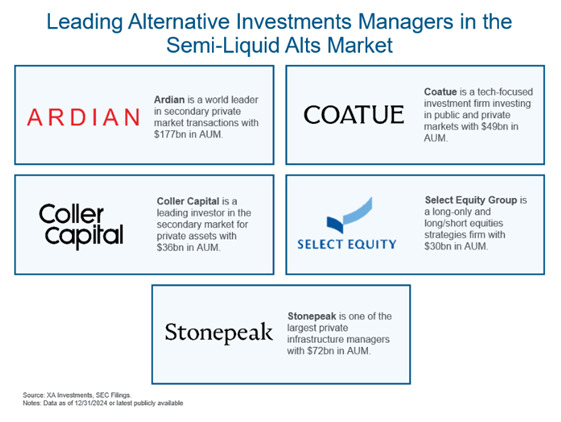

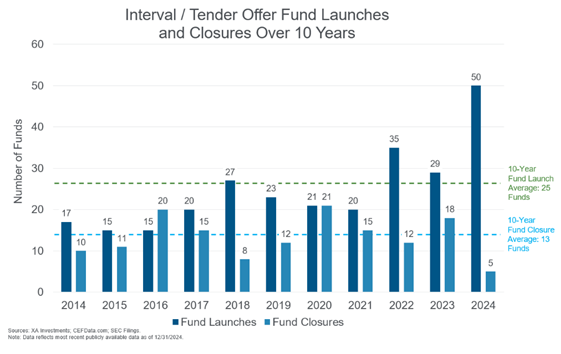

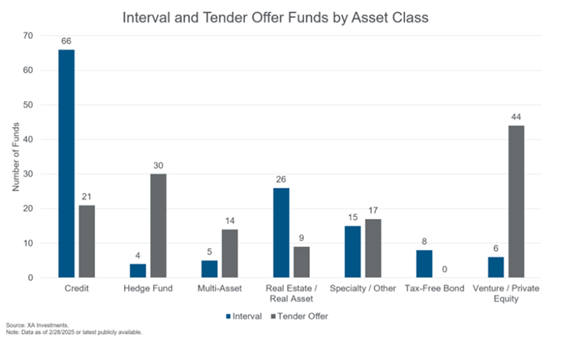

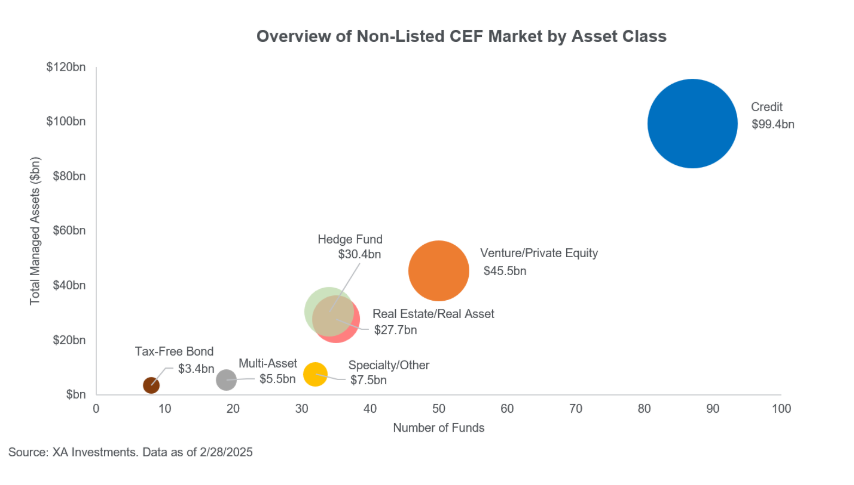

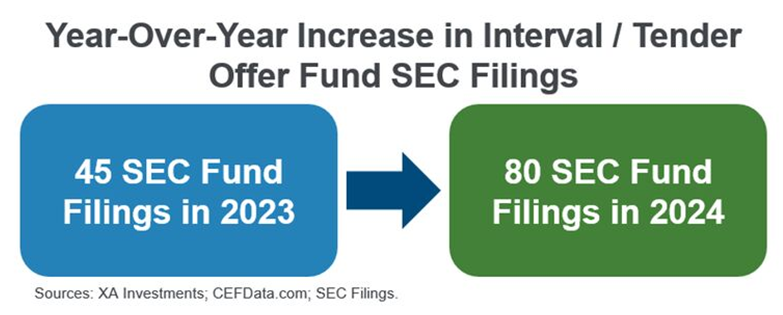

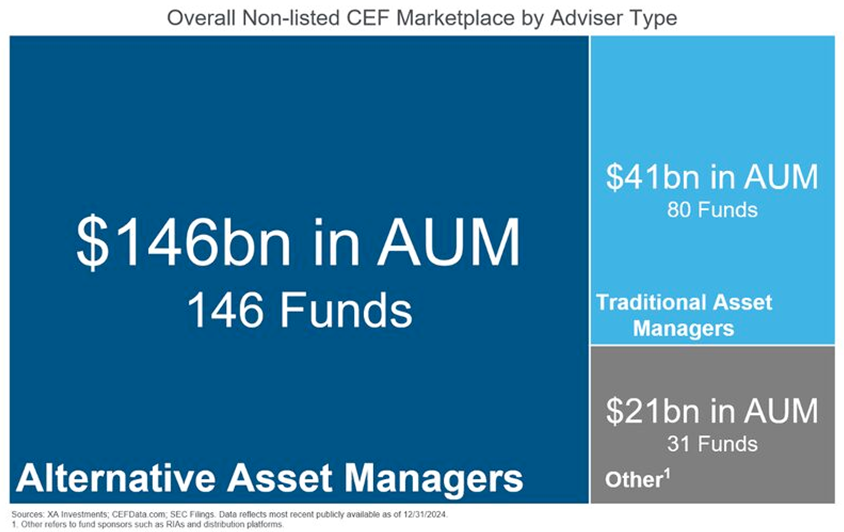

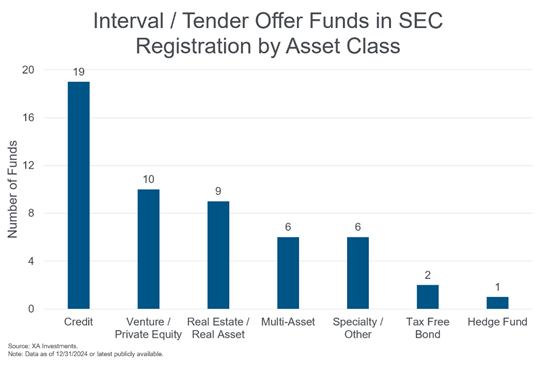

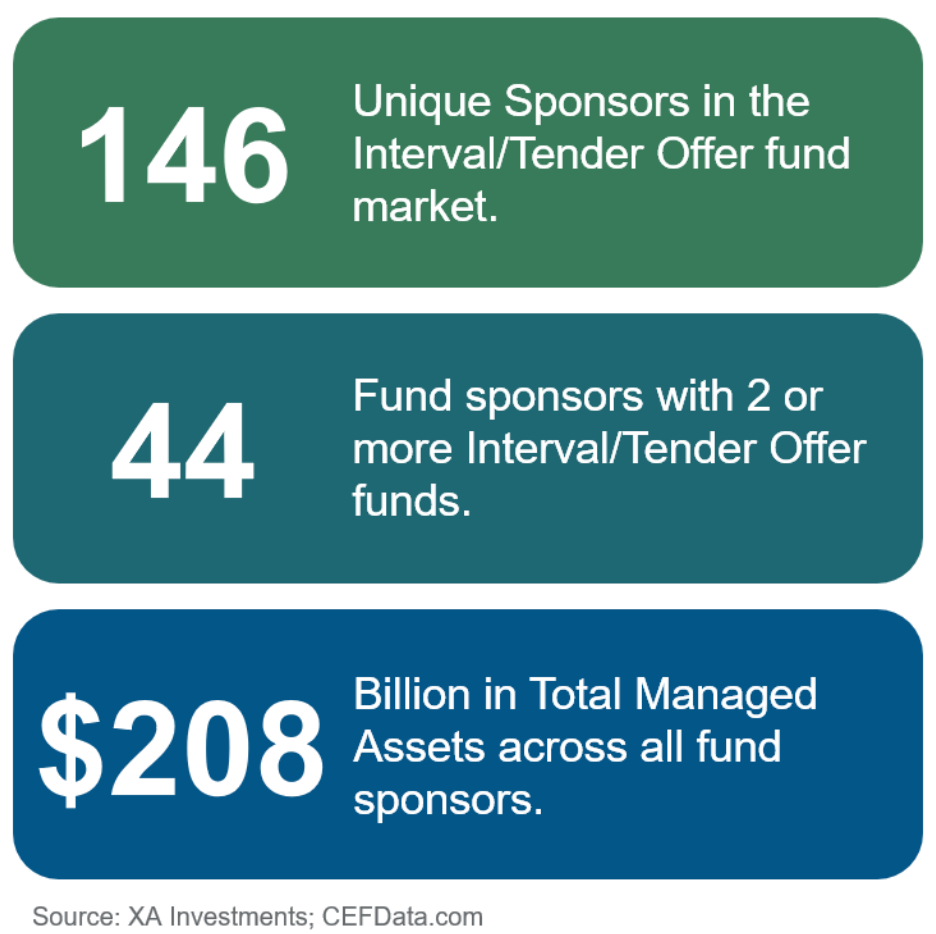

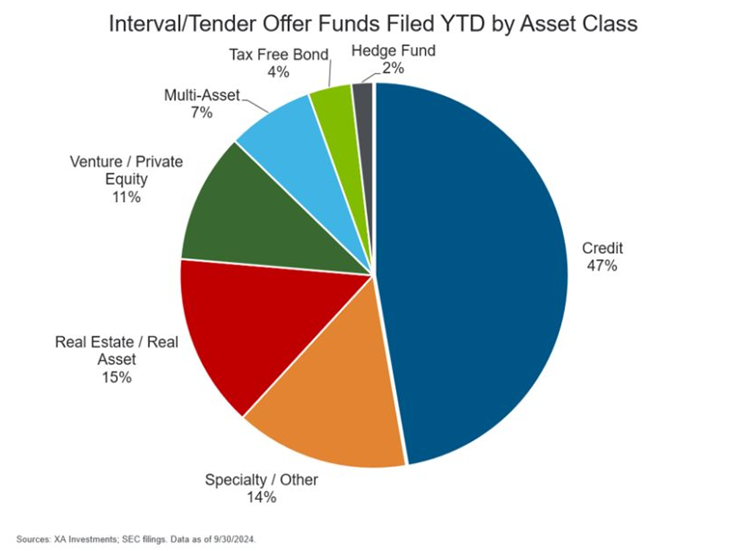

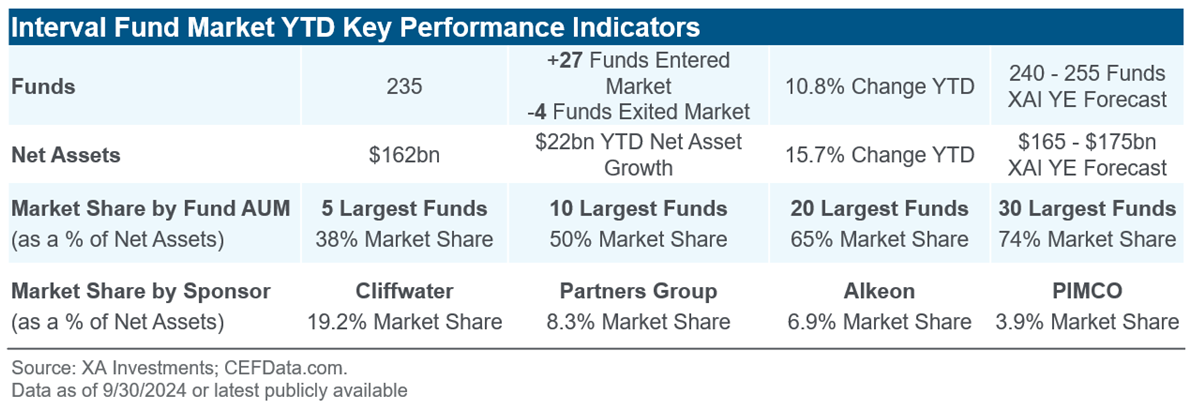

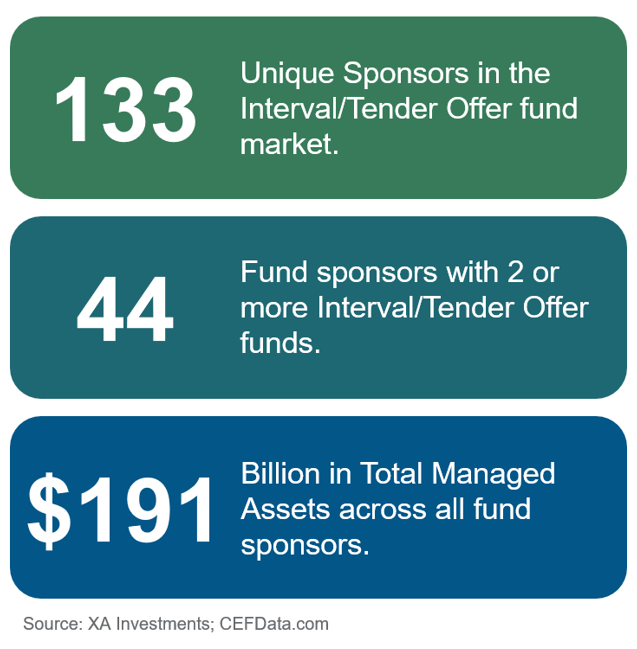

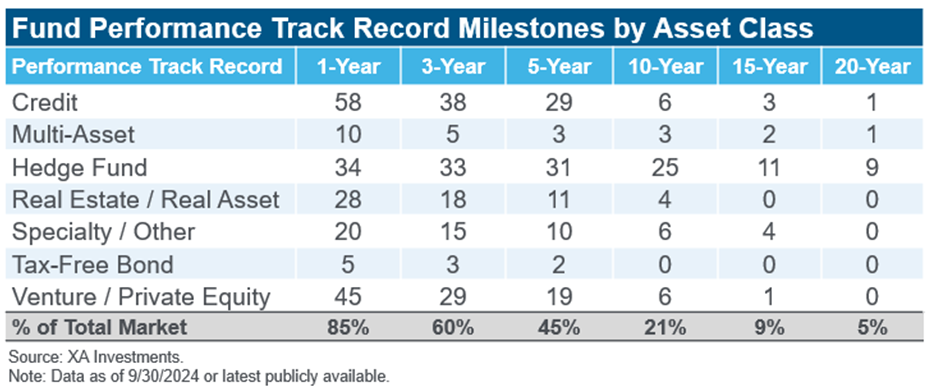

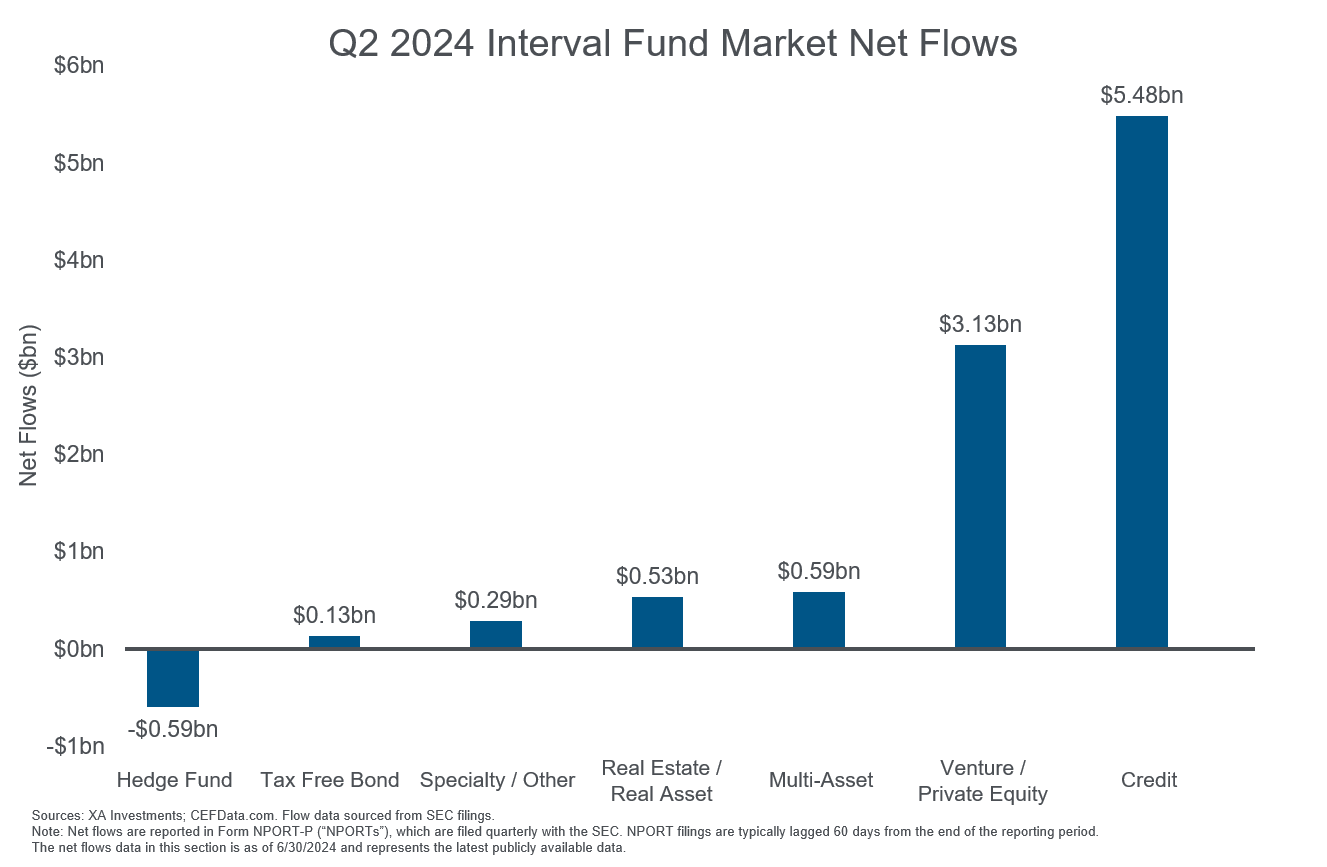

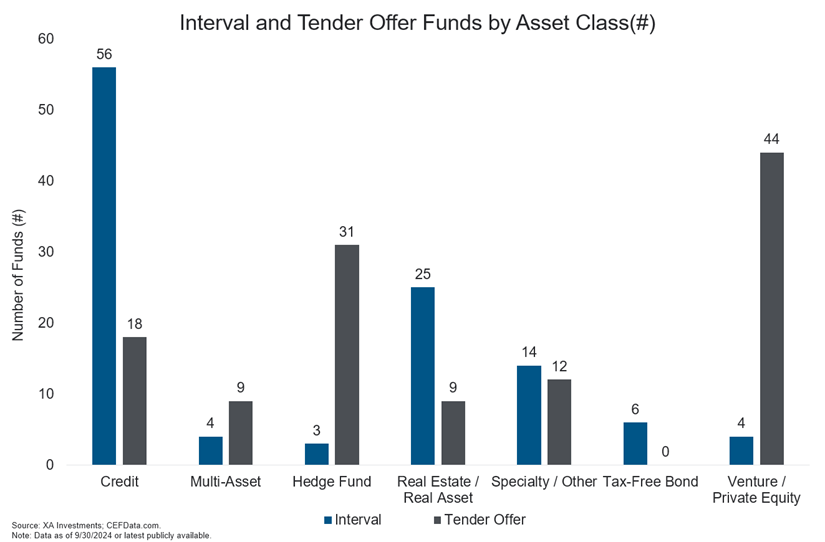

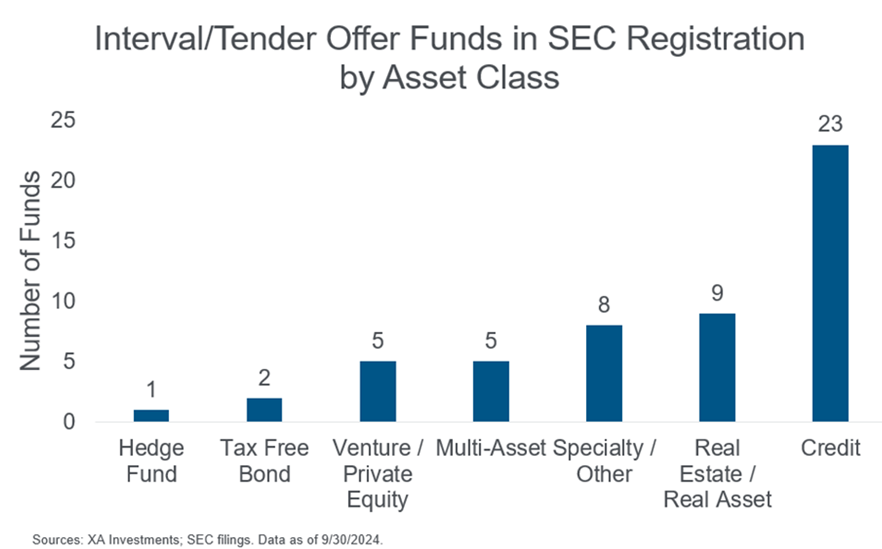

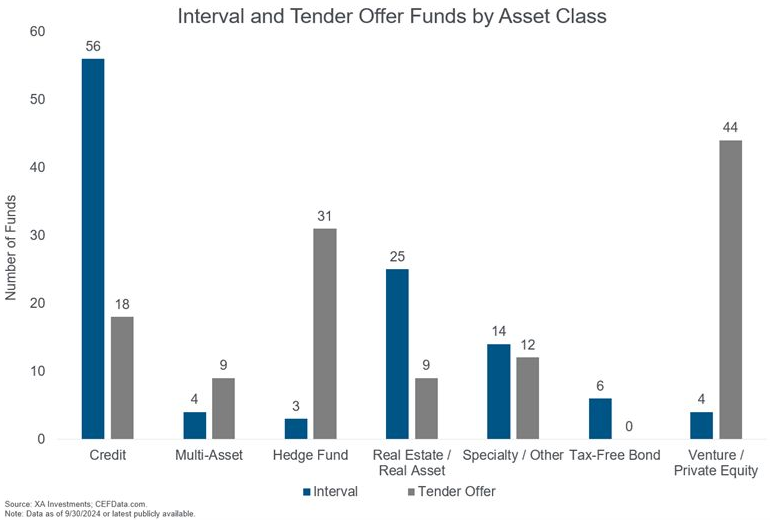

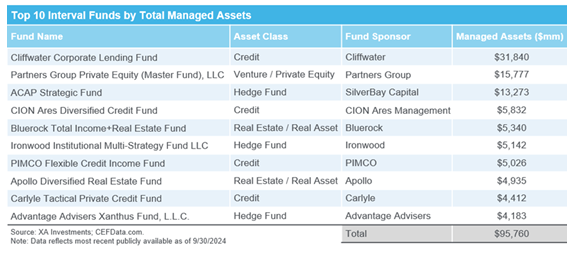

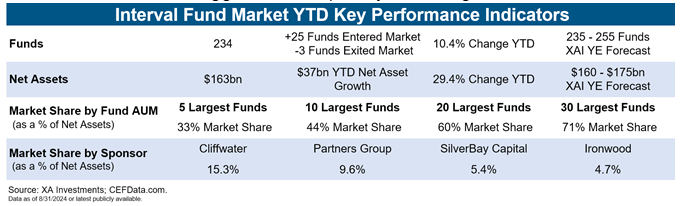

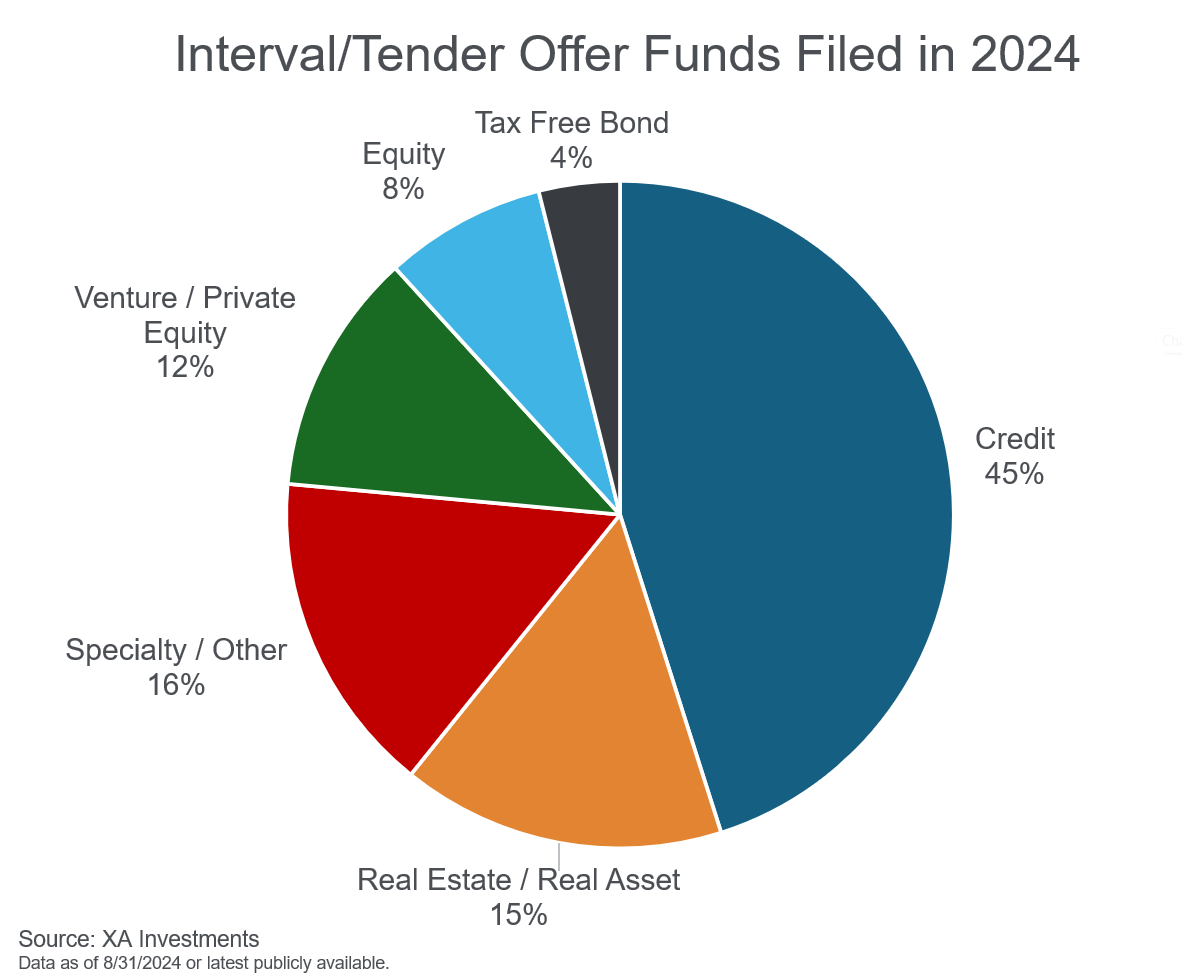

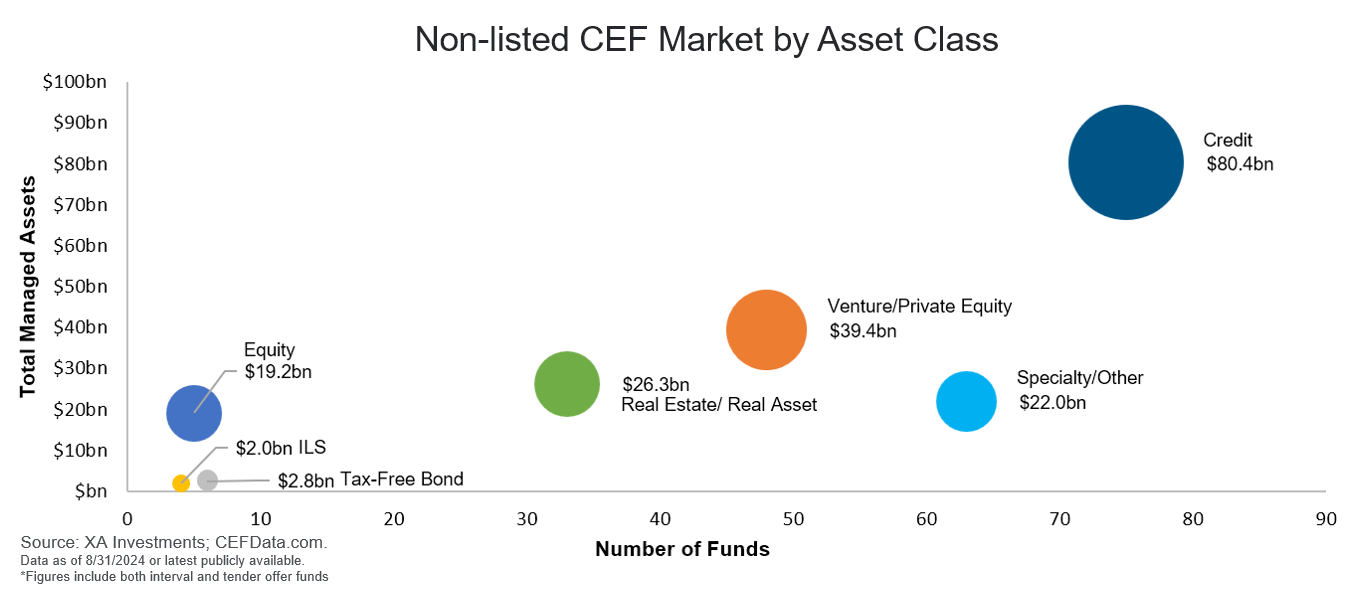

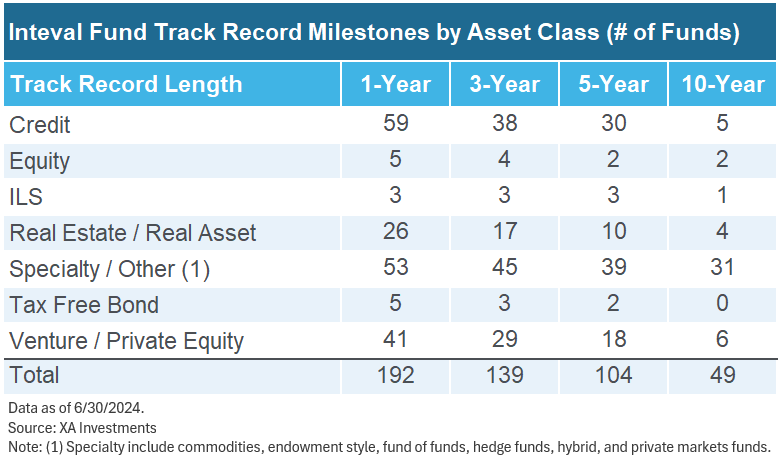

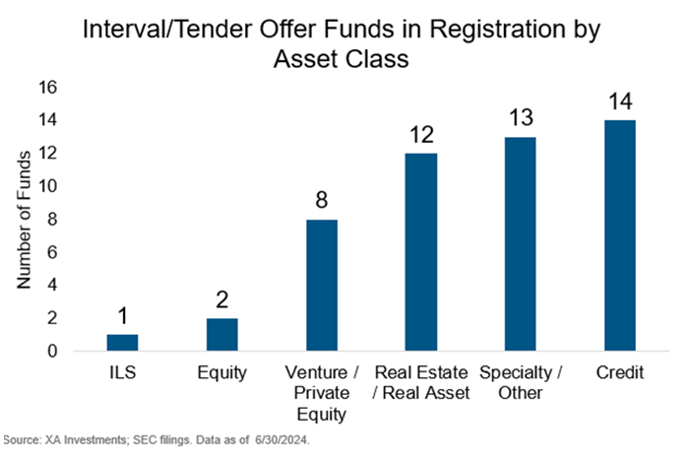

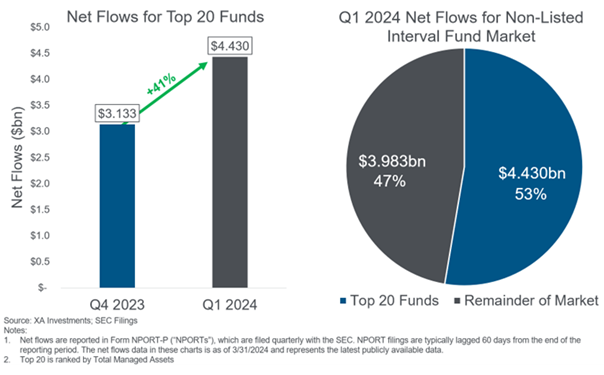

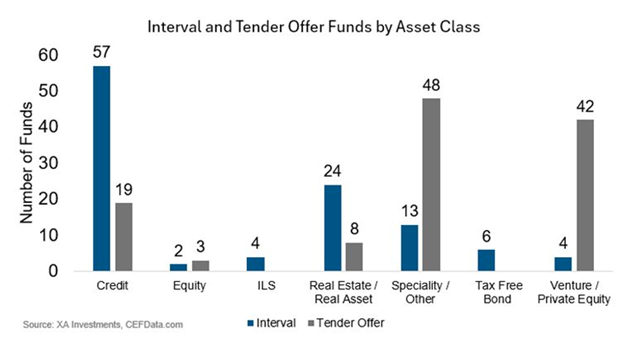

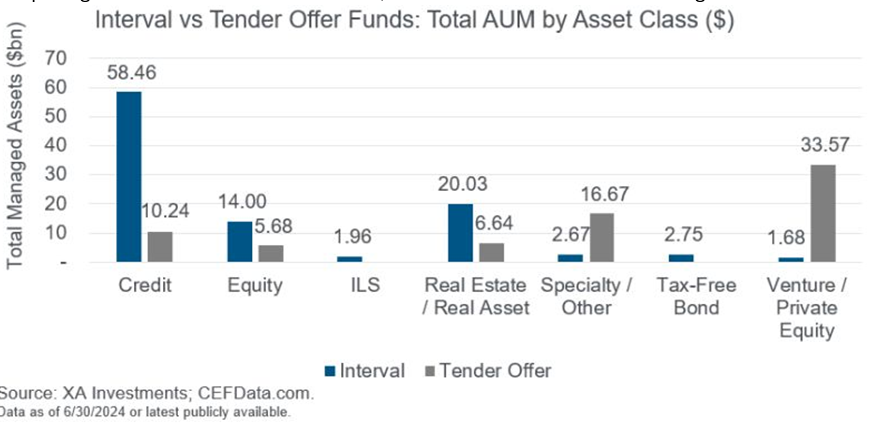

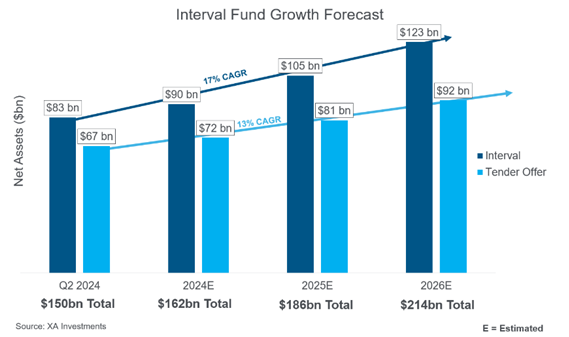

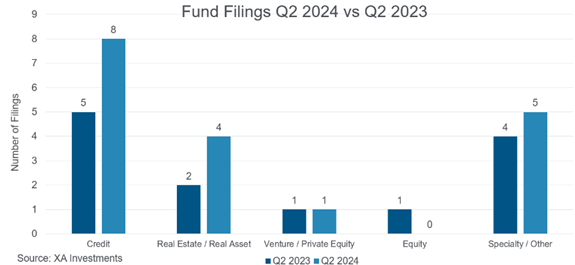

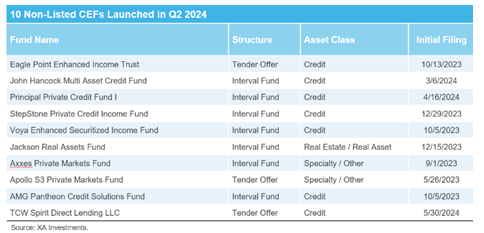

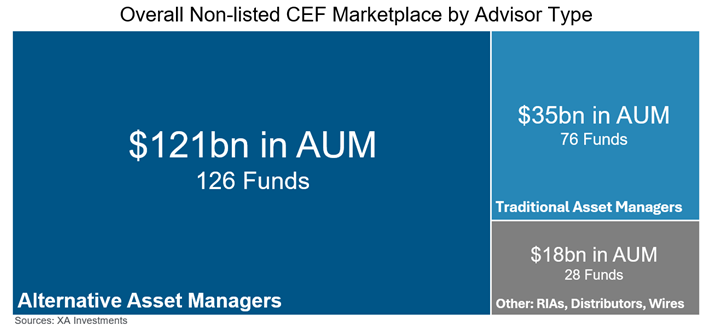

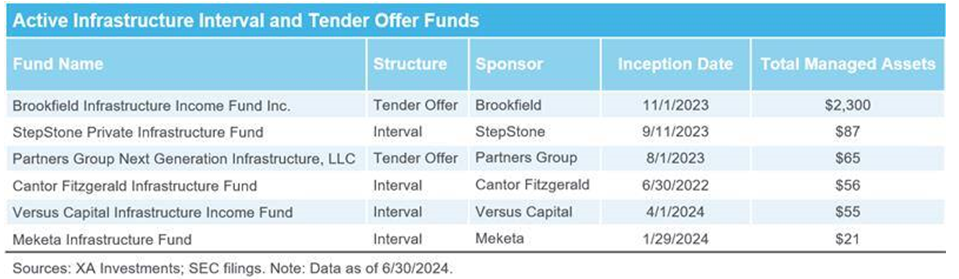

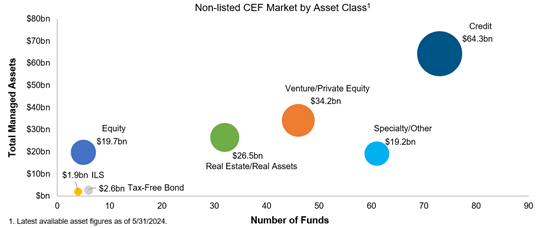

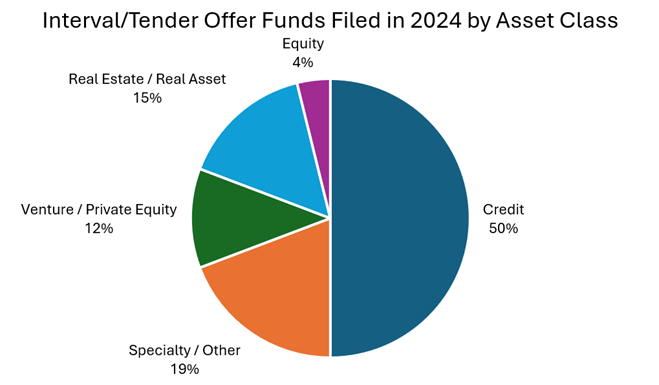

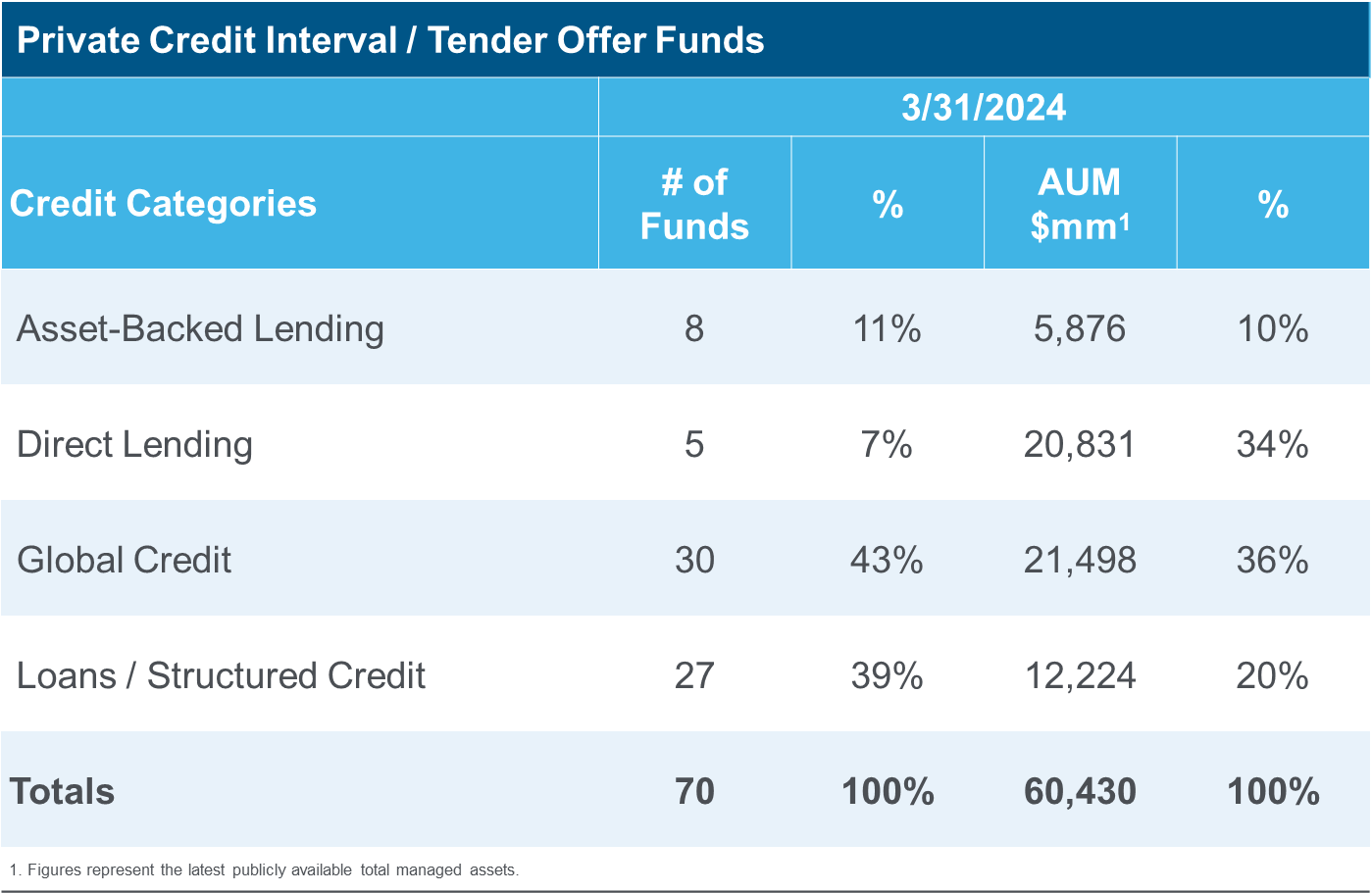

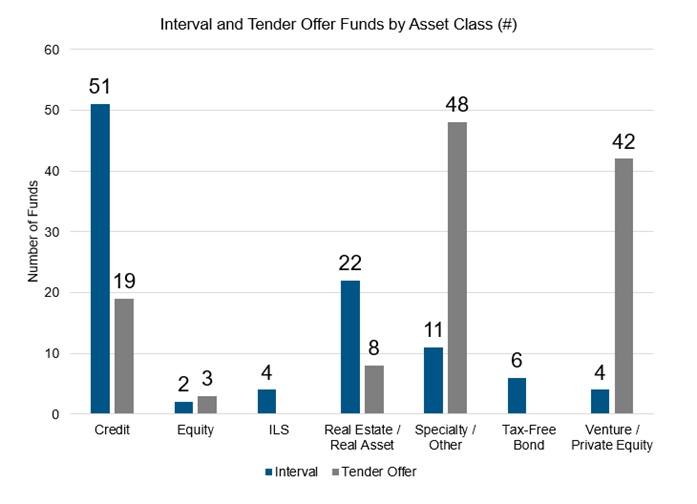

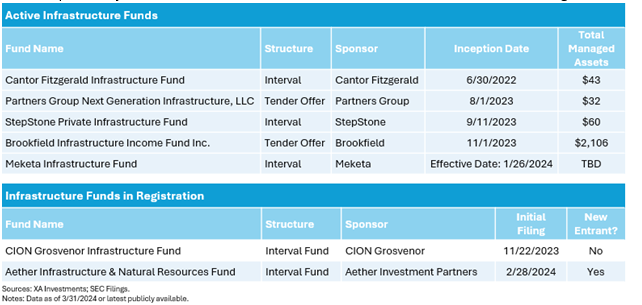

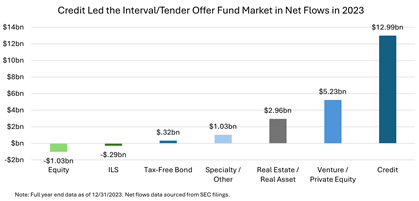

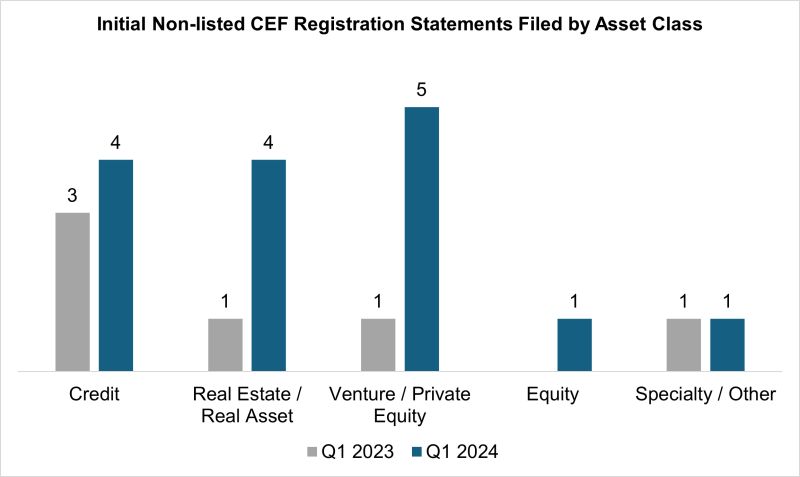

Flynn noted that not only has the US interval fund market been growing rapidly, but also an increasing number of managers are offering sustainable, alternative strategies using the interval fund structure. "In the interval fund market in the US, the focus has traditionally been on credit or real estate strategies. For the first time, we are seeing a focus on sustainable or impact strategies. This is a growing market."

Moore explained some of the differences from a manager's perspective between US interval funds and listed funds. "Seed capital is always important, but even more so in an interval fund. The interval fund involves more operational complexities, the prospectus is more involved, and it requires an independent board."

With the US-listed closed-end fund market largely closed for new IPOs, it may benefit sustainable managers to consider the interval fund pathway to raising permanent capital.

Decisions... decisions...

The New York and London IPO markets are driven by capital markets and will periodically close. In contrast, the interval fund market is always open. Flynn says, "It takes 6-9 months to launch a listed IPO and you have to plan ahead. You have to get it ready and wait for the right moment, whereas the interval fund market is evergreen in nature."

