Retail 3(c)(7) funds will compete alongside interval funds and be of particular interest to cross-border managers.

By Kimberly Flynn, CFA

President, XA Investments

October 22, 2025

The new kid on the evergreen alts block is the retail 3(c)(7) fund.

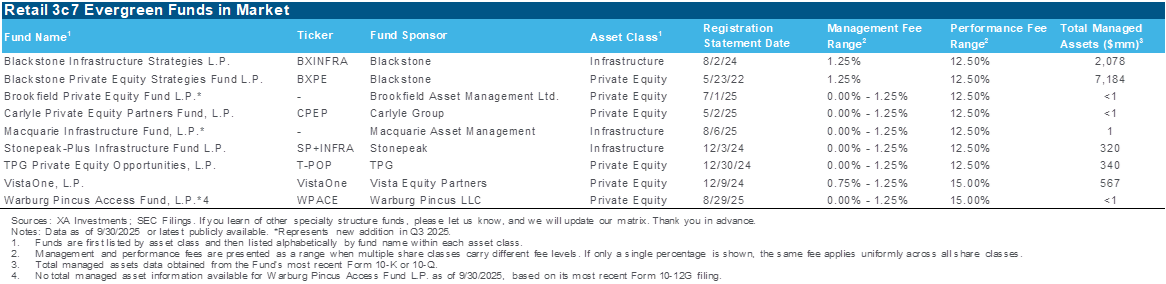

My team and I at XA Investments have observed a surge over the last year in launches of this type of specialty fund by leading alternative managers with ambitions to distribute products across the globe. Fund sponsors with new retail 3(c)(7) funds include Blackstone, Vista Equity Partners, and Stonepeak, among others.

These firms and others are turning to the retail 3(c)(7) evergreen structure to design their next private equity and infrastructure products for wealthy individuals to invest alongside family offices and institutional investors.

But, before we go any further, you might ask – what is a retail 3(c)(7) fund?

A retail 3(c)(7) fund refers to a private fund that files with the Securities and Exchange Commission (SEC) under the Exchange Act of 1934 to become a public filing entity and then reports to shareholders on Forms 10-Q, 10-K and 8-K. As such, a retail 3(c)(7) fund can be sold to an unlimited number of qualified purchasers. The ‘evergreen’ nature of the retail 3(c)(7) fund means that it is open-ended and shares some features with the interval fund, such as periodic liquidity. Most of the retail 3(c)(7) funds in the market today have monthly valuations and quarterly liquidity.

A strong appeal to investment managers of retail 3(c)(7) funds is the near-unlimited flexibility the structure allows for investment assets and strategies. In particular, and depending on their investment mandate, these funds can invest in asset classes ranging from private equity and private credit to direct cryptocurrency and luxury goods.

While interval funds have been leading the way in the evergreen democratization of alternatives trend, we expect asset growth in retail 3(c)(7) funds as well. As of September 30, the interval and tender offer fund market reached a new peak with 304 total funds and a combined $215bn in net assets. In total, there are 157 unique fund sponsors in the interval and tender offer fund market.

In the retail 3(c)(7) fund space, there are nine funds managed by eight unique fund sponsors with $10.4bn in combined assets. Blackstone leads the pack with two retail 3(c)(7) funds and dominates the assets with $9.3bn per the most recent SEC filings.

In 2025, we observed four new funds enter the retail 3(c)(7) fund market – including powerhouse firms such as Brookfield, Carlyle, Macquarie and Warburg Pincus. The newest crop of retail 3(c)(7) funds to launch is listed in the table below.

For the most part all these fund have management fees of up to 1.25, depending on share classes, and performance fees of 12.5%, with the exception of VistaOne and Warburg Pincus Access, which are 15%.

Based on XA Investment’s research with leading alternative asset managers, we expect the retail 3(c)(7) fund market to double in size in 2026. For some alternative investment boutiques, the launch of an interval fund may seem too large of a step for the organization. For firms with only drawdown funds, the evergreen retail 3(c)(7) fund may be viewed as an interim step that solves for broader access to a new audience of investors.

Underscoring the growth of these retail 3(c)(7) funds, certain wealth management businesses like JP Morgan, Citi, Goldman and UBS want alternative investment products built for sale inside and outside of the US. For fund sponsors with global distribution footprints, the retail 3(c)(7) fund can help facilitate sales and distribution efforts in the US and Europe. The retail 3(c)(7) funds can be particularly flexible when paired with offshore feeders to solve various distribution and sales challenges that ex-US registered fund structures, such as Ucits, may not be attuned to solve.

Around the world, a new crop of regulated investment funds have come to market to allow individual investors to access private market investments. In the US., there are interval and tender offer funds. In the UK, there are LTAFs – Long-Term Asset funds. Elsewhere in Europe, there are ELTIFs – European Long-Term Investment funds.

Similar to other private funds, retail 3(c)(7) funds can be set up to be sold broadly and across borders with often only disclosure obligations being localized. If this is your first time reading about retail 3(c)(7) funds, it will not be your last as we anticipate continued growth in this part of the evergreen alts market.