Listing in London or launching a US interval fund are often unfamiliar pathways for US managers attempting to raise capital. The regulatory, product and market knowledge required is immense. It is therefore important that managers partner with a firm who has expertise in each market and who can further advise on the best structure for a specific strategy.

XA Investments, through its registered closed-end fund structuring and consulting practice, serves clients in engagements ranging from full product builds to marketing services. XAI provides full product launch services, including management of the fund development, regulatory and board approval, distribution planning and offering timetable. XAI has expertise in registered closed-end funds including U.S.-listed CEFs, interval funds, tender offer funds and London-listed funds.

Disclaimer

The information in this publication is provided as a summary of complicated topics for informational and educational purposes and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such.

Illiquid investments are designed for long-term investors who can accept the special risks associated with such investments. Interval and tender offer closed-end funds are not intended to be used as trading vehicles. Unlike open-end mutual funds, which generally permit redemptions on a daily basis, interval and tender offer closed-end fund shares may not be redeemable at the time or in the amount an investor desires. Listed closed-end funds frequently trade at a discount to the fund's net asset value. All investments involve risks, including loss of principal. Investors considering an allocation to alternatives should evaluate the associated risks, including greater complexity and higher fees relative to traditional investments. Investors should carefully weigh the diversification benefits, expected returns and volatility of alternatives relative to traditional investments. Investments in alternatives involve risks, including loss of principal. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this publication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions.

This publication may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell and buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client's investment objectives.

Launching an Interval Fund Through a Private-Label Provider Can Save Time and Drive Efficiencies

May 31, 2023 | Interview by David Adler

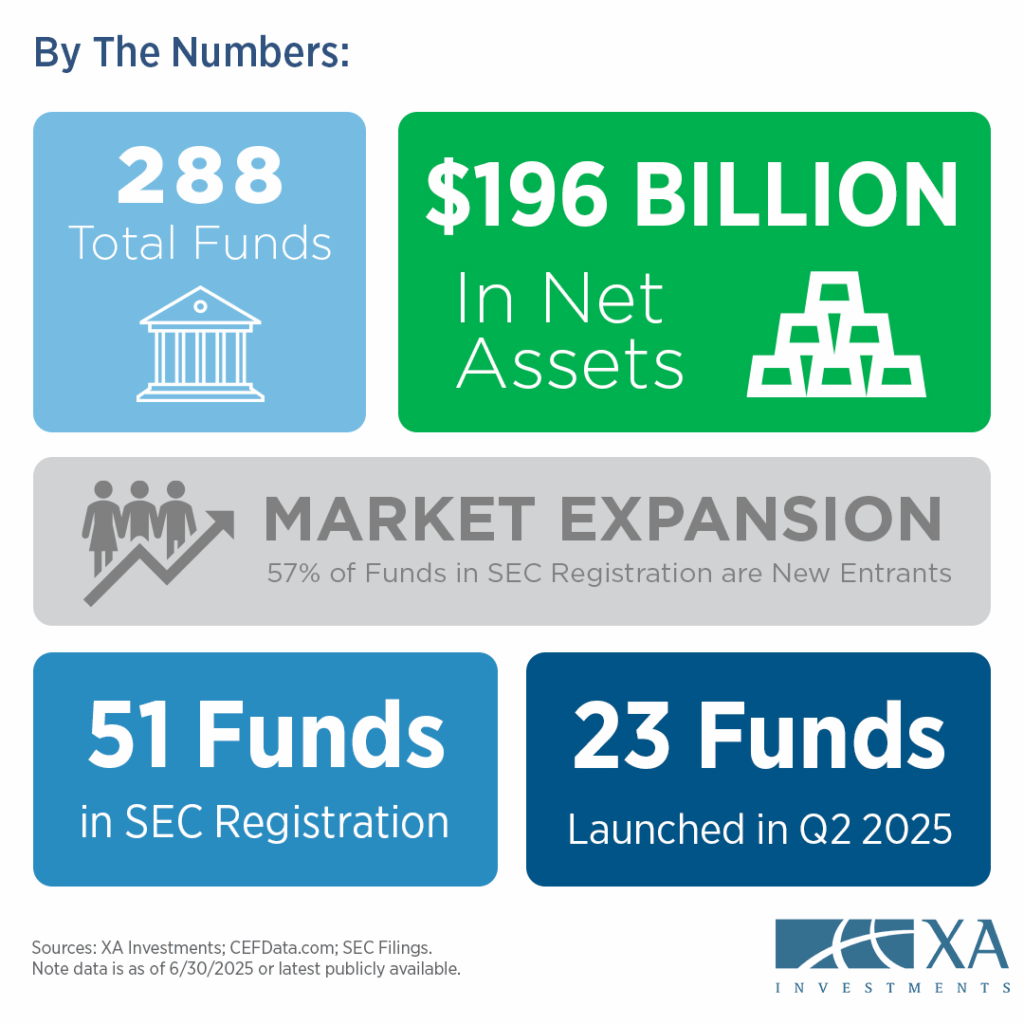

Launching an interval fund is far from easy, and the list of challenges can seem long and forbidding. At the same time, the opportunities are enormous. Given the recent surge in demand for alternative investment strategies, there has never been a more advantageous time to launch an interval fund. Consulting firms, on a private-label basis, can offer asset managers custom product design and strategic advice on various capital raising pathways.

To learn more, I spoke to leading interval fund expert Kimberly Flynn, CFA. Kim has over 20 years of experience in product development exclusively focused on registered closed-end funds ("CEFs"), including listed CEFs, interval funds and tender offer funds. Kim leads the Alternative Investments team at Chicago-based asset manager and private-label CEF provider XA Investments LLC ("XAI"). Kim's experience in launching (as well as managing, merging and closing) CEFs led to the formation of XAI in 2016. Since then, XAI has launched a propriety CEF and helped numerous clients launch their own funds. XAI offers consulting services to help asset managers launch their own proprietary funds and get to market quickly and effectively. XAI also partners with firms that wish to serve as sub-adviser and partner to enter the interval fund marketplace.

Q: How does a private-label partnership with XAI work, and what advantages does it offer to an asset manager that is interested in launching an interval fund?

A: XAI offers a turnkey, private-label CEF platform where we develop different types of CEFs including interval funds, tender offer funds and listed CEFs. We handle all activities related to the custom design, product development and launch of unique and differentiated CEFs for our clients. This includes all of the required regulatory elements such as the registration filings and the requisite operational set-up to manage a 1940 Act registered fund. We also coordinate the product build timetable, work with legal counsel to oversee production of the fund prospectus, assist with assessment and selection of fund service providers, provide setup and guidance on operational matters including valuation policies, liquidity management and portfolio management functions including leverage, building a custom website for each fund, and product positioning and full marketing services offering to ensure a successful launch. We can handle every single aspect of the interval fund launch process through our experienced team of interval fund industry experts.

On the XAI platform, we work with clients of all sizes and with a variety of alternative strategies. We have clients who are boutique alternative investment managers with small teams who are interested in accessing the retail and private wealth markets and other clients are some of the world's largest traditional asset managers who want to enter the interval fund marketplace. We also work with RIAs who are seeking to launch their own proprietary funds.

While our clients hire XAI for a variety of reasons, they all benefit from the advice we provide to de-risk the launch of a new fund. Some of our clients have full product management or product development teams in-house but are bandwidth constrained with multiple high priority initiatives and struggle to make time for a new interval fund launch. Other clients, especially alternative investment managers, have streamlined organizations, and the in-house business development team does not have staff or experience launching interval funds. XAI aligns with our clients for success and we serve as an extension of our client's investment and product teams. With our rich experience working on many different CEF builds over the years, we are able to transfer interval fund product and market knowledge to our clients during the product development process. XAI works behind the scenes to make sure the project manager at our client is recognized for the project success.

Q: Does XAI provide feedback on whether a prospective client's idea for an interval fund is feasible or even viable?

A: Yes – we typically start each client engagement with a detailed feasibility study which involves four to eight weeks of workshops around the investment strategy and its fit in the interval fund structure. We focus in on the economics of the interval fund and make sure that clients understand what it takes to break-even and to scale a new fund. We also analyze our client's firm capabilities and readiness as it relates to managing a registered fund. We want our clients to be successful, and the feasibility study helps our clients align thinking around the details of the proposed fund prior to beginning the full-scale private-label fund build. We assist with expediting internal decision making and providing additional context for such decisions. Our clients often need to take the findings of the feasibility study back to their internal constituents and work to seek approval to take next steps on the project. The feasibility study helps provide the evidence to support the market opportunity and specifically the product opportunity that the firm intends to pursue.

Q: How does XAI guide a client that has already selected an investment strategy and is committed to launching an interval fund?

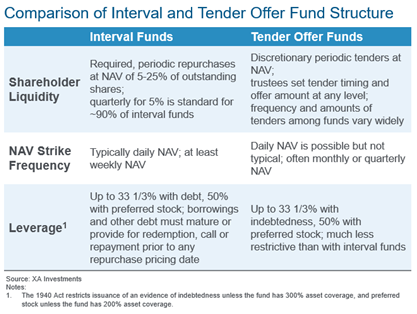

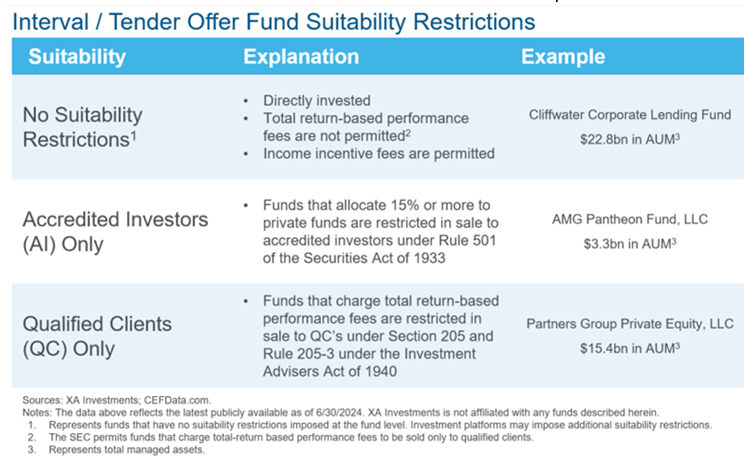

A: We advise clients that have already chosen to move forward with an interval fund on the optimal product structure given their strategy and objectives. For example, many clients want to understand the benefits and trade-offs with launching a fund in the interval vs tender offer fund structure. With tender offer funds, the fund board has the ability to stop or vary the amount or number of tenders which may be useful in volatile markets for certain illiquid alternatives. We also know the history of the interval fund marketplace and can analyze the competitive landscape to help identify gaps in the market that need to be filled and ways to differentiate the new fund.

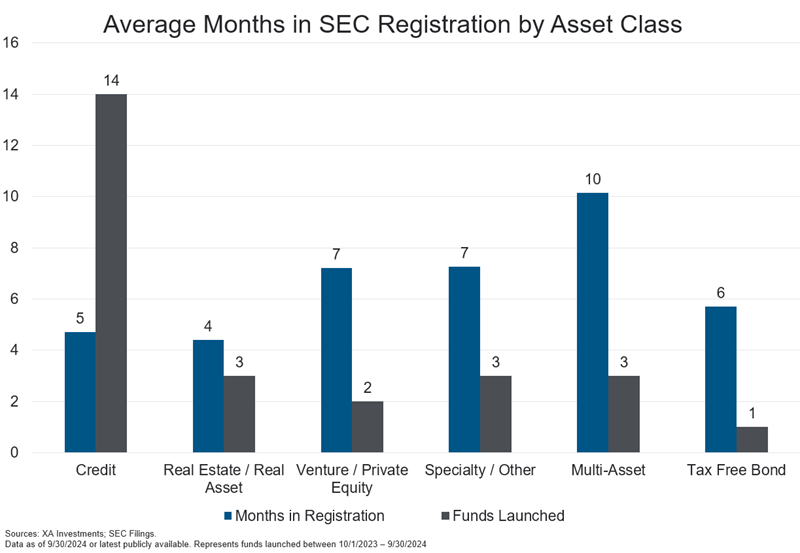

Q: How long does it take to launch an interval fund?

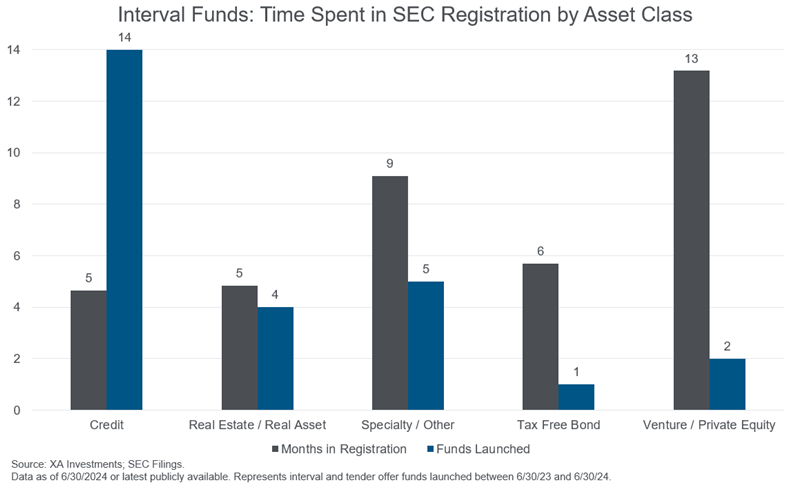

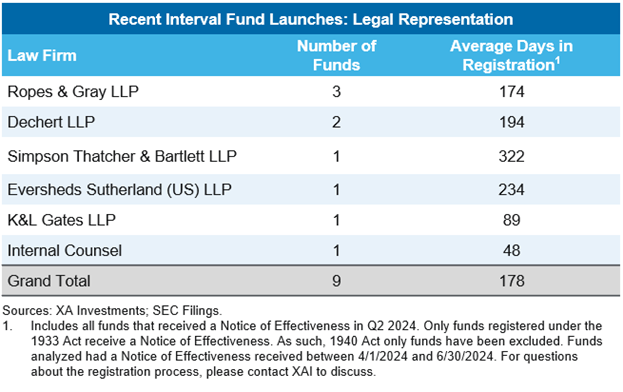

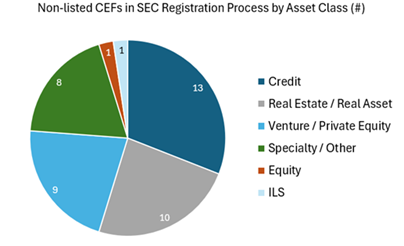

A: For the average interval fund, it can take eight to twelve months from start to finish to launch. Recently, both the SEC registration process and the wait time for interval funds to be added to clearing firm platforms have lengthened, making timetable management and sequencing concurrent processes even more critical.

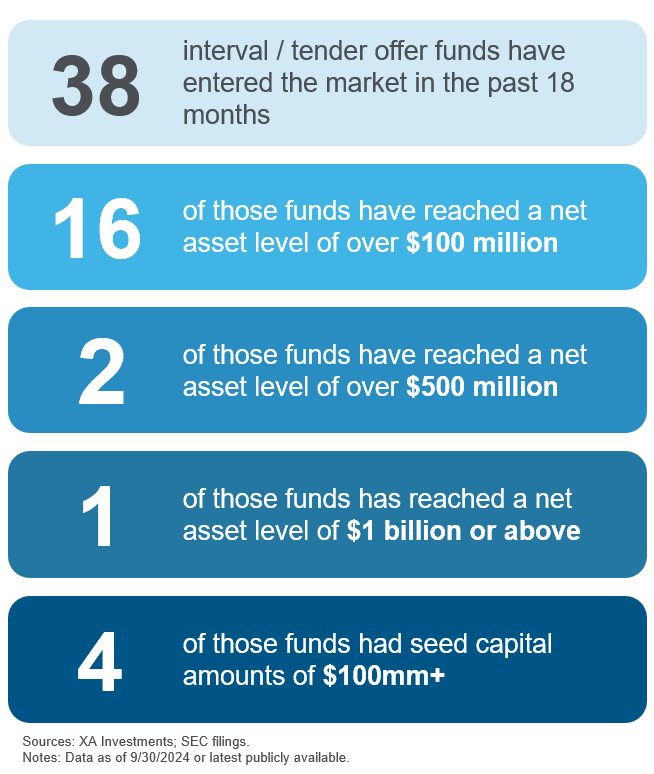

While speed to market is important for some clients who want a first mover advantage, other clients are more concerned with avoiding missteps or are more focused on medium-term milestones like reaching the $100mm or the $500mm AUM mark. XAI is able to help clients achieve their various objectives. Our interval fund platform creates efficiencies in the process that are not otherwise possible. XAI clients achieve a successful fund launch by keeping all bodies of work moving simultaneously. We help facilitate cross-functional working group activities and make sure external service providers are aligned for an on-time fund launch. Like all projects, an interval fund launch tends to uncover numerous sticking points and unforeseen challenges along the way—we focus on highlighting the common sticking points that come up in a fund launch and work with constituents to find the right solution ahead of time.

Q: Why is a private-label partnership so valuable when launching interval funds, specifically?

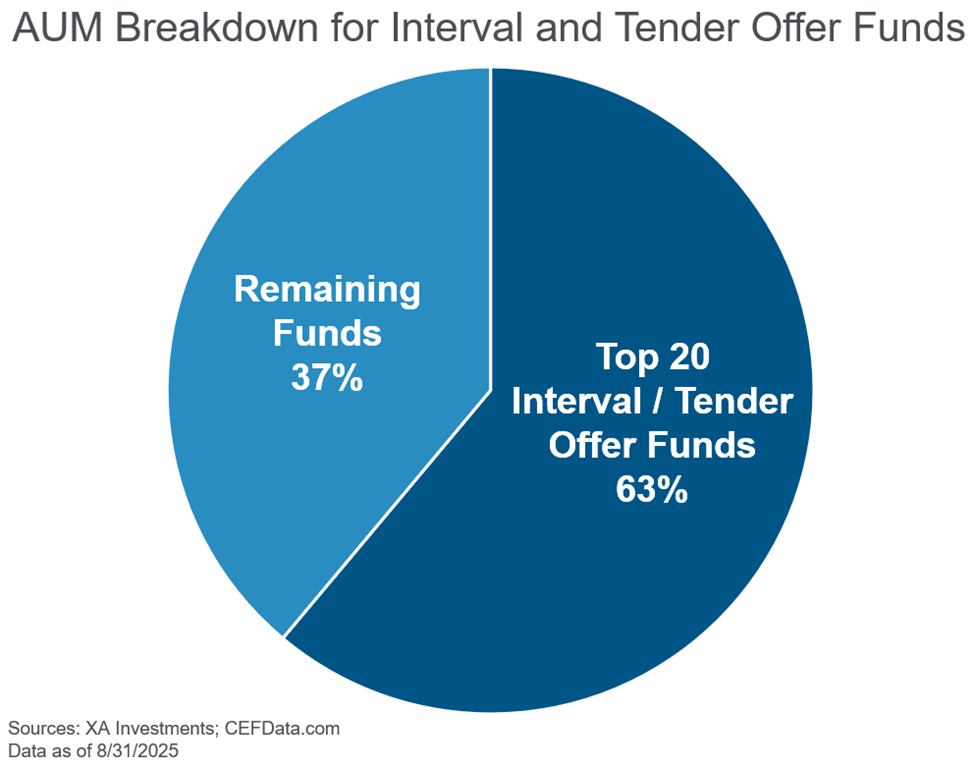

A: Interval funds are unique in that their N-2 filing or SEC registration does not reflect their practical starting point; reaching $100 million in AUM is the de facto beginning of an interval fund's life. However, raising $100 million from $0 can be incredibly difficult and requires detailed sales and distribution planning or seed capital. XAI assists clients with their go-to-market plan including sales, marketing, and national accounts planning. In addition to the SEC registration process and distribution planning, firms launching a new interval fund must also manage a fund board review and approval process. XAI has experience managing these concurrent workstreams and ensuring that nothing is overlooked.

Q: How can XAI help new/emerging managers or managers wanting to launch their first CEF?

A: XAI handles complex investment strategies and enjoys working with clients who are trying to do something that is new or different (e.g., a new asset class or new fund structure). In launching interval funds, much of the complexity of a fund launch lies below the surface. XAI dives deep into problem solving and addressing issues that arise through our proprietary interval fund product development process.

XAI can also open doors for fund sponsors when entering a new market. We understand the challenges of launching new initiatives—after all, we're a fund management firm too. Prior to launch, XAI works with its consulting clients on strategies to raise seed capital or contribute a private fund to help scale a new interval fund. XAI served as a consultant to Thornburg on the launch of its debut listed CEF offering in July 2021 – the $640mm Thornburg Income Builder Opportunities Fund (Nasdaq: TBLD). XAI also manages the $400mm XAI Octagon Floating Rate & Alternative Income Term Trust (NYSE: XFLT) which launched in September 2017. Thornburg and XAI were two of only three new listed CEF sponsors to enter the market in the past eight years.

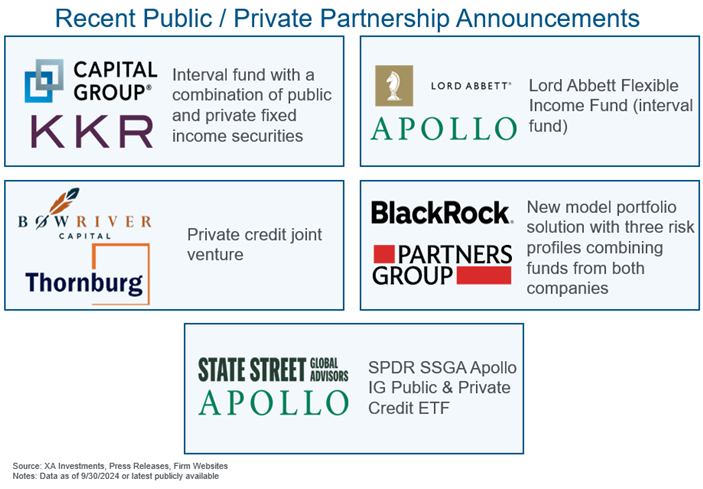

Q: Where have you seen innovation in the interval fund market recently?

A: The Hamilton Lane interval fund recently filed for a digital share class, introducing blockchain technology into the interval fund space. XAI anticipates that blockchain technology can transform the operational aspects of registered fund industry and expects the tokenization of funds and the addition of blockchain-native share classes to become more prevalent in the near future. A digital share class can help an interval fund sponsor streamline the issuance process and reduce some inefficiencies and expenses. More alternative asset managers are expected to commit to utilizing such technology to broaden investor access to the private markets. XAI will be working with industry participants and asset managers to help implement blockchain technology across the interval fund marketplace.

Q: Are there any interval fund trends you expect will do particularly well going forward?

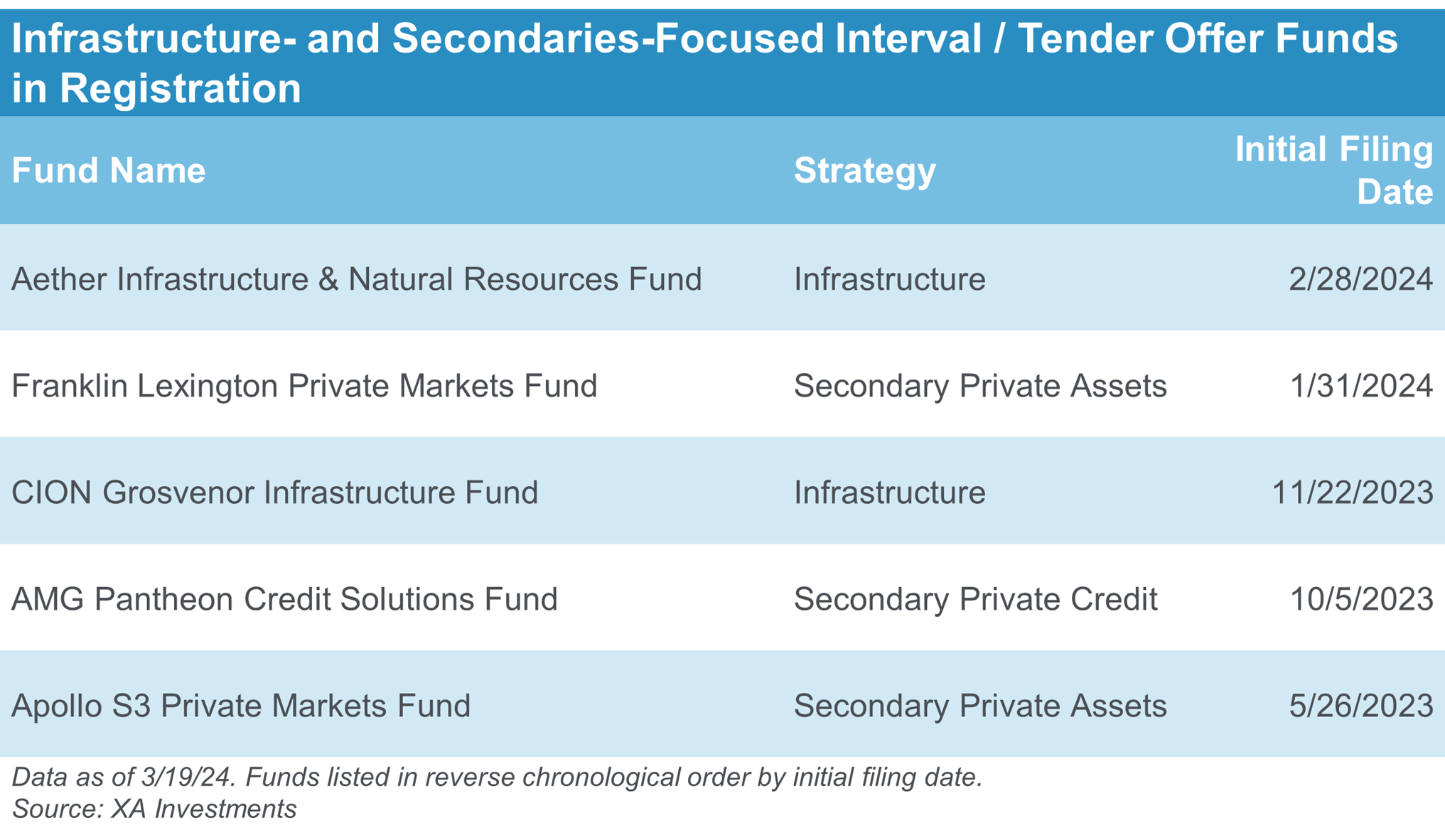

A: There is still plenty of room for product category expansion in the sustainable investing space, where we've observed tremendous growth in the last 10 years in the UK market. Sustainable investing themed funds in the London-listed fund market have had success raising capital across different asset classes including venture capital, private equity, private credit, farmland and infrastructure. In the US interval fund market, these areas of investment are all underrepresented. Infrastructure and real assets make up a relatively small portion of the assets in the interval fund market. In the US interval fund market today, we observe four sustainable focused or impact-oriented funds, but we anticipate more to follow. The fund-of-funds space will continue to grow as well as more asset allocators and institutional investment consultants sub-advising and launching proprietary funds.

Another interesting trend is that of new types of funds sponsors entering the interval fund market. We observe an increasing number of FinTech direct-to-consumer platforms that have launched proprietary funds – many of these funds are fund-of-fund strategies. We also note that RIAs with large pools of discretionary assets under management have launched proprietary interval funds. We help RIAs with product structuring and help these wealth managers identify ways to expand interval fund distribution beyond their initial client audience.

Q: Do you expect continued growth in the private-label interval fund trend?

A: We feel this is just the beginning of the private-label approach to launching interval funds. XAI is the only independent consulting firm in the market today that can guide clients from start to finish through the interval fund product development process and provides hands-on product launch execution services. The XAI platform gives new issuers the highest probability of success when launching their own proprietary funds. As more firms begin working with us in the interval fund marketplace, awareness of what we are able to do for our clients will increase. We are often approached by asset managers that indicate they plan to launch an interval fund and we help them evaluate capital raising pathways that might be best-suited to their goals and preferences.

Q: What are the global opportunities in launching interval funds?

A: Demand for interval funds and similar semi-liquid alternative fund structures is exploding globally, with a huge amount of activity taking place in Europe. We feel managers should not limit their launch and growth plans to the US, while other markets can be a better fit for specific strategies.

We have extensive consulting experience in the London market and deep knowledge of local players, ranging from brokers to media to institutional partners. Recently, we have advised prospective and current clients who are considering launching interval funds in the United States on steps towards also launching a London-listed fund in the United Kingdom or even to contemplate the updated Luxembourg evergreen fund structure which shares similarities with the interval fund.

Q: Any final thoughts?

A: Clients should not be deterred from launching an interval fund, but they should be realistic. Having the right partner and launch strategy is key. XAI can advise on the best structure for a particular investment strategy, conduct a feasibility study and, ultimately, act as an extension to the client's team throughout the fund build and launch. By working with XAI, asset managers can accelerate both decision making and the entire launch process.

About David Adler: David is an economic analyst and author. His work focuses on illiquidity and behavioral economics. For XAI, David has written several white papers, including "Invest Like the Pros: Using Liquidity Premiums to Drive Portfolio Outcomes," "Overcoming the 'Liquidity Mismatch' in Individual Investor Portfolios" and "Using Alternatives to Achieve Your Retirement Goals." For the CFA Institute Research Foundation, David wrote "The New Economics of Liquidity and Financial Frictions." David has an MA and BA in economics from Columbia University. He serves as a Senior Advisor to XAI.

About Kimberly Flynn: Kim is a Managing Director at XAI with a wide range of product structuring expertise. She is a partner in the firm and responsible for all product and business development activities. Kim is a frequent contributor to media and industry events on topics including interval funds, alternative investments and London-listed investment companies. Kim has an MBA degree from Harvard University and a BBA in Finance and Business Economics, summa cum laude, from the University of Notre Dame. Kim earned the CFA designation and is a member of the CFA Institute and CFA Society Chicago.

Disclaimer

The information in this publication is provided as a summary of complicated topics for informational and educational purposes and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such.

Illiquid investments are designed for long-term investors who can accept the special risks associated with such investments. Interval and tender offer closed-end funds are not intended to be used as trading vehicles. Unlike open-end mutual funds, which generally permit redemptions on a daily basis, interval and tender offer closed-end fund shares may not be redeemable at the time or in the amount an investor desires. Listed closed-end funds frequently trade at a discount to the fund's net asset value. All investments involve risks, including loss of principal. Investors considering an allocation to alternatives should evaluate the associated risks, including greater complexity and higher fees relative to traditional investments. Investors should carefully weigh the diversification benefits, expected returns and volatility of alternatives relative to traditional investments. Investments in alternatives involve risks, including loss of principal. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this publication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions.

This publication may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell and buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client's investment objectives.

The Rise of Alternatives and the New 60/40 Portfolio

May 03, 2023 | David Adler

The 60/40 portfolio—60% equity, 40% bonds—historically was the standard model for asset allocation. The intuition underlying this portfolio strategy is one of diversification: when equities fall, the bond portion of the portfolio provides stability, offsetting the equity decline. The 60/40 model has long been unquestioned as a dependable way to achieve stable returns. Market shifts in 2022 changed that thinking.

In 2022, both equities and bonds declined significantly: -19.44% for equity (S&P 500 Index) and -13.01% for bonds (BBG Barclays US Aggregate Bond Index). In simplest terms, the 60/40 portfolio stopped working, and investors experienced large drawdowns. Investors were left to wonder why traditional portfolio diversification failed and how they could better protect their portfolios in the future.

To help address these questions, XA Investments organized an expert panel discussion on February 15, 2023 at the New York Stock Exchange to re-examine the 60/40 portfolio and identify better strategies for asset allocation going forward. The panelists shared their broad range of perspectives:

- • Brian Chiappinelli, Managing Director, Cambridge Associates

- • Michael O'Malley, Real Estate Professor, University of Notre Dame

- • Nathan Shetty, Head of Multi-Asset, Nuveen

- • Moderator: Kimberly Flynn, Managing Director, Alternative Investments, XA Investments

The overwhelming consensus of the panel was that a 60/40 portfolio could still be successful, but the definition of "equity and bonds" needed to be expanded to include alternative investments to help achieve improved diversification and higher potential returns and downside protection.

Panel moderator Kim Flynn of XAI said, "With the negative performance of both stocks and bonds in 2022, many investors are considering using alternatives to replace traditional investment exposures. For example, investors might replace trading from fixed income allocations to high yield bonds with an alternative income option that might offer higher yields, diversification potential, and less duration risk."

A related theme of the event was to highlight recent advances in product design which allow investors to implement the "new 60/40." Alternatives are now more accessible than ever to a broad range of investors, leading to a potential revival of a 60/40 allocation, albeit one redefined to include more alternative asset classes.

While the traditional 60/40 has bounced back somewhat in Q1 2023, the experience of 2022 and the need for increased diversification within the portfolio remain at the forefront of investors' and managers' minds. The BlackRock Investment Institute recently issued a report on April 17, 2023 warning, "We don't see the return of a joint stock-bond bull market. We think strategic allocations of five years and beyond built on these old assumptions do not reflect the new regime we're in."

New Asset Classes

Flynn also pointed out that individual investors tend to be highly reliant upon the traditional 60/40 portfolio, despite its limitations. Nuveen's Nathan Shetty, who pronounced 2022 a "bloodbath for 60/40," drilled more deeply into some of the traditional allocation's inadequacies.

"60/40 is an arbitrary stock/bond split; it doesn't consider the intra-asset class composition, objectives, constraints, or risk tolerances and most importantly it doesn't reflect changing risk, return and correlation," he said.

Shetty argued for the need for an expanded asset class mix for investors, particularly in fixed income: "Going forward, I don't see bonds being the unicorn asset they were over the last 40 years. Correlations are likely to be positive with equities. We need to seek ballast elsewhere - cash, real assets, commodities, and long vol/trend following strategies seem like compelling alternatives."

Shetty also pointed to the attractiveness of private credit, both for ballast and as a source of income. "Private credit is particularly relevant to the recent economic backdrop. These are typically floating rate structures and so could participate in rising rates," Shetty said.

Though Shetty himself avoids the 60/40 framework, instead taking a more granular approach focused on factors and geography, many other conference participants found immense value in the simplicity of the 60/40 allocation, but one now redefined to include alternative investments.

"Today's tools are more sophisticated than when 60/40 was devised," said Brian Chiappinelli of Cambridge Associates. "The 60/40 split hasn't changed but the exposure to alts will increase relative to history."

Real estate may also fit into the new 60/40 portfolio. "It is the largest asset class in the world, and is a meaningful part of a diversified portfolio as it has the ability to provide depreciation-shielded current income with long-term appreciation," said Michael O'Malley of Notre Dame in his presentation. He further noted that real estate itself is a highly variegated asset class. Today's investors also have new choices in how to access real estate. "Sophisticated investors have the ability to build real estate portfolios through direct investments, private funds, and publicly-traded and private REITs," O'Malley said.

Increased Access to Alts Drives New Portfolio Construction

A consistent theme of the conference was that this new, more diversified 60/40 is now available to individual investors. "Modern advancements in product design make these allocation decisions easier and allow individual investors to access a broader set of alternative investment options," Flynn said.

This increased accessibility of alternative investments stems from three drivers, according to Chiappinelli:

- • Regulatory regime updates: "The SEC guidelines changed, expanding the definition of an accredited investor [thereby increasing the universe of those who can invest in alts]," he said.

- • Financial management trends: "There is increased understanding by financial managers of how to explore alternatives within a vehicle," Chiappinelli said.

- • Improved vehicles: Here Chiappinelli pointed to the explosion in the number of structures that hold alts, including both listed and non-listed closed-end funds, such as interval funds, and collective investment trusts (CITs).

Not only is access to alternatives more viable than it was in the past, but alternative investments are also more prominent, leading to increased demand from individual investors. "Ten years ago, nobody talked about private investments. Now, social influencers have exposed investors to venture capital [and the like]," Chiappinelli said.

Much of alternatives' higher historical returns derive from an illiquidity premium. This brings a new dimension - and potential caveat - to constructing a portfolio using these new vehicles. Interval funds offer only partial liquidity (typically via quarterly share repurchases), which can be particularly noticeable during a crisis. Allocators need to be aware of this potential for illiquidity, Chiappinelli said, regardless of how the product is sold. Nonetheless, he said, "Cambridge Associates has been a strong advocate for alternatives. We have seen this on the institutional side and now the retail side."

And there is another fund structure which offers liquidity in a traded form, namely publicly listed closed-end funds. Kim Flynn closed the conference at New York Stock Exchange pointing to the elegance of this vehicle in its ability to hold illiquid alternative investments while offering liquidity by trading on an exchange.

Disclaimer

The information in this publication is provided as a summary of complicated topics for informational and educational purposes and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such.

Illiquid investments are designed for long-term investors who can accept the special risks associated with such investments. Interval and tender offer closed-end funds are not intended to be used as trading vehicles. Unlike open-end mutual funds, which generally permit redemptions on a daily basis, interval and tender offer closed-end fund shares may not be redeemable at the time or in the amount an investor desires. Listed closed-end funds frequently trade at a discount to the fund's net asset value. All investments involve risks, including loss of principal. Investors considering an allocation to alternatives should evaluate the associated risks, including greater complexity and higher fees relative to traditional investments. Investors should carefully weigh the diversification benefits, expected returns and volatility of alternatives relative to traditional investments. Investments in alternatives involve risks, including loss of principal. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this publication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions.

This publication may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell and buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client's investment objectives.

Interval Fund Governance Considerations

March 22, 2023 | XA Investments LLC

Role of the Interval Fund Board

All interval funds must be governed by a fund board of directors. Like a corporate board of directors, the board of an interval fund registered under the Investment Company Act of 1940 (the "1940 Act") has a fiduciary duty to represent the interests of the fund's shareholders. The operations of the fund, however, are clearly different than those of a corporation. With very few exceptions, 1940 Act registered interval funds have no employees. As such, the fund board relies on various service providers to manage the fund's operations. The primary service provider is the fund's investment adviser. Additional key service providers include fund administrator and accountant (often the same firm), the fund's chief compliance officer, and the fund's independent auditor. As a fiduciary, the fund board should continually assess the performance of the fund's service providers, their respective fee arrangements, and the conflicts of interest that each service provider may have with the fund and its shareholders.

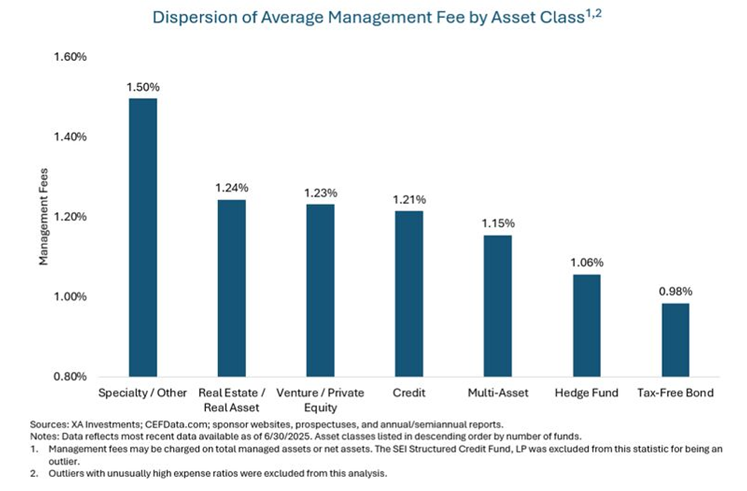

In practice, all registered funds likely have at least one service provider with an inherent conflict - most commonly, the adviser. Due to advisory fees being charged on either net assets or managed assets, the adviser may be incentivized to take risks it would not normally consider. The fund board should consider the potential mitigating factors and the level of conflict it deems acceptable given the fund's structure and goals.

Fund Board Activity Level

The fund board's chief role is to provide oversight for the fund and its shareholders - not to be involved in the fund's day-to-day management. Even still, the fund board oversees the management and operations of the fund, as the ultimate decision-maker on behalf of shareholders. This means that, depending on a fund's investment strategy and structure, the fund board could meet along with the fund's key service providers only once per quarter, or it may need to meet more often. Generally, most registered fund boards have four quarterly meetings with the investment adviser, CCO, administrator and accountant, along with perhaps two additional meetings during the year for "special" or non-regular matters.

Directors oversee the performance of the fund, the agreement with and fees paid to the adviser for its services, conflicts of interest, and the fund's compliance program, among other things.

Portfolio Management and Fund Operations

It is not the fund board's role or responsibility to make portfolio management decisions or make recommended investments for the fund or its adviser. The fund board delegates operational responsibility to the fund's officers. The fund's officers oversee the day-to-day operations of the service providers. Officers typically include a President or CEO, Treasurer and CFO, Secretary and/or Chief Legal Officer, CCO, and various assistants to the roles.

1940 Act and Fund Board Independence

The 1940 Act prescribes certain requirements for fund board independence. The 1940 Act requires that at least 40% of directors be "independent" and strictly defines independence. In reality, nearly all registered fund boards are predominantly independent, as various necessary fund board approvals would not be reasonably feasible without a larger number of independent directors.

What qualifies a director as "independent"? For one, they cannot own equity or stock of the investment adviser (or any sub-adviser) or their parent companies, subsidiaries, etc. Additionally, an independent director should not have currently or during the previous two years a significant business relationship with the fund's adviser (including sub-advisers), distributor/underwriter, or their affiliates. A classic example is employment or consulting arrangements - the former is clear, while the latter is subject to counsel review and likely a facts and circumstances test (and to be safe, most counsel would likely find any direct consulting relationship to taint the independence).

A director who is not independent is considered an "interested person" under the 1940 Act. All funds should at least annually consult with their directors (most use an annual questionnaire) to determine whether any independence issues exist.

Key Members on an Interval Fund Board

A fund board will typically have four or five total members, with three to four of those members considered independent. Each fund board member may vote on matters (although interested directors may not vote on certain matters). All fund board members have equal votes. With that said, certain fund board members may fill specific roles, including the following:

- • Chairman of the Board

- • Chair of the Audit Committee

- • Chair of the Nominating & Governance Committee

- • Chair of ad hoc or other committees

Fund Board Committees

Most fund boards have established committees that focus on specific subject matters. The most common are the audit committee and nominating & governance committee. Fund board members can expect to provide additional time and effort to their committee assignments. Additionally, fund boards may often establish ad hoc committees for various unique or irregular operational matters such as capital transactions, investigations, etc.

- • Audit Committee. The audit committee typically oversees the accounting and financial review, audit and reporting process, as well as the internal controls over financial reporting. Additionally, the committee will often oversee the fund's principal financial officer and the fund's independent auditor.

- • Nominating & Governance Committee. The nominating & governance committee oversees the fund's process and matters related to fund board membership and fund board efficacy, including annual fund board self-evaluation, compensation reviews and recommendations, searches for new fund board members, and nominations of fund board members.

Fund Board Diversity Recommendation

Fund boards and the asset management industry have become increasingly aware of disparities in shareholder representation on fund boards. For example, a recent industry survey showed that 65% of all independent fund board members for registered funds were men, while 86% of independent fund board members for registered funds identified as white. With that in mind, some fund sponsors and fund boards have adopted policies and procedures to encourage more diverse representation in their fund board searches and nominating processes. With that said, there is currently no obligation in the U.S. for a fund board to adopt such procedures or seek to meet any diversity requirements.

Fund Board Formation Options

Interval fund managers may decide to use an existing mutual fund board or stand up a new fund board. Alternatively, management may wish to save time/money by joining a series trust platform which has a shared fund board.

- A. Recruit Board Member Candidates for New Fund Board

-

1. Candidates recommended by trusted service providers

Typically include candidates with expertise in the asset class, finance/accounting, operations, capital markets, and/or the investment management industry. Interval fund board candidates often have alternatives experience as well. -

2. Manager interviews candidates and makes selections

Pre-screen or evaluate candidates by determined criteria. -

3. Chosen candidates accept and are appointed at the initial board meeting

The fund board members will then oversee the fund for as long as they serve. - B. Join an Existing Series Trust Platform

-

In the mutual fund market, series trusts are commonly used as a way to gain economies of scale for small or new fund managers. While all closed-end funds, including interval funds, require each trust to be a separate legal trust, several fund administrators have created quasi-series trust platforms with shared fund boards and service providers to help reduce costs and speed up the product launch.

Best Practices for Fund Board Formation and Candidate Selection/Election Process

- • Experience. The learning curve can be steep for interval funds which typically house alternative investment strategies. Interval fund boards will need a level of comfort with valuation policies and procedures for less liquid or illiquid assets. Past experience with alternative investments is a key consideration in the candidate selection process.

- • Fit is Important. Group fit among members is important to helping with critical and complex decision making.

- • Audit Committee Chair. It can be difficult to find an audit chair with necessary qualifications, experience and the comfort level to oversee fund audits and the principal financial officer's team. Identify candidates early in the process and determine their ability/desire to serve as an Audit Committee Chair.

- • Trustee Counsel. Speak with the selected fund counsel and ask for recommendations. Trustee counsel and fund counsel must work closely together, so a good working relationship and experience together can be helpful to the trust and also drive fee efficiencies.

- • Candidate Availability. Identify fund board candidates that have time to dedicate to the fund board and that can attend in-person meetings. If candidates are still working full-time, scheduling (and potentially independence conflicts) can be a challenge.

- • Geographic Location of Candidates. Select candidates in the same time zone to ease scheduling of special and ad hoc fund board meetings - this can be especially trust for funds that intend to rely on co-investment relief and have high transaction velocity. The fund boards of such funds are often required to have ad hoc meetings that need to be organized quickly.

- • 1940 Act Experience. Identify candidates (at least one) with prior board service experience on a 1940 Act fund board or a candidate with experience serving as an officer of a 1940 Act fund as an asset manager. Experience with the broader 1940 Act rules and regulations can be very helpful.

- • Prestige Is Not Important. Because the role of the board for a 1940 Act fund is different from an operating company, there's much less (if any) value in having board members that would be seen as prestigious for (e.g., board membership for a Fortune 500 company). Fit and specific experience outlined above are more important than an impressive resume or connections.

Additional Resources for Fund Sponsors and Fund Board Candidates

Disclaimer

The information presented herin is presented in summary form and is, therefore, subject to qualification and further explanation. It is intended for informational purposes only. Further, the information is not all-inclusive and should not be relied upon as such. XA Investments LLC does not warrant the accuracy, timeliness, or completeness of the information herein, and this publication is not offered as advice on any particular matter and must not be treated as a substitute for specific advice. In particular, information in this publication does not constitute legal, tax, regulatory, professional, financial or investment advice and nothing contained herein should be construed as such advice.

Career Insights with Helen Vaughan

March 8, 2023 | Helen Vaughan

For International Women's Day, XA Investments would like to recognize Helen Vaughan. Our team recommended Helen for a board role on an UK investment trust that is under development through our XAI consulting practice. Helen currently serves as non-executive director on three Irish fund boards, an Irish management company, a UK ACD company and a UK investment trust. Previously, Helen was the Chief Operating Officer at the JOHCM Group, Director of Business Development at Credit Suisse, Head of Investment Operations at SLC Asset Management, and Head of Client Accounting at Framlington.

Helen believes surrounding yourself with good people, listening to different perspectives but ultimately taking responsibility for the decisions you make is crucial to success. We are pleased to share some of her insights and offer others the opportunity to learn from her.

What is your most valued skill or personality trait that has helped drive your career success?

I was very fortunate to be brought up in a loving and nurturing family. My parents gave me the inner self confidence to pursue what I think is right (a trait I share with my father). In addition to having confidence in my decisions, I think that one of my most valuable personality traits is being pragmatic. I have also been very fortunate with respect to the people who have worked for me - I do not think you can succeed without surrounding yourself with good people and listening to different perspectives. That being said, you must ultimately take responsibility for the decisions you make.

Why did you pursue various non-executive director (NED) roles and how do you think you were best prepared to take on that type of governance role?

After nearly 30 years as an executive in investment management, I took the opportunity to retire from my executive life, move to West Wales and rebalance my life. This involved taking care of my two elderly parents and reassessing my priorities. I am a doer and needed to maintain work engagement, which I was able to do through my NED roles. Prior to retiring as an executive, I qualified as a Certified Investment Fund Director, so the transition from executive to a governance role was fairly seamless. Since then, I have continued to add to my portfolio of NED roles.

Recommendations for resources for women looking to advance their careers?

When I started work in the 1980s, things were very different. The large accountancy firm I trained with did not even have one female partner at that time! Things have progressed in leaps and bounds, and there are now many more opportunities for women and groups which can help women advance their careers. Women in Asset Servicing, Women in Investment, the Diversity Project and many other groups all help in providing opportunities for career progression. However, there is no real substitute for finding a strong mentor within your work organization to help you progress.

10 Lessons Learned in Launching Interval and Tender Offer Funds (Non-listed CEFs)

February 6, 2022

- Start the Process with Sales

The sales, distribution, national accounts and marketing strategy is often overlooked or discounted by investment strategy-led firms. Many first-time fund sponsors begin drafting the N-2 prospectus before working through the various sales and marketing considerations, which can impact the terms and structure of the fund. It is important to first consider what retail or end investors want and what changes need to be made to the investment strategy to avoid unnecessary amendments and re-work after launch. - Don't Chase the Market Leader

The non-listed CEF market has tremendous growth potential as retail demand for access to alternatives increases and as more advisors and investors adopt the use of the non-listed CEF structure. There are several alternative asset managers currently leading the non-listed CEF market by assets in the credit and real estate segments. There are also several well-established traditional asset management firms that have launched multiple non-listed CEFs with the support of their large mutual fund sales teams. New fund sponsors should not be concerned with chasing these players. Alternative investment managers can be successful with a small sales team that has strong relationships with RIAs or family offices. Focus on existing institutional client relationships - clients that know and trust the firm. - New and Different is Good, but

Challenging

The SEC registration process can be elongated by multiple rounds of comments and edits required on new or nuanced fund structures. Experienced product design and legal teams can assist with keeping this process as smooth and quick as possible. Find legal counsel, auditors or consultants that have specific experience with non-listed CEFs. - Product Design Matters

Alternative asset managers with primarily private funds lack familiarity with registered funds and may not have an appreciation for the nuances of the 1940 Act, including reporting requirements and legal limitations. Product design drives the ability to sell the fund and allows the fund to be competitive in the marketplace. Many non-listed CEFs with good portfolio performance have been closed or failed to scale and gain critical mass, which can result from the product structure being treated as an afterthought. - Clones Not Welcome Here

Non-listed CEFs are designed to house illiquid investments. If an investment strategy fits in the mutual fund, UCITs or ETF structure, it is likely not a good fit for the non-listed CEF structure. The SEC staff will question any non-listed CEF that has a large allocation to liquid securities and may challenge the structural fit. As such, clone funds or variations on liquid investment strategies are not likely to work in a non-listed CEF. Fund sponsors should consider evaluating existing private fund strategies to see if any of those institutional alternatives can be offered to retail investors using the non-listed CEF structure. - Get in Line with Clearing Firms

Early

Adding a new non-listed CEF to a major custody platform like Schwab, Fidelity or Pershing can take upwards of 3 to 6 months. There is a queue, it is typically first come, first served and gathering indications of interest ahead of onboarding is important. If the fund is complex or the sponsor is slow to address diligence questions, the onboarding process will likely be stalled. - Liquidity, Liquidity, Liquidity

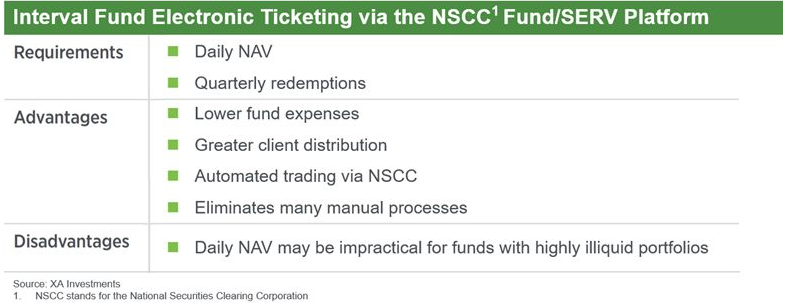

Liquidity is a crucial topic for both managing and marketing non-listed CEFs. Non-listed CEFs typically hold illiquid assets and require advanced liquidity planning to be prepared to meet quarterly redemption requests. Fund managers must think long and hard about their liquidity management plan and ensure they are prepared to withstand multiple quarters of full redemptions. When marketing non-listed CEFs, sponsors should properly convey to investors that the investment should be long-term, they will have limited liquidity at exit, and their redemption request may be prorated. If framed properly, the lack of liquidity can be a selling point when educating investors on the benefits of a non-listed CEF, as it can help prevent the realization of temporary losses. - Daily NAV Opens Doors

Non-listed CEFs that generate a daily NAV strike are permitted to join the NSCC/FundSERV mutual fund ticketing platform, which can significantly impact a fund's ability to gain sales traction. Non-listed CEFs with a less frequent NAV calculations must use subscription documents for new investments into the fund. An increasing amount of non-listed CEF sponsors with largely illiquid investment portfolios have developed policies and procedures to arrive at daily valuations by working with experienced fund administrators and 3rd party valuation agents. - Avoid the Valley of Death

The registration of a non-listed CEF with the SEC is not its starting point; the practical launch is when it reaches $100 million in AUM. By kickstarting the launch of a fund with seed capital, lead capital or contributed capital (e.g., private fund conversion), managers help de-risk the launch of their fund. No new investor wants to be the first investor into a small, sub-scale fund. Very few third-party sales teams effectively raise capital in non-listed CEFs because the initial sale from dollar zero is so challenging. Starting out of the gate with $50mm or $75mm accelerates the capital raising process with RIAs and family offices and allows the fund to reach a critical mass whereby the expenses are not a drag on the returns of the fund or the pocketbook of the sponsor. - Consider Saving Time/Money with Series

Trust Platform

In the mutual fund market, series trusts are commonly used as a way to gain economies of scale for small or new fund managers. While closed-end funds, including non-listed CEFs, require each trust to be a separate legal trust, several fund administrators have created quasi-series trust platforms with shared fund boards and service providers to help reduce costs and speed up the product launch.

Disclaimer

The information presented herein is presented

in summary form and is, therefore, subject to qualification and further explanation. It is

intended for informational purposes only. Further, the information is not all-inclusive and

should not be relied upon as such. XAI does not warrant the accuracy, timeliness, or

completeness of the information herein, and this publication is not offered as advice on any

particular matter and must not be treated as a substitute for specific advice. In

particular, information in this publication does not constitute legal, tax, regulatory,

professional, financial or investment advice and nothing contained herein should be

construed as such advice. Performance data quoted represents past performance. Past

performance does not guarantee future results. Current performance may be lower or

higher than the performance data quoted.

This publication may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell and buy any specific security offering. Such an offering is made by the applicable prospectus only.

Career Insights with Anne Kritzmire

March 8, 2022 | Anne Kritzmire

For International Women's Day, XA Investments would like to recognize Anne Kritzmire. Anne currently serves as Lead Independent Director for Thornburg Closed-end Funds, as well as Managing Partner for Your True Note and a member of the Lake Forest Graduate School of Management's Business Leader Faculty. Previously, Anne held numerous leadership roles at Nuveen in CEFs and multi-asset solution marketing. Anne was also formerly the President of the Closed-End Fund Association (CEFA).

Anne has valued curiosity and learning at every stage of her career. We are pleased to share some of her insights and offer others the opportunity to learn from her.

Advice you might offer women at the beginning of their career?

First - Embrace learning, and stay curious. In addition to conventional ways of learning, I recommend getting curious about how things and people work. For example, what are the guiding principles that an organization lives by? How do different groups and systems interact and collaborate? What drives success? When did failure occur and what can you learn from it? Early in my career, I thought I was going to solve engineering problems. My team designed a hard disk drive that was as big as 4 loaves of bread and stored less than 1/4 the amount of data a single photo on my phone now requires. My career has since evolved to focus on helping people design communications and connecting dots as a board member. Things change. They always will. But, seeking to understand causes and drivers of success or failure - at work or for one's own happiness - has been a long-term asset.

Second - Don't be too cautious, and lean into failure. As the eldest daughter of a midwestern religious family, a recovering engineer and a mother, the quest for perfection runs in my blood. Early on in my career, being too cautious in the pursuit of perfection kept me from both fun and reward, so I began to embrace failure and learn from it. Perhaps find something small you might fail at, then learn and challenge yourself to expand from there. It may be messy, but it will definitely be more rewarding than not trying.

Third - Engage with people and connections at work and beyond, and make it a two-way street. I loved a recent HBR article on women and office politics. I used to be in the "my work should speak for itself" camp. My intentions were good - I assumed everyone around me was smart and could figure things out. They were, but most were also time-starved. I had more success when I learned to proactively help people understand, even if I became known for using food analogies to do so. Always be grateful for and gracious to the people you get to interact with, and you will go much further than you can on your own.

Recommendations on resources for women looking to advance their careers?

I love learning from any resource. I am a lifelong reader, a podcast listener during daily

walks, and I am motivated by great speakers at conferences - live or virtual. However, the

most valuable resource is your network of people, particularly other women. Years ago at

Wharton's Securities Industry Institute, I was first introduced to the psychology behind the

words "Please help". Human beings are wired to help others, and women generally more than

men. For instance, the women who attend the Barron's Top Women Advisors' conference are at

the very top of their profession, yet they regularly come together with strong appetites to

teach and learn.

Many find networking to be uncomfortable or superficial. It's a conversation I've had with my grown daughter. If you genuinely dislike people, that's another story, but sharing insights, help, enthusiasm, and concerns can be quite meaningful, even over a Zoom happy hour. If you are looking for a place to start, there are groups organized to connect busy peers - whether that's entrepreneurs, CEOs, accountants, financial marketers, or business majors from your alma mater. Ask around. And, career insights need not be just from professional contacts. A connection made through my volunteer work with the Boy Scouts is helping me sharpen up my next career chapter. The board of a non-profit I'm passionate about has taught me plenty about governance and executive management when we decided to replace the CEO.

Finally, I would recommend proactively cultivating a network that includes as much diversity as you can make time for (and more). Seek out people of diverse ages, diverse backgrounds and diverse cultures. The bigger your career aspirations are, the wider the group you'll want to consider, understand, and travel that two-way street with.

I am lucky to now be in a place where, through both volunteer and paid work, I can help people - especially women and girls - become their best selves. Many thanks to my own network, including XAI's Kim Flynn, whom I've long respected and am honored to call a friend.

Trivia question: Did you know that Cards Against Humanity funds a full tuition scholarship for women majoring in science, technology, engineering, and math?

Overcoming the Interval Fund "Valley of Death"

December 15, 2021 | Kimberly Flynn

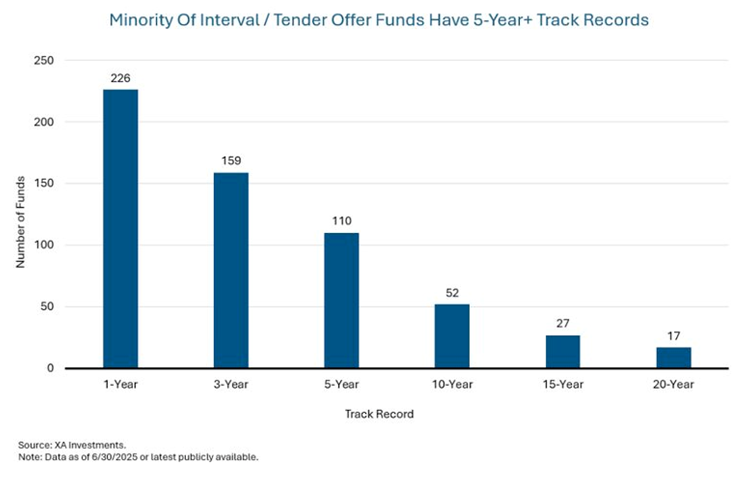

Over the past five years, the interval fund market has experienced explosive growth, as the structure has attracted both managers and investors by expanding access to illiquid alternative investments in a registered fund structure. While many managers are eager to launch an interval fund, the process can be more difficult than one might expect. Managers need to understand and prepare for a variety of challenges in order to be successful.

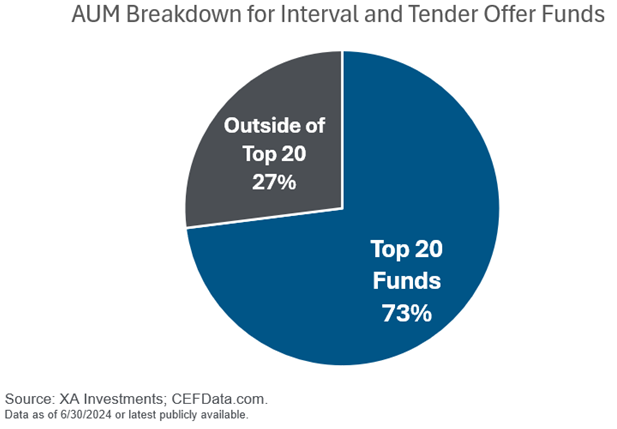

For example, the registration of an interval fund is not its starting point; the practical launch is when it reaches $100 million in AUM. This phase can be thought of as the interval fund "valley of death," a term borrowed from the technology industry that refers to the gap between a brilliant idea and its successful commercialization. Reaching $100 million in AUM is important for a variety of reasons: Below the $100 million mark, the fund will find itself eating its management fees as managers waive fees to keep expense ratios in line. It may also be difficult to get a smaller fund onto a custody platform.

Life of an Interval Fund

Managers should not be deterred from launching an interval fund, but they should develop a plan to cross the "valley of death." Seeding the new interval fund with contributed capital or converting a private fund can be incredibly helpful. There are a few structural features that may make certain funds more attractive as well, including providing daily NAV/electronic ticketing and not charging performance fees. Additionally, fund sponsors should aim to target advisors who are already interval fund buyers through advisor communities like ADISA, AICA, Blue Vault and IPA.

For more information on best practices to overcome the "valley of death," read XAI's new white paper written in collaboration with our thought partner, Ultimus Fund Solutions, here.

Risks

The information in this article is for informational and educational purposes only and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such. An investment in CEFs involves risks, including loss of principal. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this communication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions. This information may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell or buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client's investment objectives.

Permanent Capital Vehicles: Diversify Revenue Streams and Benefit from Demand Growth

November 29, 2021 | Kimberly Flynn

As various access points for institutional-quality alternative investments have evolved in recent years, the closed-end fund ("CEF") structure has gained visibility as a suitable vehicle for institutional investment strategies. Key elements of CEFs relative to private funds are lower investment minimums, better liquidity through secondary trading and tender offers, increased portfolio transparency, and tax Form 1099s. Many investment managers are familiar with the U.S.-listed CEF structure, but many are less familiar with other types of CEFs that may be a better fit for certain strategies, namely the U.S. interval fund and London-listed investment fund. These marketplaces are growing as demand for alternatives increase due to the persistent all-time low interest rate environment and peak public equity market valuations.

An interval fund is a continuously offered, non-listed U.S. CEF, typically structured with a perpetual life. Like U.S.-listed CEFs, interval funds and tender offer funds can house a spectrum of investment strategies, but, unlike U.S.-listed CEFs, interval funds are not publicly listed, and do provide for daily liquidity. Instead, interval funds offer repurchase opportunities based on a price at NAV at certain 'intervals,' generally quarterly, and share repurchases range from 5% to 25% of the total assets within the fund per repurchase period.

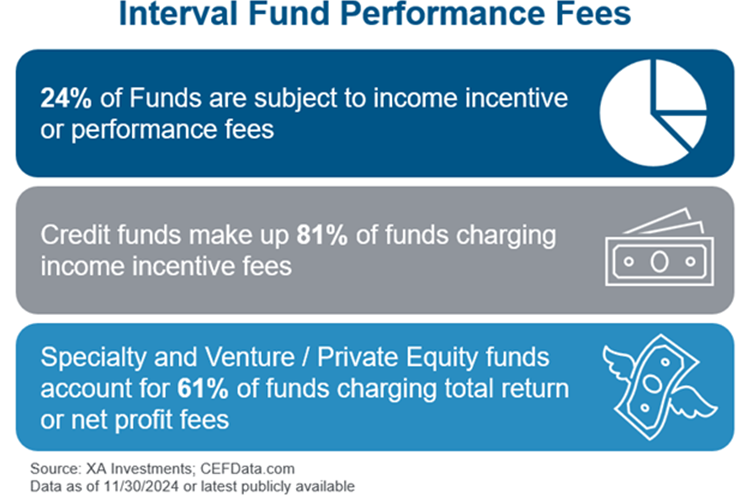

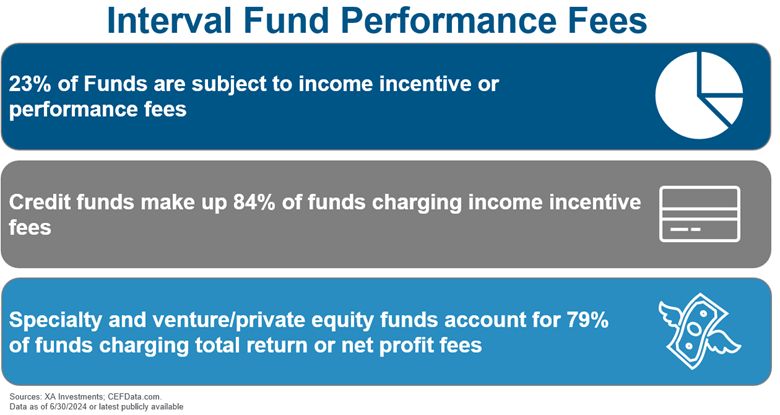

Alternative managers may appreciate the interval fund structure because it can provide a pool of long-term capital with limited liquidity requirements, it can be marketed to individual investors, and it typically allows for more sophisticated investment strategies that may have higher fee margins than mutual fund strategies. Some interval funds also include income incentive fees.

Similar to U.S.-listed CEFs, London-listed investment funds are publicly traded closed-end funds that may offer investors daily liquidity in the secondary market without directly impacting the investment portfolio. The structure is well-suited to less liquid or illiquid alternative strategies, and the U.K. institutional investor base is very responsive to new investment trends, particularly sector-based, niche or thematic alternatives and ESG or impact investment strategies.

For more information on permanent or long-term capital vehicles, please see the below resources or contact us at info@xainvestments.com.

To read XAI's white paper on Interval Funds, please click here.

To read XAI's white paper on the London-Listed Fund Market, please click here.

Risks

The information in this article is for informational and educational purposes only and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such. An investment in CEFs involves risks, including loss of principal. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this communication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions. This information may contain "forward looking" information that is not purely historical in nature, including projections, forecasts, estimates of market returns, and proposed portfolio compositions. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell or buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client's investment objectives.

Career Insights with Danielle Cupps

March 8, 2021 | Danielle Cupps

For International Women's Day, XA Investments would like to recognize Danielle Cupps. Dani is a mom of three children and currently serves as Director of Digital Customer Engagement Market and Team Alignment at McDonald's Corporation. We are also proud to have her serve as an Independent Trustee for the XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT).

Dani understands the importance of mentorship in the workplace having mentored younger colleagues over the years. We are pleased to share with you some of her valuable insights.

Advice you might offer women at the beginning of their career?

Be open to help,

collecting, sharing and reflecting on lessons learned at every step. I've been spoiled by

wonderful mentors and peers, men and women - from an early boss who, one Thanksgiving,

pulled me from the analyst pool in New York to my hometown of Chicago, to the big-hearted

CEO of a wire and cable company who offered to host my wedding in his distribution center,

to the private equity portfolio manager who I likened to frosted mini-wheats because she was

pure sugar on one side and scrappy, hard-working brilliance on the other. My list of role

models is long, and full of wisdom I cherish.

At the same time, being a working mom, or any working person with serious caregiving responsibilities at home, can be tricky. Inevitably, you will feel inadequate, underprepared, exhausted, humorless, and disconnected - not once, but again and again, as you shoot for exceptional at work and home. At some point, you will get to soccer camp late, and find your 8-year-old son is the only boy in camp for 6-year-old girls. Or you will race to be with a hurt child instead of... anything. When life happens, cut yourself some slack (quoting a sharp female leader at McDonald's), and trust others who want to help. That's not easy when you're wired to be the responsible one, the person others trust to get things done. But vulnerability is indeed an invitation to forge lasting connections.

Most importantly, always lean into the toughest challenges with gratitude - deep, sincere gratitude for the "complications" that make your life layered, fulfilling, and uniquely yours. It's an extraordinary privilege to have choices and be challenged by personal and professional opportunities about which you care deeply. And when you're struggling with this, reach out to mentor or help another woman. This will be good for you and her.

Recommendations on resources for women looking to advance their careers?

For women looking to advance in careers, the most valuable asset is your network of other

women. I love the timeless wisdom of a good book, I listen with interest to daily podcasts,

I adore opportunities to hear and reflect upon an insightful speaker, and I am deeply

grateful for numerous male mentors and advocates in my life. However, when I need career

help, the best resource is other women. Returning to work after retiring for several years

to raise children, my community of female friends worked overtime with no pay on my behalf -

working women opened dozens of doors and provided references for new career opportunities,

fellow school moms leaned in to fill gaps for my kids, and sisters and lifelong friends

shared thoughtful advice, informed by decades of love and friendship.

Today, my bold ambition is to influence the workplace to be more accommodating for our daughters and more inclusive for those who want and deserve more. Because a network of millions of women share this bold ambition, including capable female leadership at XA Investments, most notably Kimberly Ann Flynn, Managing Director, Alternative Investments, I am confident that we will succeed.

Income and Volatility: Paid to Ride Out a Storm

January 15, 2020 | David Adler

Instead of staying invested for the long-term, investors may react to short-term volatility by rushing to the exits. Unfortunately doing this and realizing losses can cause damage to one's financial health. Dividend or other income producing investments can help investors with the volatility "problem" as income creates incentives for investors to stick with their long-term investment plan and weather a storm.

Warren Buffett, in his 2014 Berkshire Hathaway annual letter, explains "...volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong."1

Economist John Cochrane, former President of the American Finance Association notes: