The research team at XA Investments is pleased to share with you our XAI Interval Fund Daily Observations. We share these observations on our LinkedIn page (when we are not posting about another topic) and compile them here at the end of each week.

For more information on the XA Investments LLC Quarterly Market Updates for Non-Listed CEFs and Listed CEFs, contact us at info@xainvestments.com. The in-depth reports provide actionable insights and consolidated data, including market statistics, IPOs, recent fund filings, sponsor data, and market overview.

10/17/2025

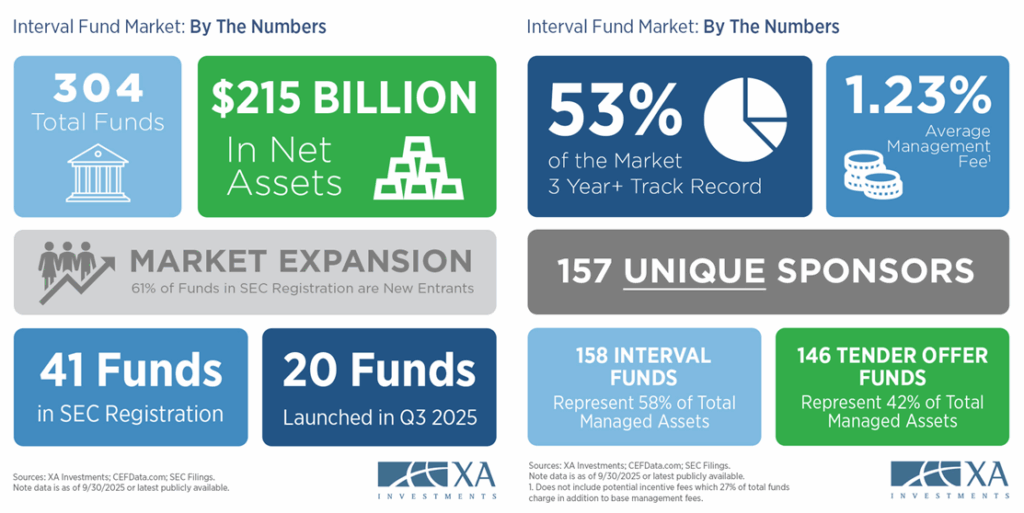

Now totaling 304 funds, the interval and tender offer fund market continues to expand, drawing increased attention from asset managers and investors. This quarter’s report highlights key market data and developments, significant AUM milestones, new fund launches, and other emerging trends.

10/15/20025

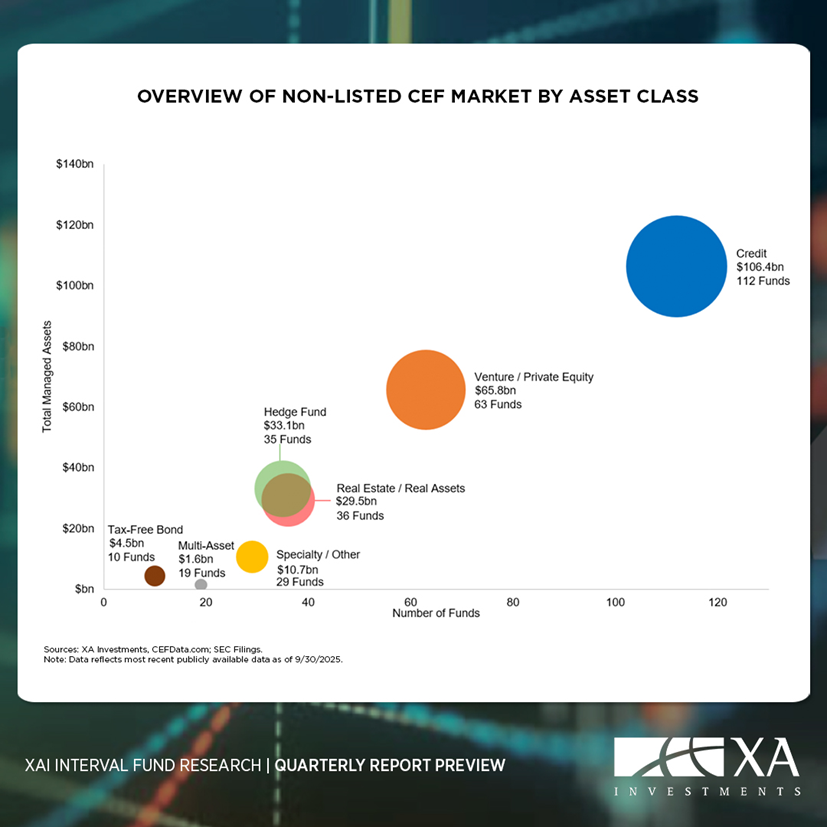

Quarterly Report Preview: Hedge funds are a significant part of the non-listed closed-end fund universe with 35 funds and $33.1bn in AUM. This quarter’s research highlights strategies represented in the category and examines recent net flow activity. Subscribe to XAI’s Quarterly Research Report to learn more.

10/14/2025

Quarterly Report Preview: The recent Trump Executive Order on 401(k) plans could open the door for private equity and other alternatives in retirement accounts. To learn more about how this development may affect the interval and tender offer fund market, subscribe to XAI’s quarterly research report.

10/12/2025

Quarterly Report Preview: The interval / tender offer fund market now stands at $215 billion in net assets as of 9/30/2025. The interval fund market is growing quickly, with a 33% increase from the previous year and a 10% increase in net assets over the previous quarter.

10/9/2025

Quarterly Report Preview: Curious which firms are entering the interval and tender offer fund market? Subscribe to XAI’s Quarterly Research Report to learn more about the latest entrants and how they are positioned within the market.

10/7/2025

Quarterly Report Preview: The interval fund market now stands at 304 funds with $251 billion in total managed assets as of 9/30/2025. Credit funds continue to lead the way in both the number of funds and total managed assets.

10/5/2025

Quarterly Report Preview: The interval fund market has now surpassed 300 funds marking a new milestone! To see the latest entrants and track market growth, subscribe to XAI’s quarterly research report.

9/25/2025

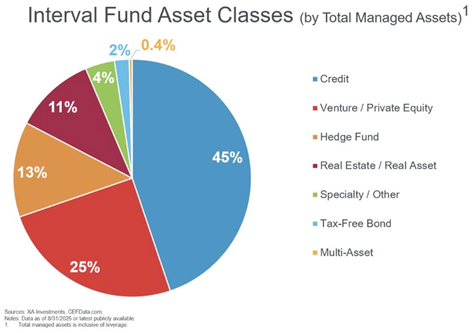

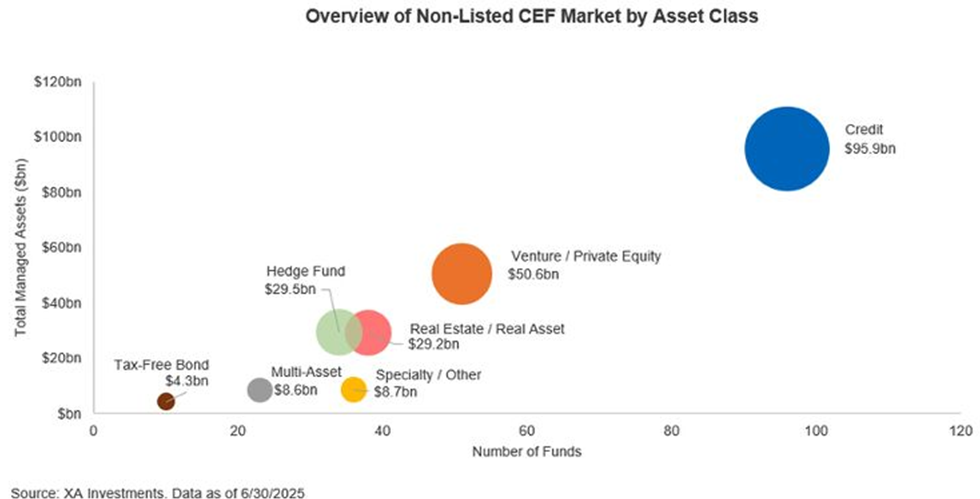

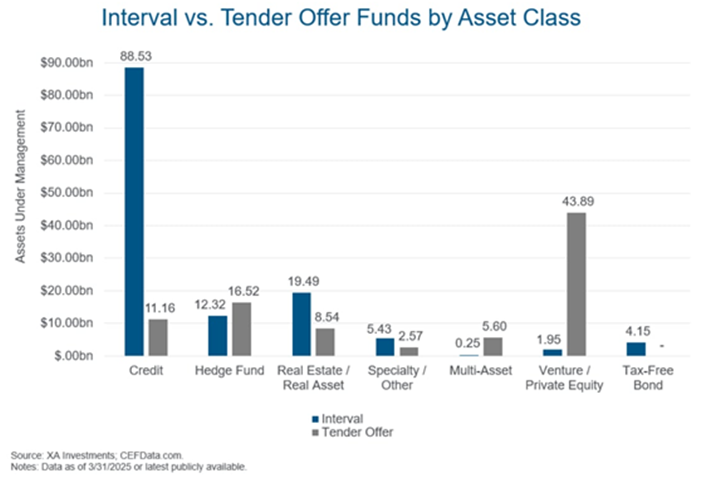

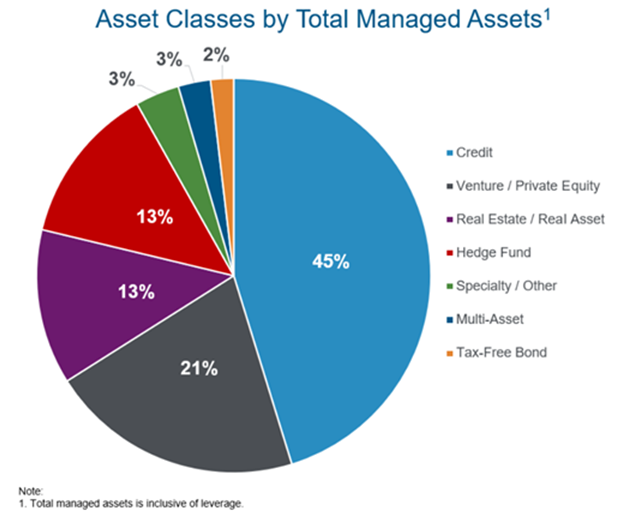

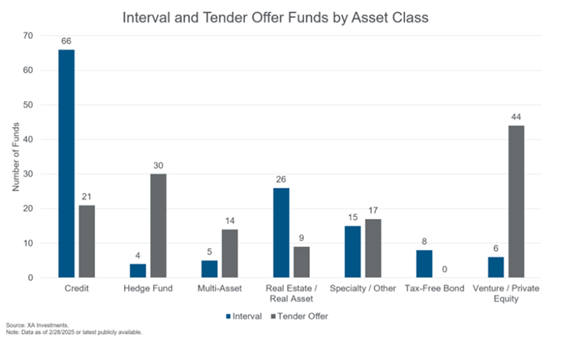

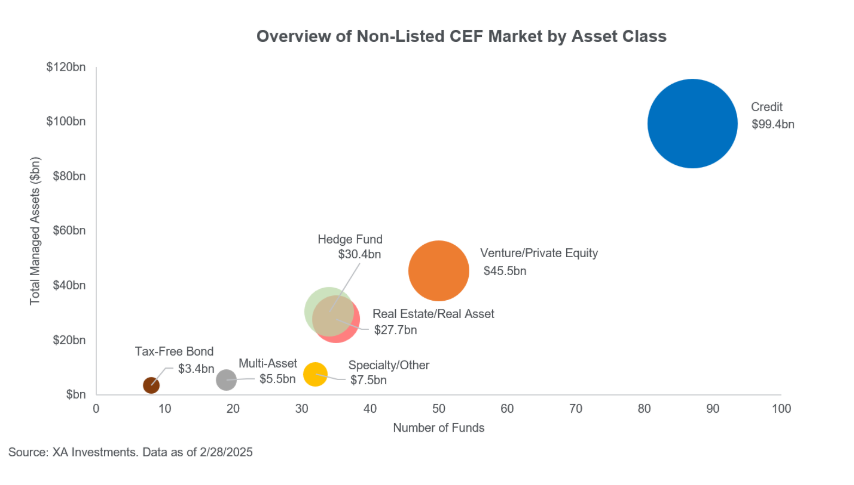

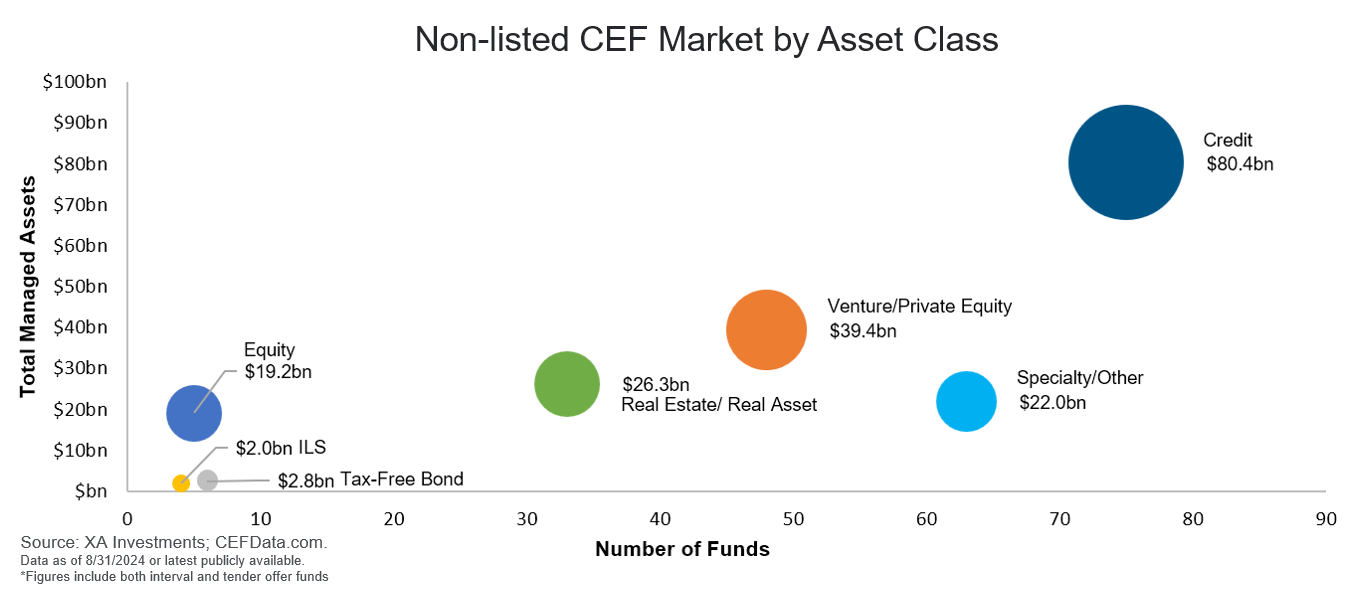

Credit interval funds represent the largest asset class with $117.4 billion in total managed assets, accounting for 45% of the interval fund market. Venture/Private Equity follows with 25%, while Hedge Fund and Real Estate / Real Asset represent 13% and 11% respectively.

9/18/2025

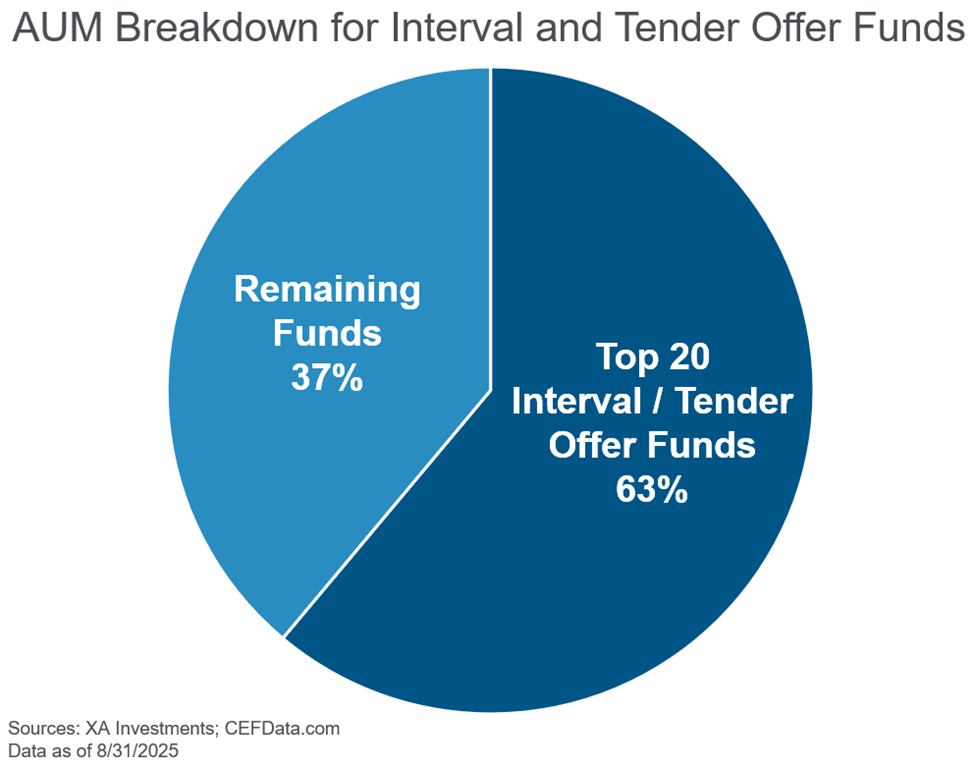

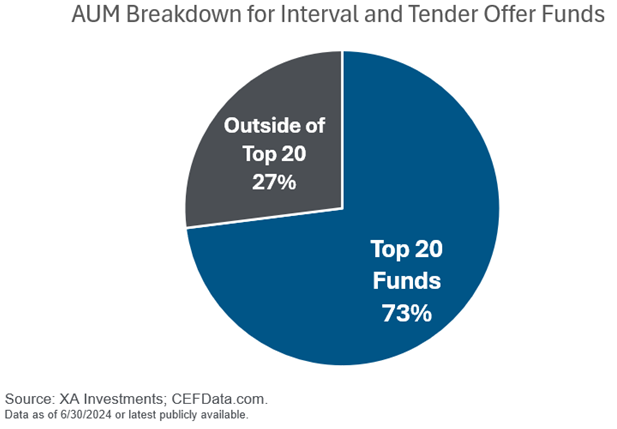

The interval fund market leaders are Cliffwater, Partners Group, Alkeon Capital Management and StepStone. The 20 largest interval and tender offer funds each have over $2.8bn in total managed assets and together comprise 63% of the market by total managed assets.

9/11/2025

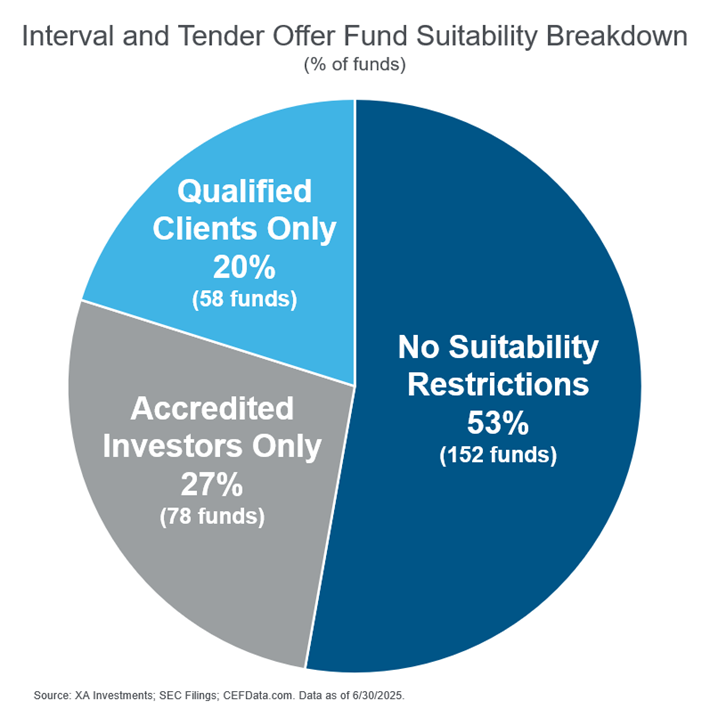

The interval and tender offer fund market is becoming more accessible for a wide range of investors! In Q2 2025, 14 interval and tender offer funds removed their accredited investor suitability restrictions after SEC Staff changes. More accreditation removals are expected throughout the rest of the year.

9/9/2025

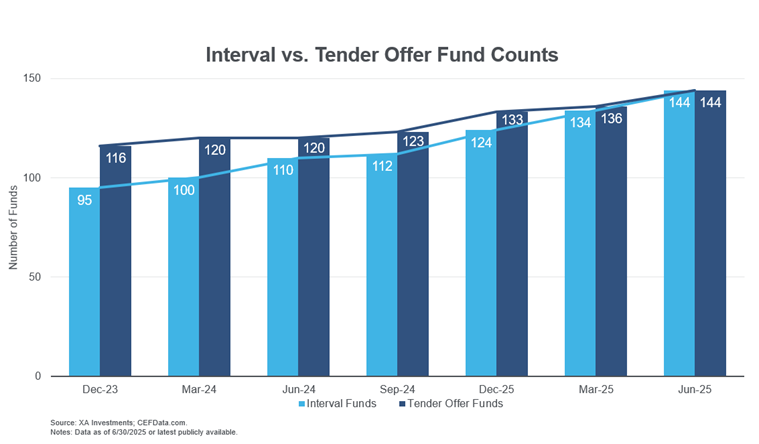

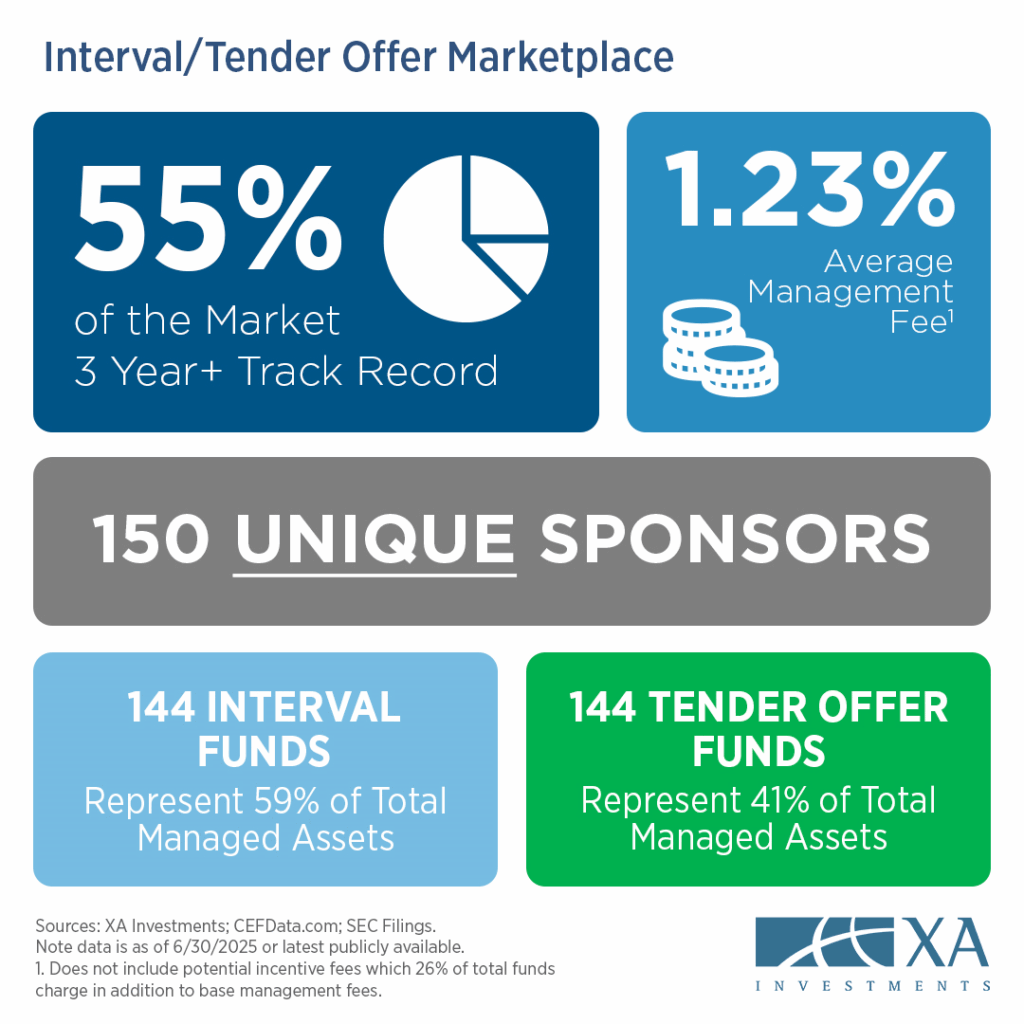

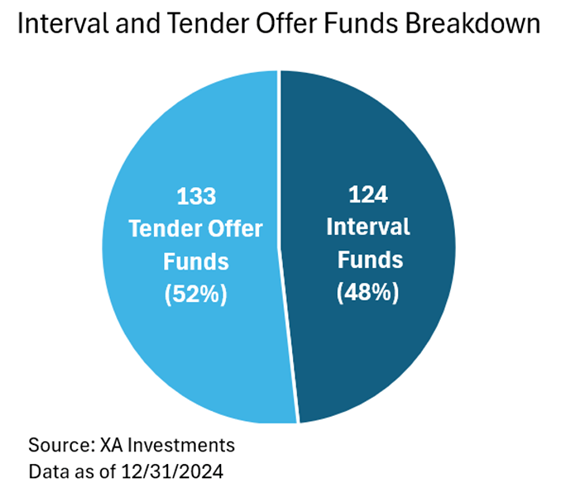

It’s a tie! The number of interval funds (144 funds) has caught up to the number of tender offer funds (144 funds). The number of interval funds increased 52% since December 2023, compared to tender offer funds increasing 24% over the same period.

9/2/2025

The number of unique fund sponsors in the interval fund market is growing. 12 new interval fund sponsors have entered the market in 2025. XAI predicts there will be approximately 30 new interval fund sponsors by year end.

8/28/2025

💡 XA Investments LLC advises its interval fund consulting clients to develop and regularly update comprehensive marketing materials. While most interval funds have a basic fund website or fact sheet, it is surprising how many interval funds are missing an opportunity to educate and inform new potential investors. These materials should include a dedicated fund website, a fact sheet, an investor presentation, and additional educational content. Providing important information such as leverage percentages and distribution rates can enhance investors’ understanding of funds in the market.

8/26/2025

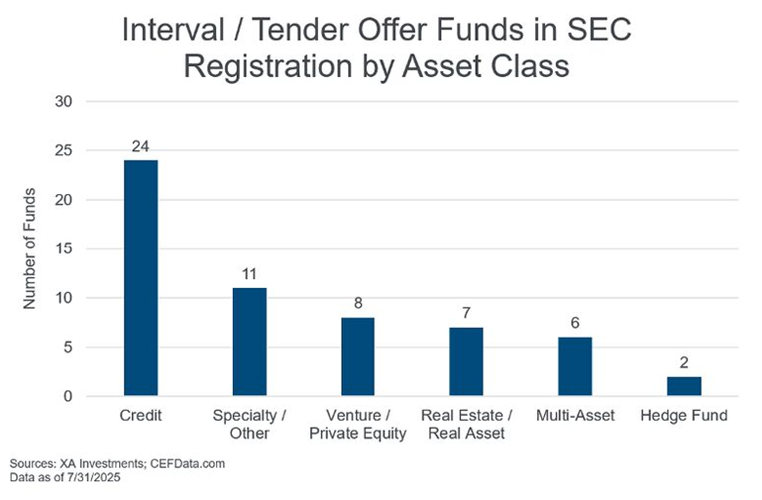

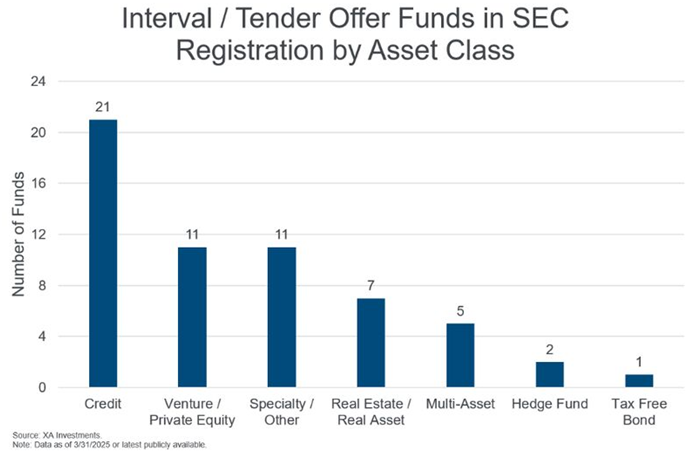

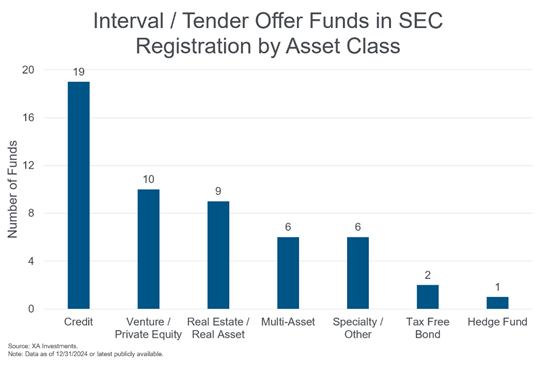

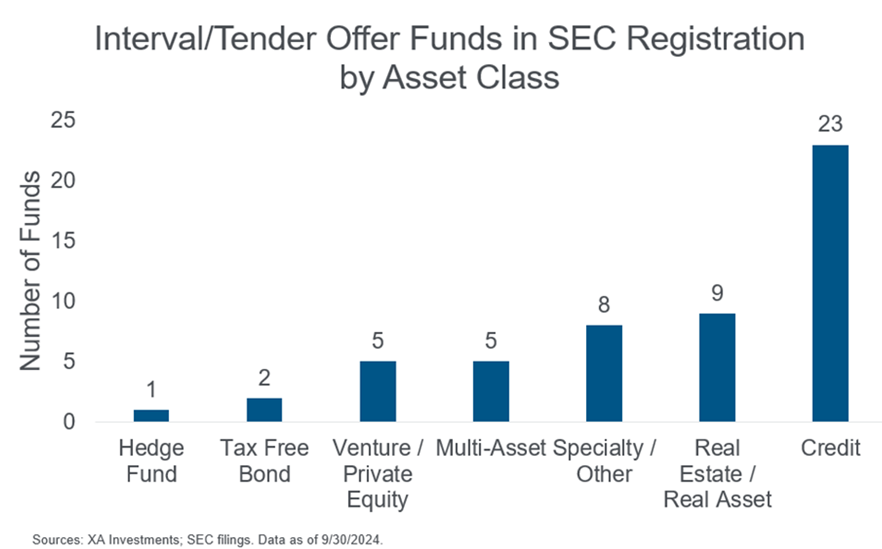

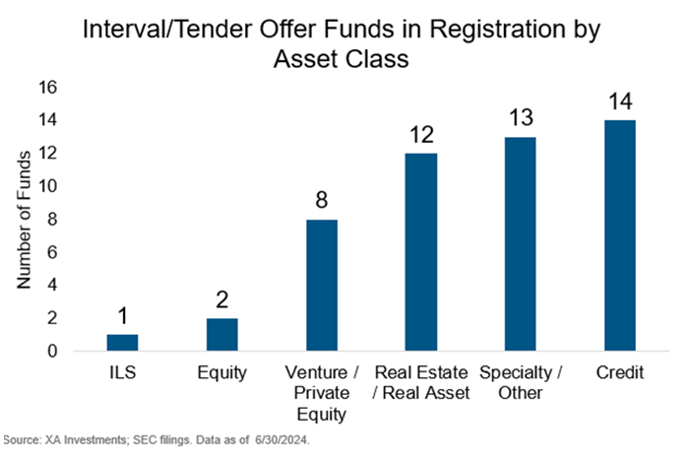

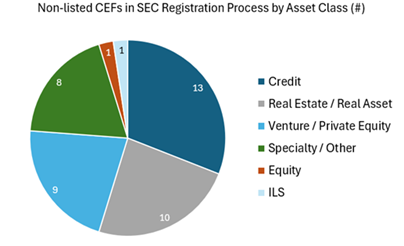

The pipeline of new interval and tender offer funds has grown to 58 funds in the SEC registration process as of 7/31/25. XAI observes 28 repeat sponsors in the pipeline, including Capital Group, Calamos, and Hamilton Lane. New first-time fund sponsors include, among others: Lincoln Financial, Man Group, and Blue Owl. (Data as of 7/31/2025)

8/12/2025

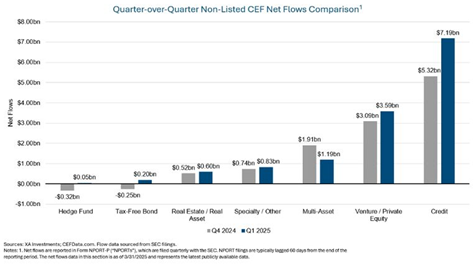

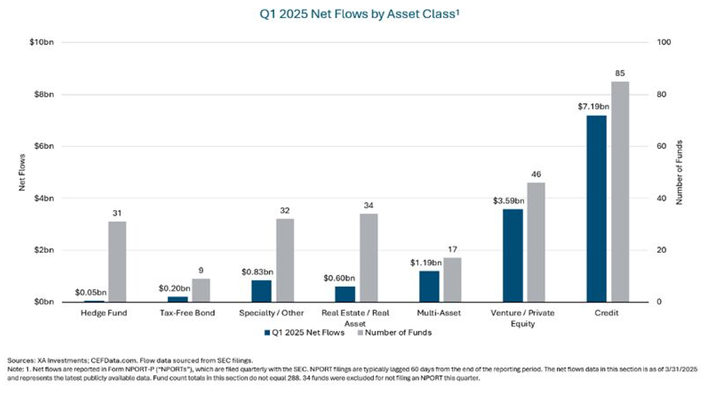

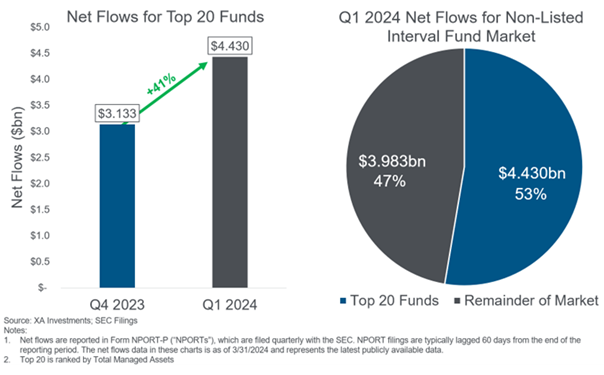

Net flows across the interval and tender offer fund market increased by $2.6bn quarter-over-quarter, from $11.01bn in Q4 2024 to $13.65bn in Q1 2025. Credit drove the majority of the increase, followed by gains among Venture/Private Equity.

Note: Net flows are based on Form NPORT-P filings as of 3/31/2024 and represent the most recent publicly available data. NPORT filings are typically lagged 60 days from the end of the reporting period.

8/11/2025

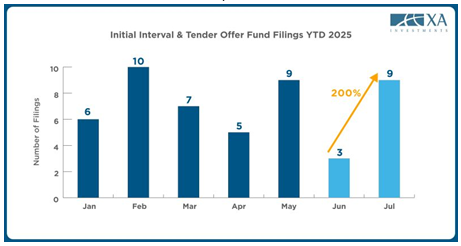

After a slow start to the summer, new interval and tender offer SEC filings are picking up. From June to July, there was a 200% increase in new filings, with more filings expected for the rest of 2025.

8/7/2025

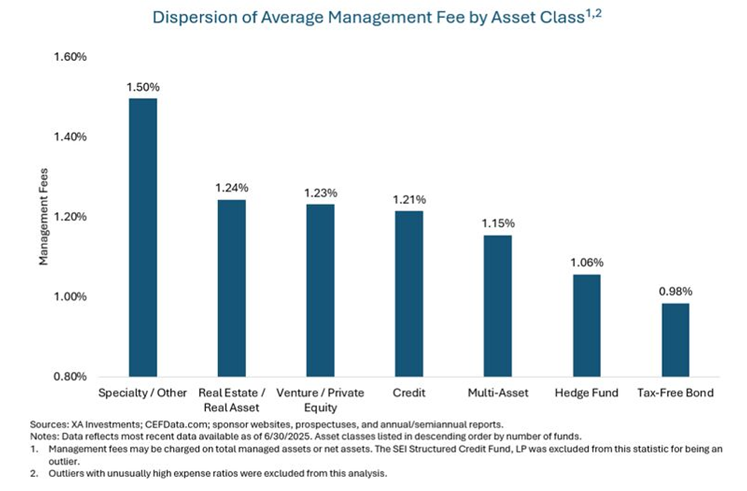

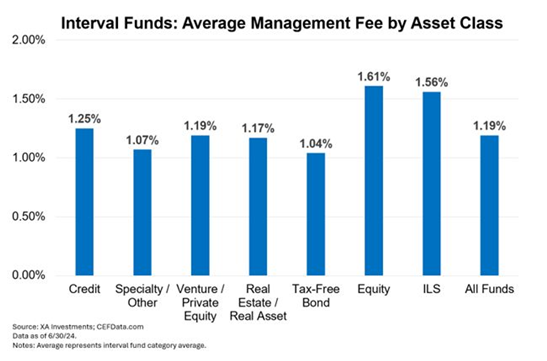

Management fees across the non-listed CEF market are typically between 1.00% and 1.50%. Net expense ratios vary more widely, driven by some strategies charging incentive fees or underlying private fund fees. Due to leverage, credit funds have the highest average net expense ratio (2.84%), followed by Venture/Private Equity (2.55%) and Multi-Asset strategies (2.48%).

8/6/2025

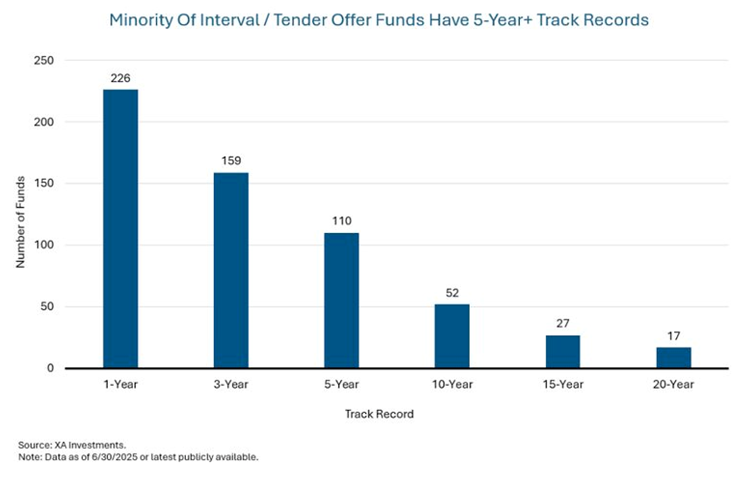

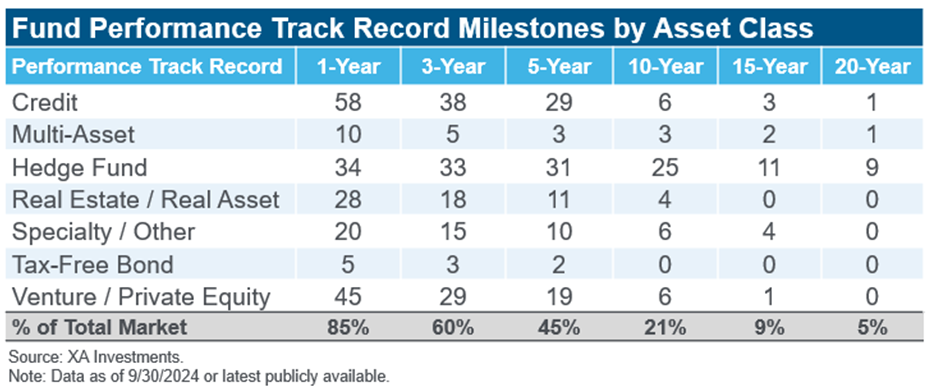

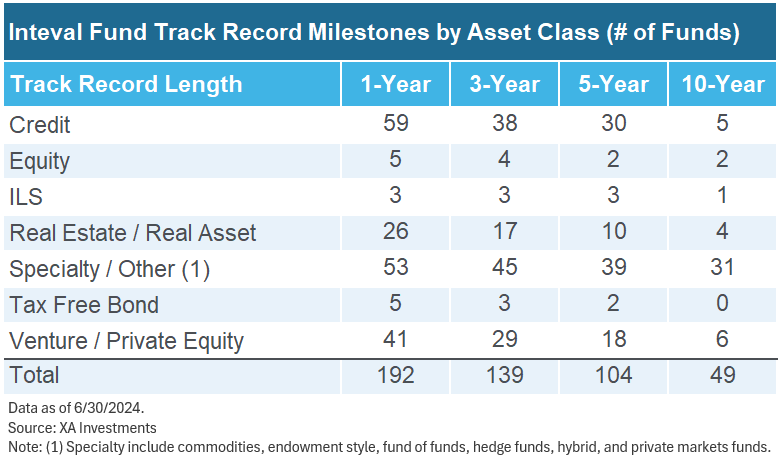

The non-listed closed-end fund market continues to mature, with more funds reaching longer performance milestones. As of 6/30/2025, 78% of funds have at least a 1-year track record, 55% have reached a 3-year track record, and 38% now have a 5-year track record.

While earlier success in the market may have been driven by manager brand names and broader historical results, the maturation of the market is now leading to a growing preference for managers with established track records.

7/31/2025

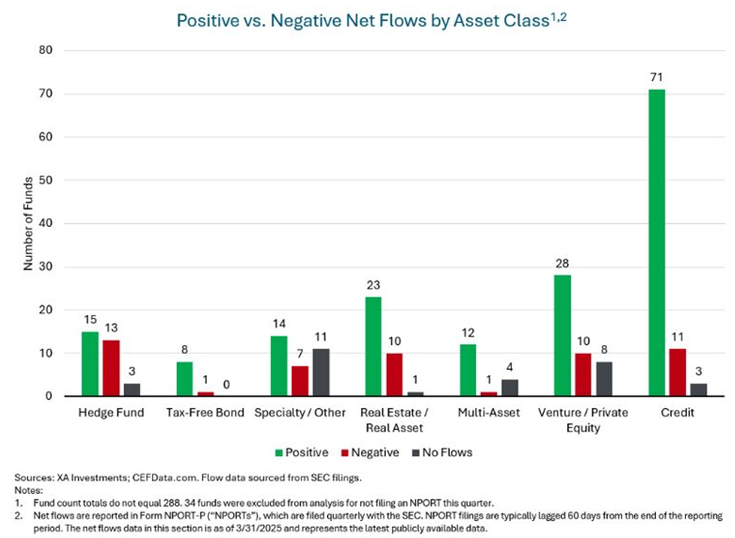

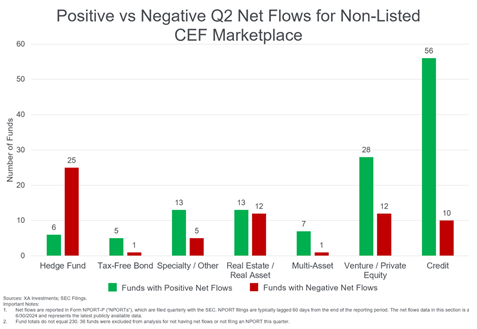

67% of interval and tender offer funds reported positive net flows in Q1 2025. Credit and Venture/Private Equity strategies led the market, with 71 and 28 funds, respectively, posting positive net flows. In contrast, Hedge Funds saw the highest concentration of funds experiencing outflows, with 13 of 31 funds reporting negative net flows.

Note: Net flow data is sourced from Form NPORT-P filings and reflects the latest publicly available data as of 3/31/2025. NPORT filings are typically lagged 60 days from the end of the reporting period.

7/29/2025

In Q1 2025, the non-listed CEF market saw positive net flows across all asset classes. Credit and Venture/Private Equity strategies led the non-listed CEF market when it came to net flows in Q1 2025. Credit funds raised $7.19bn across 85 funds, while Venture/Private Equity strategies gathered $3.59bn across 46 funds.

Note: Net flows are sourced from Form NPORT-P filings and reflect data as of 3/31/2025, the latest publicly available information. NPORT filings are typically lagged 60 days from the end of the reporting period.

7/23/2025

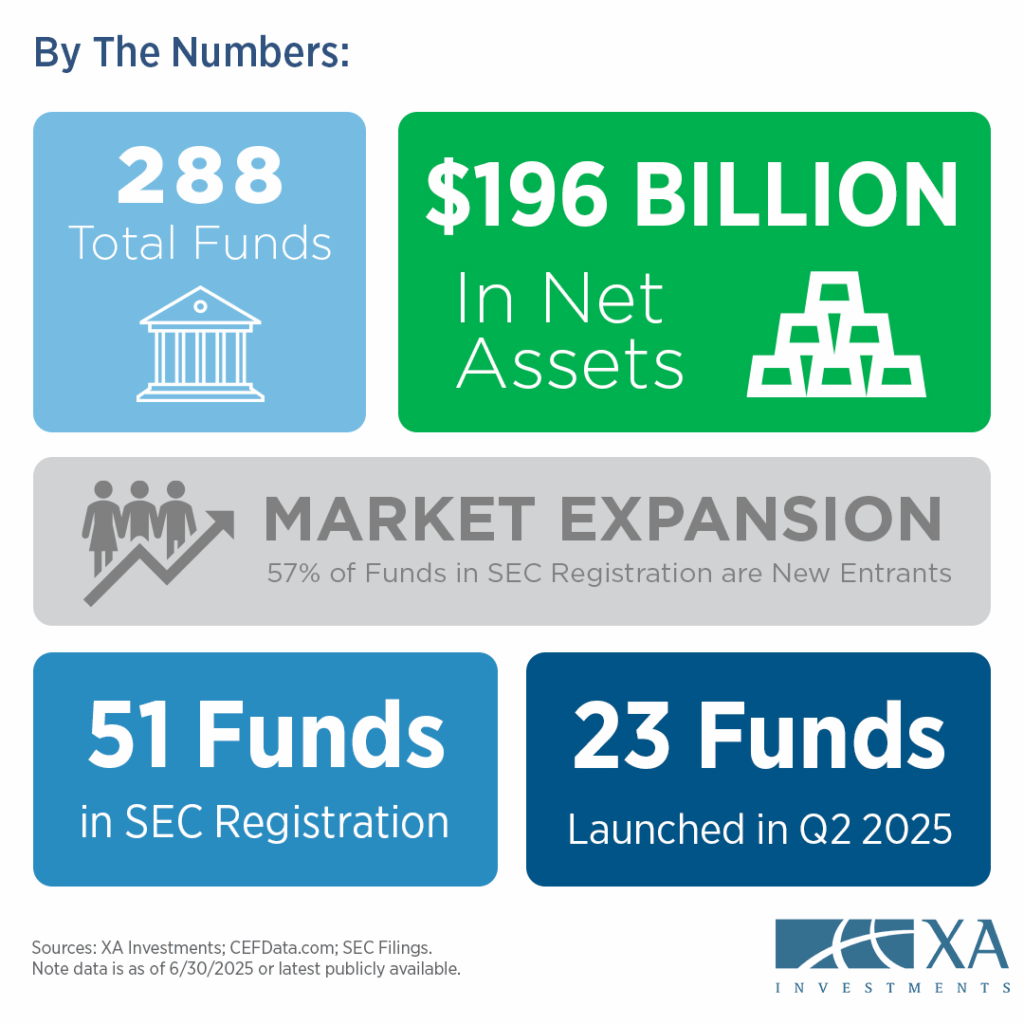

Now totaling 288 funds, the interval and tender offer fund universe continues to expand, drawing increased attention from asset managers and investors. This quarter’s report highlights key market data and developments, including regulatory changes, net flows, new fund launches, and other emerging trends.

7/20/2025

Quarterly Report Preview: The use of leverage to enhance income and increase total returns is becoming more commonplace among credit interval funds. See which credit interval funds are using leverage in the upcoming XA Investments Quarterly Research Report.

7/17/2025

Quarterly Report Preview: Who’s new in the interval / tender offer fund market? Learn about the 17 new interval fund SEC filings, the 23 new interval funds launched in Q2 2025, and more in the upcoming XA Investments Quarterly Research Report.

7/15/2025

Quarterly Report Preview: Curious about whether or not your interval fund fees are competitive? Learn about management fee ranges, performance fee ranges, and more in the upcoming XA Investments quarterly research report.

7/13/2025

Quarterly Report Preview: The world of alternative evergreen fund structures is expanding. Learn more about some of the Evergreen Specialty Structures including Retail 3(c)(7) Funds and more in the upcoming XA Investments Quarterly Research Report.

07/10/2025

Quarterly Report Preview: The interval / tender offer fund market has $196 billion in net assets as of 6/30/2025. The interval fund market is growing quickly, with a 31% increase from the previous year and an 8% increase over the previous quarter.

07/08/2025

Quarterly Report Preview: The removal of the unwritten SEC rule limiting CEFs’ ability to invest in private funds without suitability restrictions has led many funds to remove accredited suitability restrictions. To learn which interval funds are removing their suitability restrictions, subscribe to XAI’s quarterly research report.

07/02/2025

The interval fund market now stands at 288 funds with $227 billion in total managed assets as of 6/30/2025. Credit funds continue to lead the way in both the number of funds and total managed assets.

06/27/2025

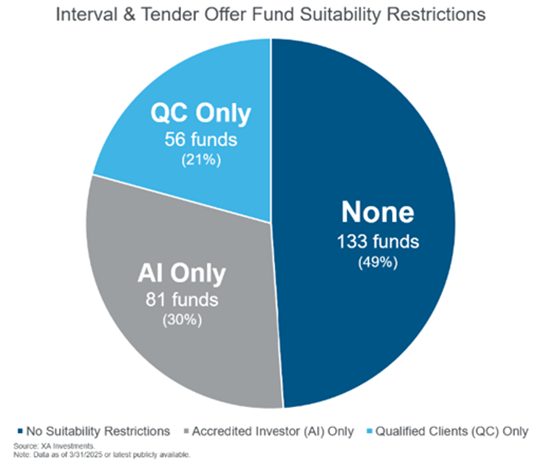

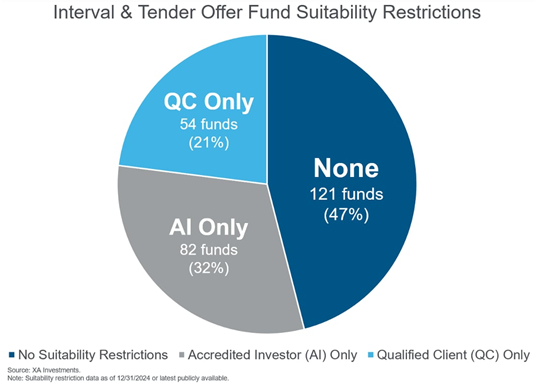

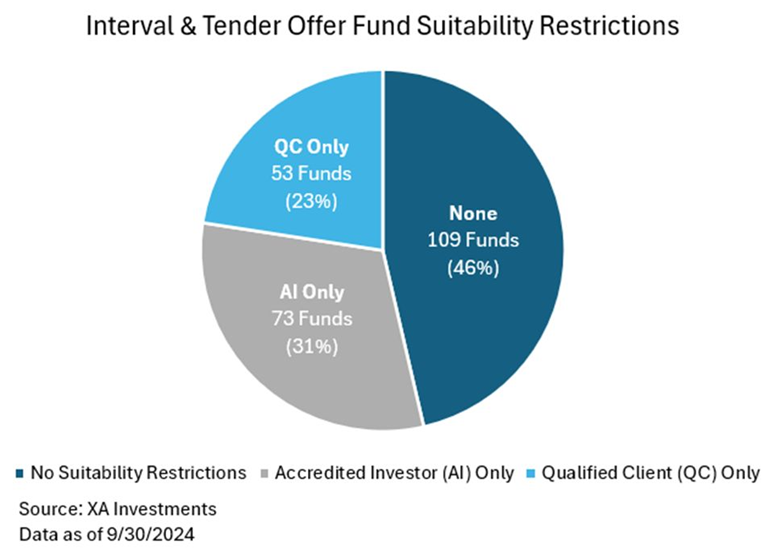

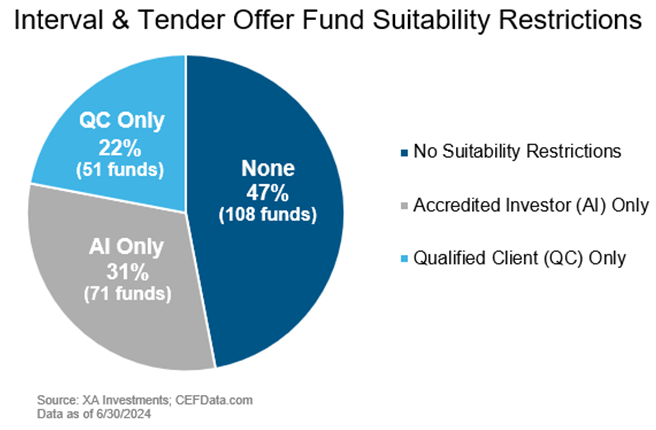

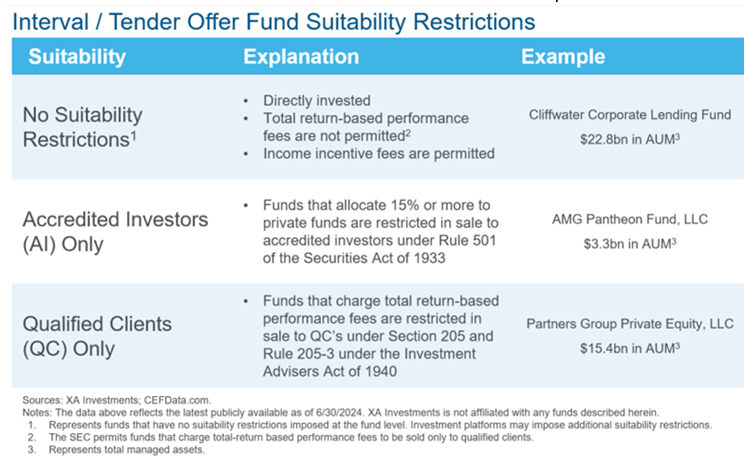

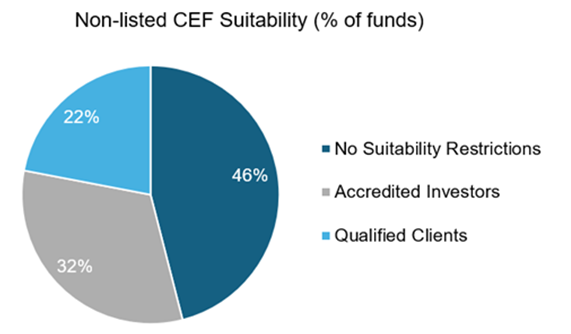

XAI observes that an interval fund that is broadly salable attracts the greatest net flows. Nearly half (49%) of interval/tender offer funds do not have any fund-level suitability restrictions; 30% are open to accredited investors, and 21% are open to qualified clients. Funds without suitability restrictions raise capital more effectively, accounting for 53% of interval fund market net flows in 2024.

Note: NPORT data is typically lagged by 60 days from the end of the reporting period. The data in this post is as of 12/31/24 and represents the latest publicly available data as of year-end.

06/18/2025

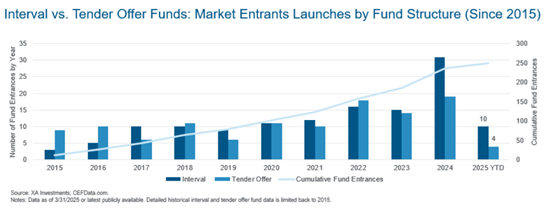

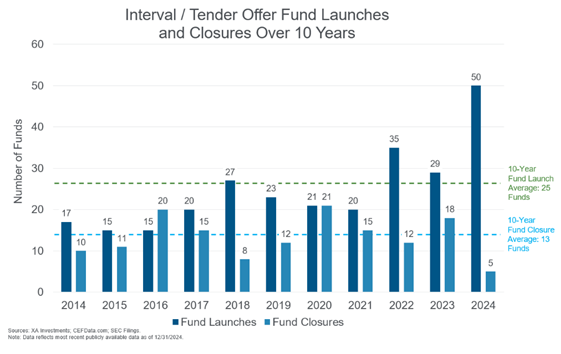

The non-listed closed-end fund (CEF) market has experienced continued growth in new product launches over the past decade. Since 2015, a total of 250 interval and tender offer funds have entered the market (132 interval funds and 118 tender offer funds). The number of funds launched has accelerated in recent years, with 2024 marking the highest number of launches (50) in a single year. (Data as of 3/31/2025)

06/17/2025

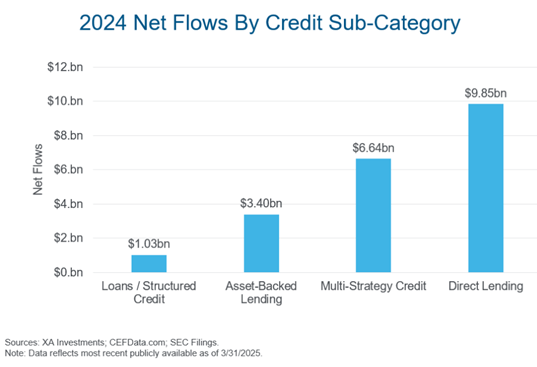

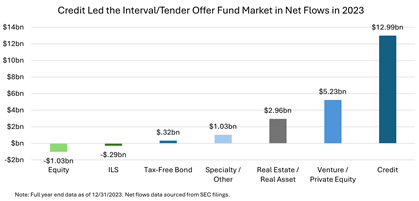

2024 was a record year for interval and tender offer fund net flows with credit funds bringing in over $20.91bn. Direct Lending funds led the credit category with $9.85 billion in net flows, followed by Multi-Strategy Credit funds with $6.64 billion.

Net flows are reported in Form NPORT-P (“NPORTs”), which are filed quarterly with the SEC. NPORT filings are typically lagged 60 days from the end of the reporting period. The net flows data above are as of 12/31/2024 and represents the latest publicly available data. Chart represents credit fund net flows from 1/1/2024 to 12/31/2024.

06/12/2025

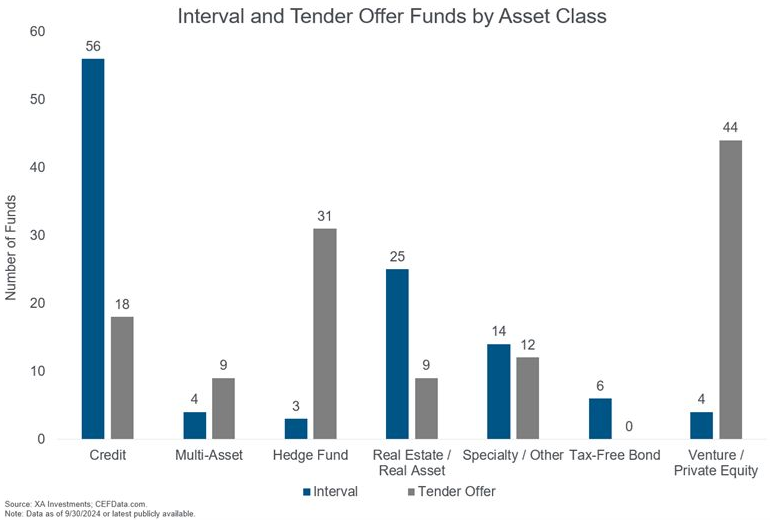

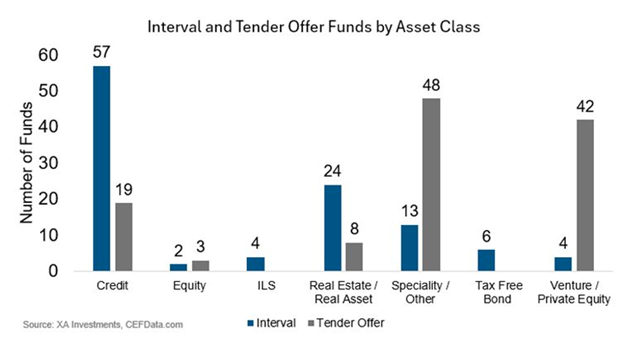

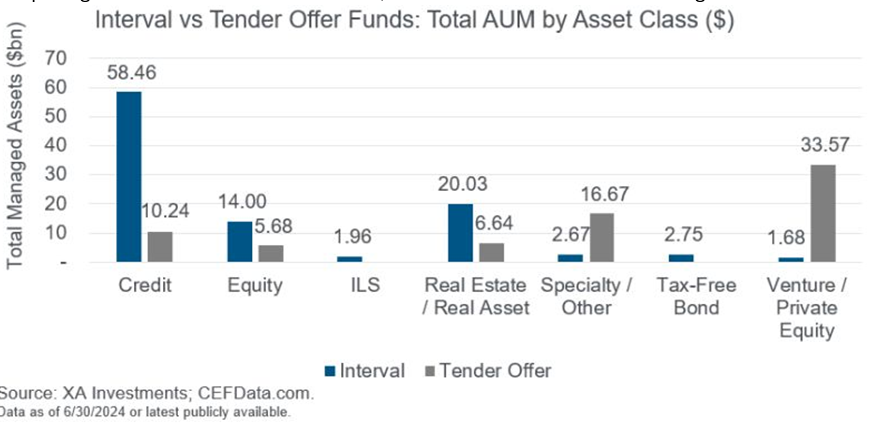

Interval funds represent 60% ($132.1 billion) of the $220.4 billion in total managed assets across non-listed CEFs, despite accounting for only 50% of funds by count. Credit funds make up the largest segment of interval funds by AUM with $88.5 billion, while Venture/Private Equity funds dominate the tender offer fund structure with $43.9 billion.

06/10/2025

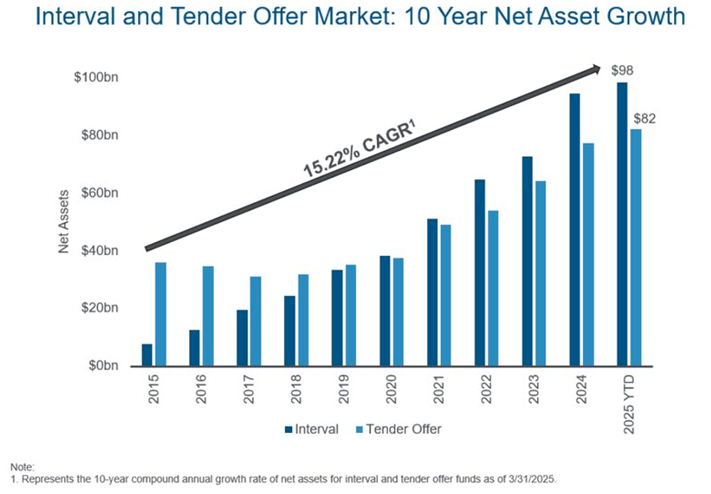

The interval and tender offer fund market net assets have grown at a 15% compounded annual growth rate over the past decade. Combined net assets rose from approximately $44 billion in 2015 to over $180 billion by Q1 2025. Both interval and tender offer fund structures have contributed meaningfully to this long-term growth. (Data as of 3/31/2025)

06/06/2025

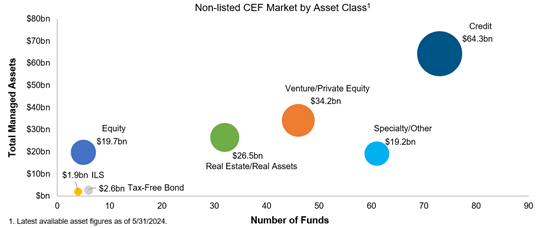

Credit funds represent the largest asset class in the interval and tender offer fund market, with $99.7 billion in total managed assets, accounting for 45% of the market. Venture/Private Equity follows with 21%, while Hedge Funds and Real Estate strategies each hold 13%.

06/03/2025

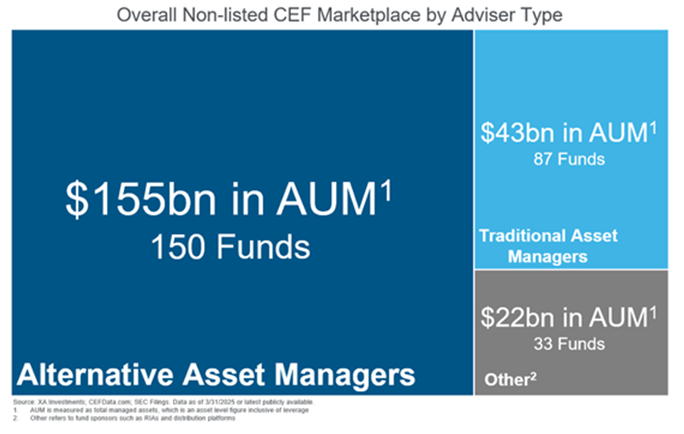

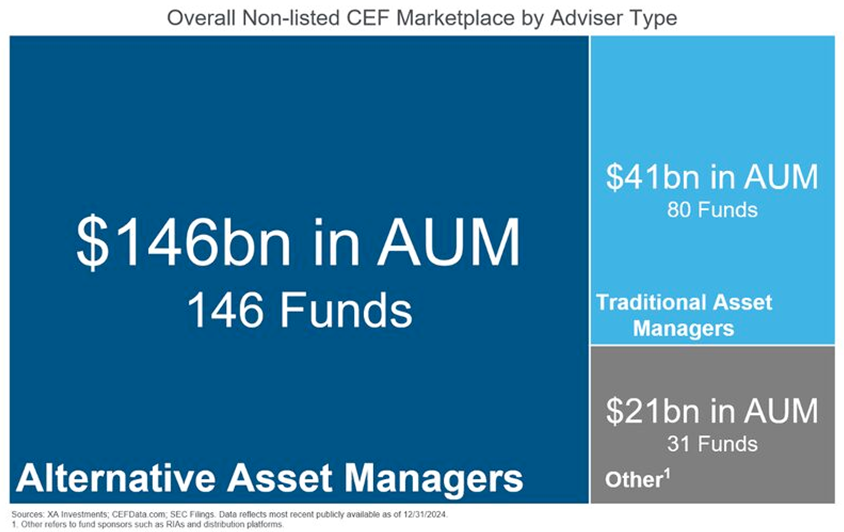

Alternative asset managers continue to dominate the interval fund market in AUM and number of funds ($155bn in AUM and 150 funds). Traditional asset managers have struggled to raise capital as effectively with $43bn in AUM across 87 funds. Other specialty firms have gathered $22bn in AUM across 33 funds.

5/29/2025

The pipeline of new interval and tender offer funds has grown to 58 funds in the SEC registration process as of 3/31/25. In the pipeline, XAI observes 27 repeat sponsors including iCapital, Brookfield, and Carlyle. New first-time fund sponsors include, among others: Blue Owl, Raymond James, and CAIS. (Data as of 3/31/2025)

5/27/2025

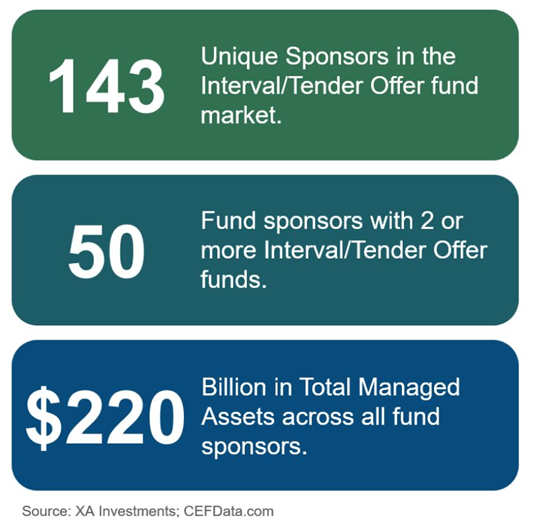

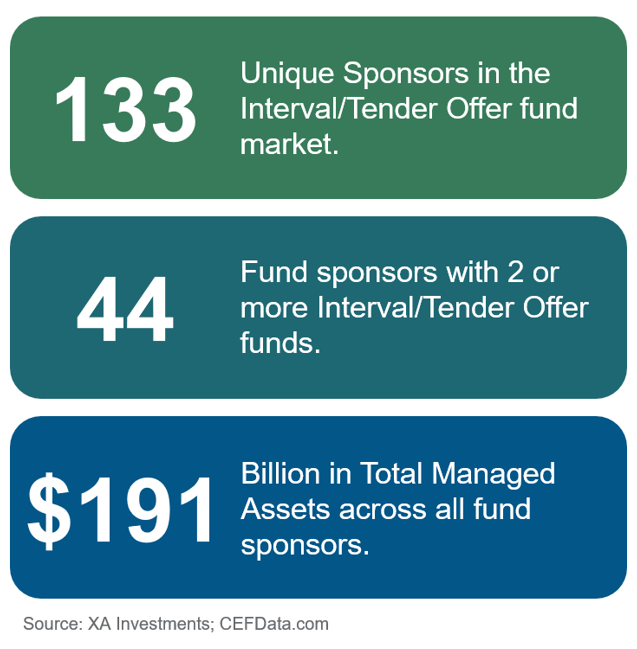

There are 143 unique sponsors in the Interval/Tender Offer fund marketplace. Out of the 143 sponsors, 50 sponsors have two or more funds, with 27 existing sponsors in SEC registration now and planning to launch another fund. (Data as of 3/31/2025)

5/13/2025

💡 Industry Improvement Idea: Interval and tender offer fund sponsors should check their fund description on Bloomberg to make sure that it includes the fund’s structure. It is important to explicitly state that the fund is either an interval fund or a tender offer fund so that Bloomberg users understand the fund’s structure and liquidity features. Including the fund’s structure in the description also allows Bloomberg users to pull up lists of comparable funds with the same structure. Bloomberg permits changes from fund sponsors who want to improve their fund descriptions for searchability or for marketing reasons.

4/25/2025

Quarterly Report Highlight: Want to learn why some interval fund sponsors are conducting simultaneous offerings under the 1940 and 1933 act for the same fund? See the case study in the XA Investments Quarterly Research Report.

4/24/2025

Quarterly Report Highlight: Over the past year, net flows have increased by 84% year-over-year, with more than $20 billion raised in the Credit asset class alone. Discover deeper insights into the net flows of the interval / tender offer fund market in the XA Investments Quarterly Research Report.

4/23/2025

The XA Investments LLC Q1 2025 Quarterly market research report is now available in the XAI Knowledge Bank. In the report learn about the 270 interval / tender offer funds in the market, changes in the SEC, 2024 net flows, and more.

4/17/2025

Quarterly Report Preview: What’s new in the interval / tender offer fund market? Learn about the 23 new SEC filings, the 14 new funds launched in Q1 2025, and more in the upcoming XA Investments Quarterly Research Report.

4/16/2025

Quarterly Report Preview: In Q1 2025, the number of new interval fund filings increased by over 53% compared to Q1 2024, rising from 15 to 23 funds.

4/15/2025

Quarterly Report Preview: 2024 was a big year for capital raising in the interval and tender offer fund market, with the market bringing in over $39 billion in net flows. Net flows data is typically reported on a 60-day lag after the quarter end for each fund. To receive full coverage of 2024 year-end net flows, subscribe to XA Investment’s proprietary research.

4/8/2025

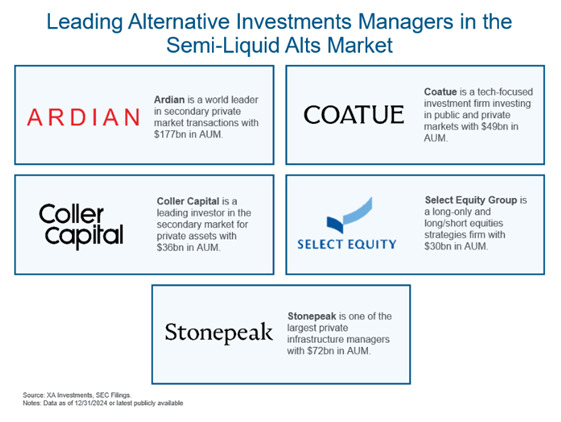

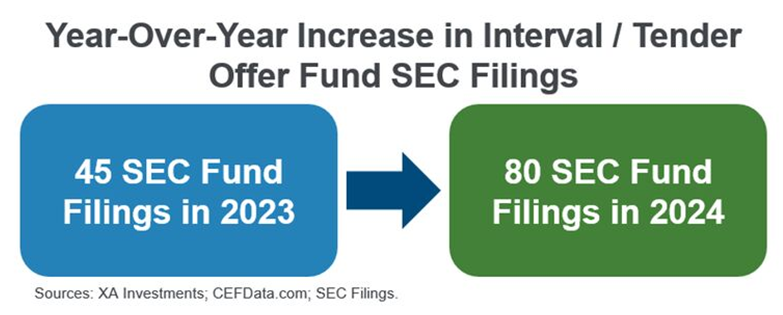

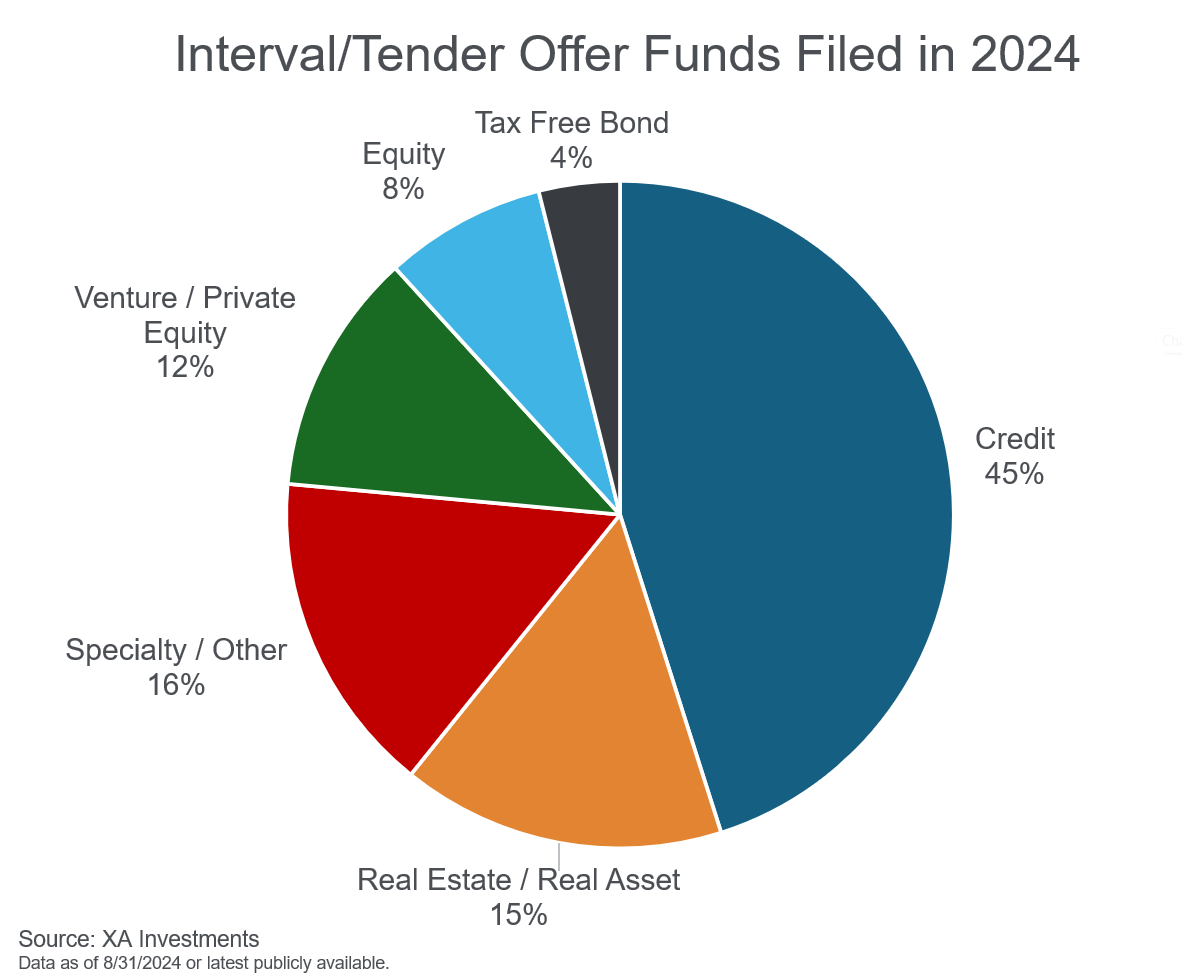

In 2024, 50 funds entered the market, and 80 funds filed with the SEC. Among these, funds were filed or launched by leading alternative investment managers Ardian, Coatue, Coller Capital, Select Equity, and Stonepeak.

4/4/2025

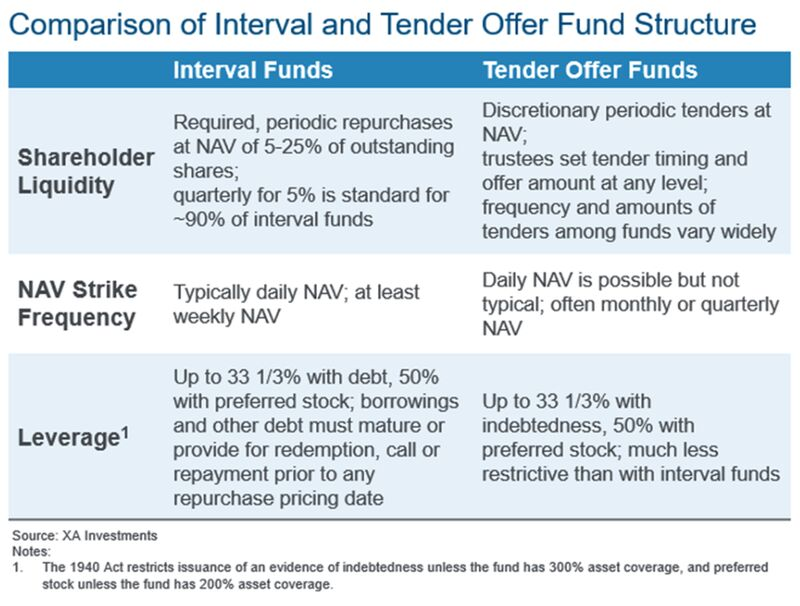

💡Industry Improvement Idea: XAI encourages interval and tender offer fund sponsors to educate and to constructively explain the differences in the interval and tender offer fund structures. It serves the industry well to speak in a positive way about the differences as some interval fund sponsors may see themselves launching a tender offer fund down the road.

3/27/2025

In 2024, the interval fund industry rapidly expanded with 50 fund launches and just 5 closures – the highest and lowest, respectively, in the past decade! This trend surpasses the ten-year average by 25 more openings and 8 fewer closures.🚀

3/25/2025

The interval fund market now stands at 265 total funds with $178bn in net assets, reflecting a net gain of 8 funds and $6bn in net assets in 2025 YTD (as of 2/28/2025).

3/20/2025

💡 Industry Improvement Idea: Quarterly NPORT filings provide valuable data for investors and market observers and many market participants will scrape the data since it is reported in a standardized form. We encourage all fund sponsors to review these filings more thoroughly as NPORT data becomes more heavily relied upon throughout the industry.

3/18/2025

The interval fund market now stands at 265 funds with $219 billion in total managed assets as of 2/28/2025. Credit funds continue to lead the way in both the number of funds and total managed assets.

03/13/2025

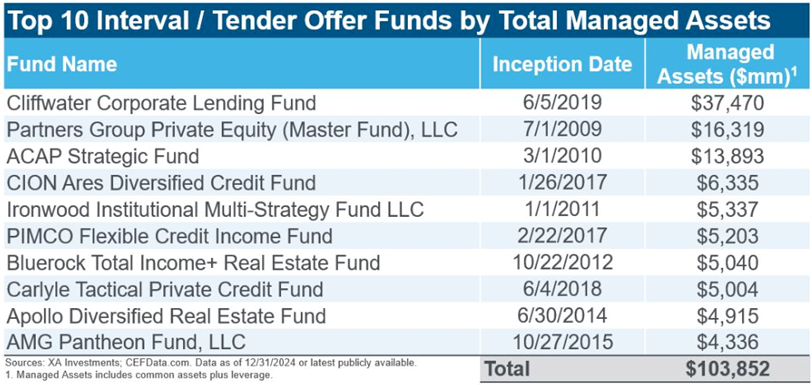

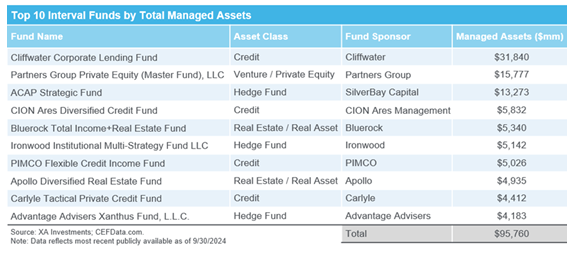

The top 10 interval / tender offer funds have each surpassed $4 billion in managed assets as of 12/31/2024, totaling over $100 billion across the 10 funds. This represents an 8.5% (~$8 billion) increase over the previous quarter’s results.

03/11/2025

💡 Industry Improvement Idea: XAI observes that more funds have been using leverage to enhance income and increase total returns. XAI encourages interval and tender offer fund sponsors to consider improving their disclosures regarding the use of leverage, including adding leverage ratios to their fund fact sheets and fund.

03/06/2025

There were 80 total new interval / tender offer fund SEC filings in 2024 compared to 45 total new fund SEC filings in 2023. This represents a 77% (35 fund) year-over-year increase with more funds expected to be filed in 2025.

03/04/2025

Alternative asset managers continue to dominate the interval fund market in AUM and number of funds ($146bn in AUM and 146 funds). Traditional asset managers have struggled to raise capital as effectively with $41bn in AUM across 80 funds. Other specialty firms have gathered $21bn in AUM across 31 funds.

02/27/2025

XAI observes that an interval fund that is broadly saleable gains the most sales traction. Nearly half (47%) of interval/tender offer funds do not have any fund-level suitability restrictions; 32% are open to accredited investors, and 21% are open to qualified clients. Funds without suitability restrictions raise capital more effectively, accounting for 54% of 2024 YTD (1/1/24 – 9/30/24) net flows.

Note: NPORT data is typically lagged by 60 days from the end of the reporting period. The data in this post is as of 9/30/24 and represents the latest publicly available data as of year-end.

02/25/2025

The pipeline of new interval funds has grown to 53 Interval/Tender Offer funds in the SEC registration process as of 12/31/24. In the pipeline, XAI observes 26 repeat sponsors including Hamilton Lane, Morgan Stanley, and BlackRock. New first-time fund sponsors include, among others: Segall Bryant & Hamill, Coatue Management, and Global X. (Data as of 12/31/2024)

02/20/2025

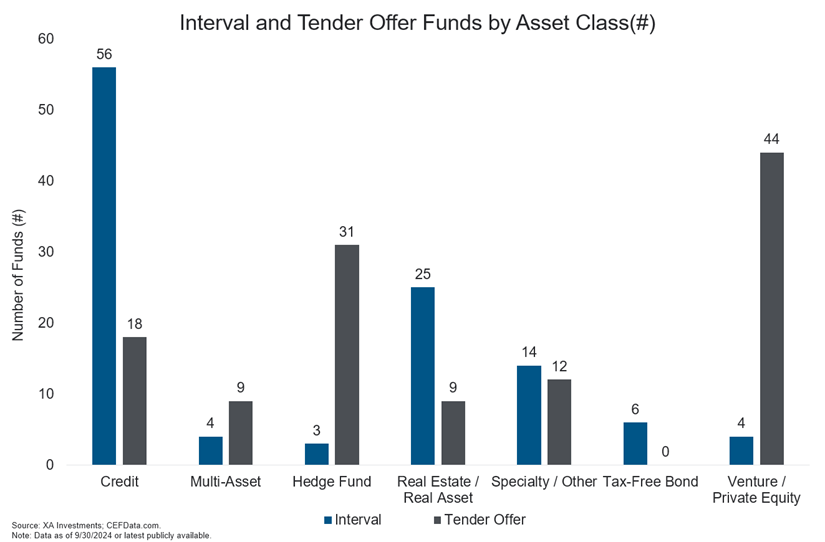

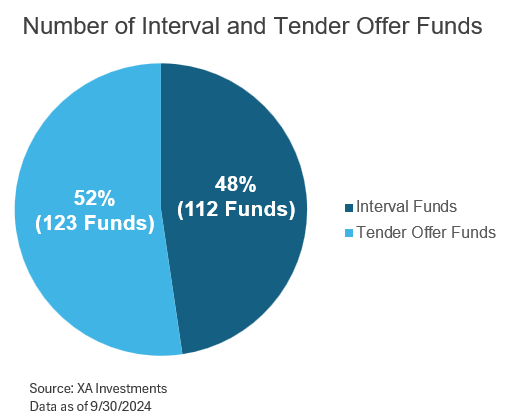

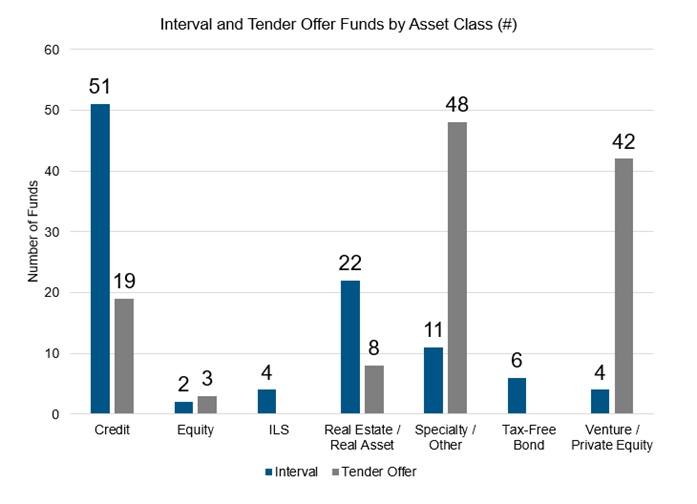

Tender offer funds represent 52% of the 257 total non-listed CEFs in the marketplace. Among the tender offer funds, Venture / Private Equity funds (42 or 32%) are the most prevalent. Among the interval funds Credit funds (63 or 51%) are the most prevalent.

02/18/2025

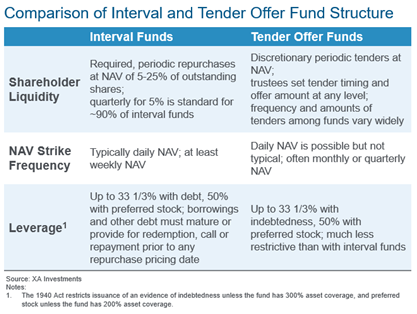

FAQ: Q: What is the main difference between an interval fund and a tender offer fund? A: Shareholder liquidity. With that said, we maintain that these sister structures are very similar. Check out the table below to learn more about the structural differences between interval and tender offer funds.

02/13/2025

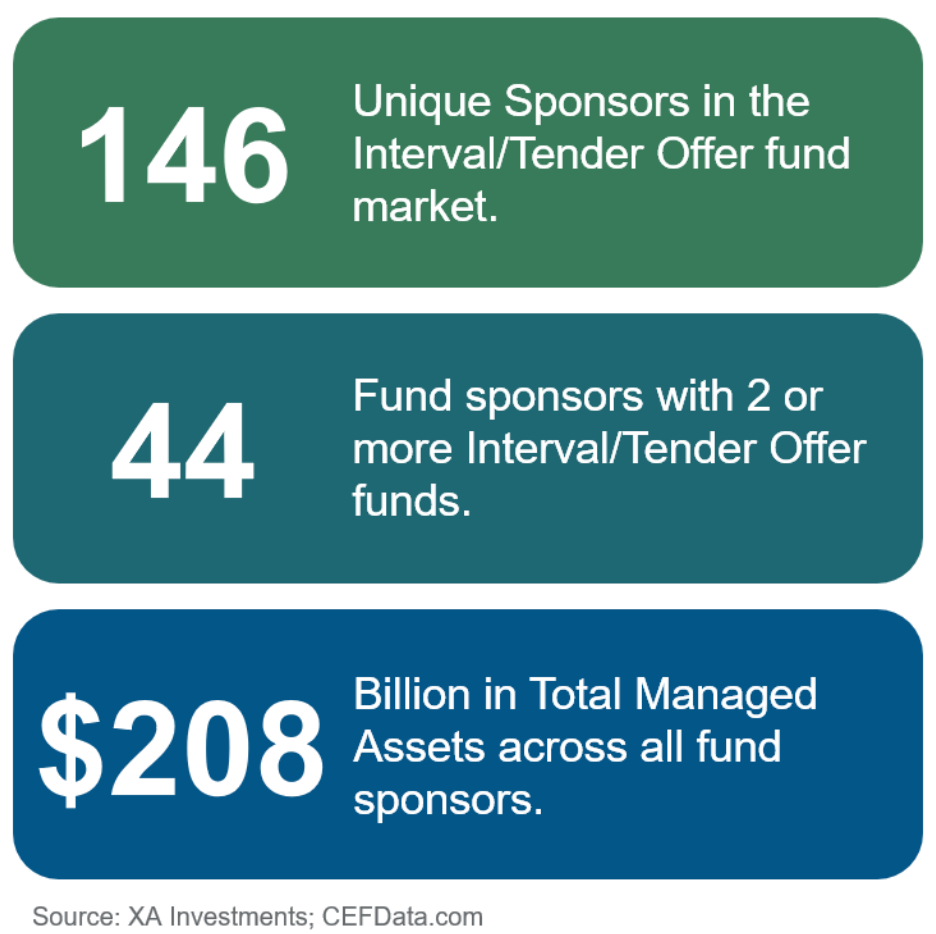

There are 146 unique sponsors in the Interval/Tender Offer fund marketplace. Out of the 146 sponsors, 44 sponsors have two or more funds, with 18 existing sponsors in SEC registration now and planning to launch another fund. (Data as of 12/31/2024)

02/11/2025

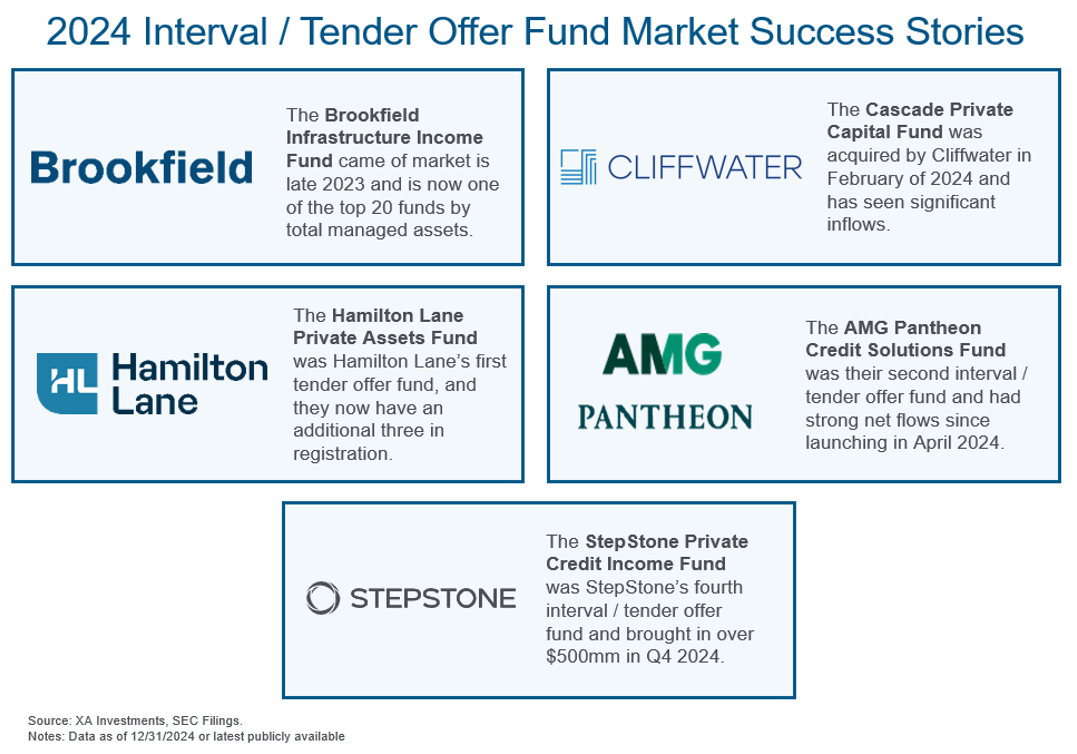

Some of the interval / tender offer funds that had notable growth and success raising assets in 2024 include the Brookfield Infrastructure Income Fund, the Cascade Private Capital Fund, the Hamilton Lane Private Assets Fund, the AMG Pantheon Credit Solutions Fund, and the StepStone Private Credit Income Fund.

02/07/2025

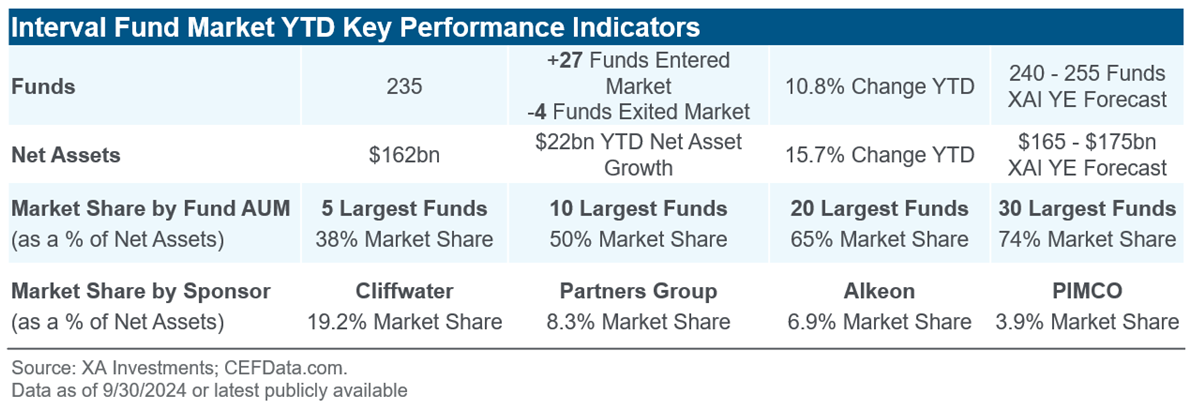

The 20 largest interval and tender offer funds each have over $2bn in total managed assets and together comprise 65% of the interval/tender offer fund market by total managed assets. The market leaders include Cliffwater, Partners Group, Alkeon Capital Management and PIMCO.

02/06/2025

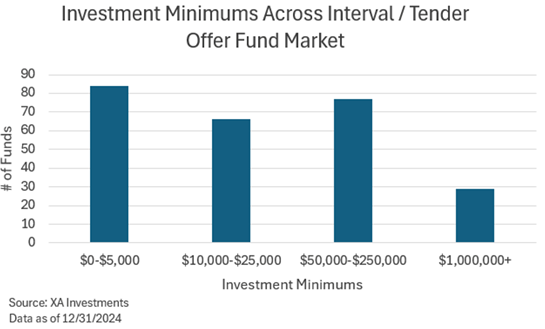

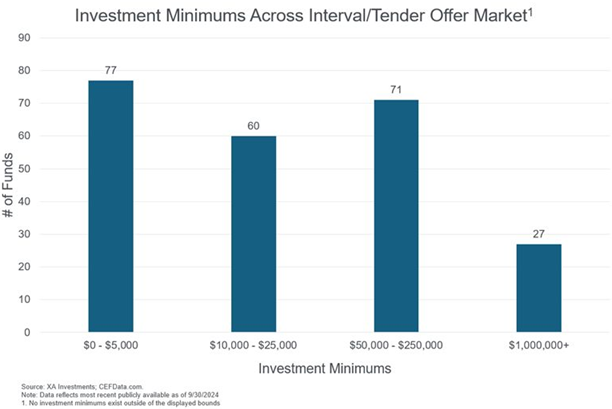

More than half of all interval and tender offer funds in the marketplace have investment minimums that are $25,000 or below, making the funds accessible for a broad audience of retail investors. Note, no investment minimums exist outside the displayed bounds.

12/20/2024

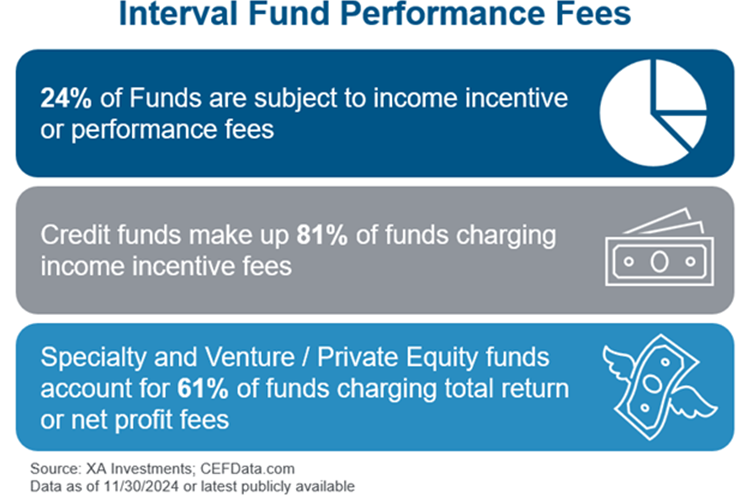

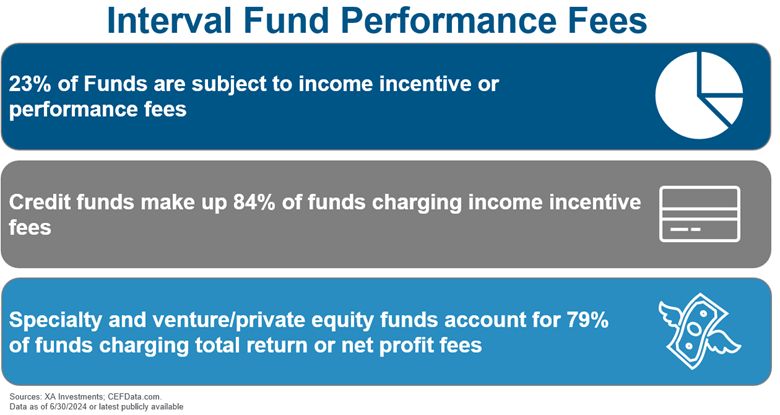

24% of all funds in the interval and tender offer fund market are subject to income incentive or performance fees. Breaking down the funds: Credit funds make up 81% (26 funds) of funds charging income incentive fees. Venture / Private Equity and Specialty funds account for 61% (17 funds) of funds charging total return or net profit fees.

12/09/2024

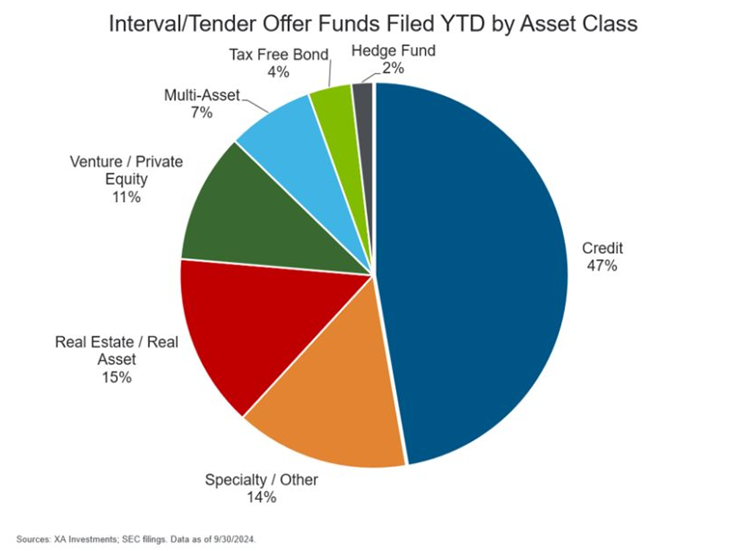

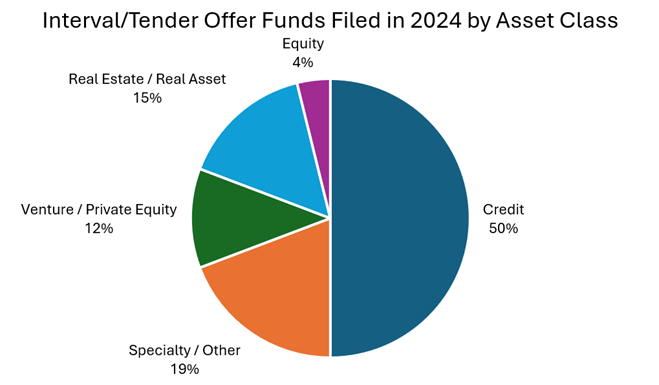

Anticipated interval fund market expansion: As of 9/30/2024, 55 new interval/tender offer funds filed their initial registration statement with the SEC so far this year. Credit funds account for 47% of the registrations.

12/06/2024

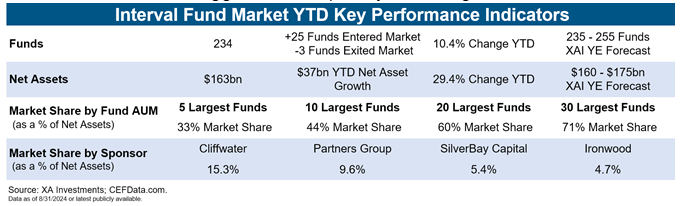

Year to date, the interval / tender offer fund market has observed 22 new funds launched and $22bn in net asset growth (as of 9/30/2024). Key performance indicators shown below continue to demonstrate strong growth and adoption rates.

12/03/2024

There are 133 unique sponsors in the Interval/Tender Offer fund marketplace accounting for a total of 235 funds. Out of the 133 sponsors, 44 sponsors have two or more funds, with 18 existing sponsors in SEC registration for another fund. (Data as of 9/30/2024)

11/26/2024

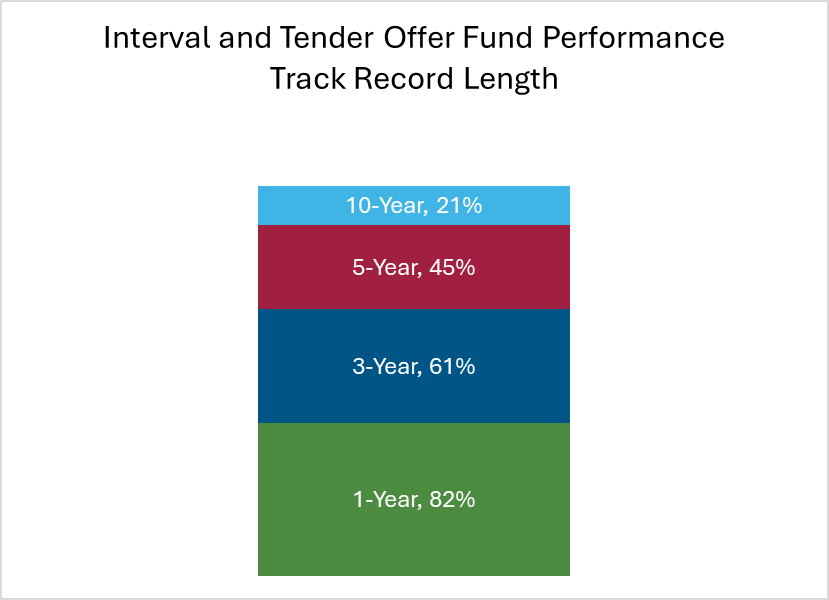

The interval and tender offer fund market has continued to grow and mature. Of the 235 funds in the market, 60% of the funds have a 3-year track record and only 21% have a 10-year track record.

11/21/2024

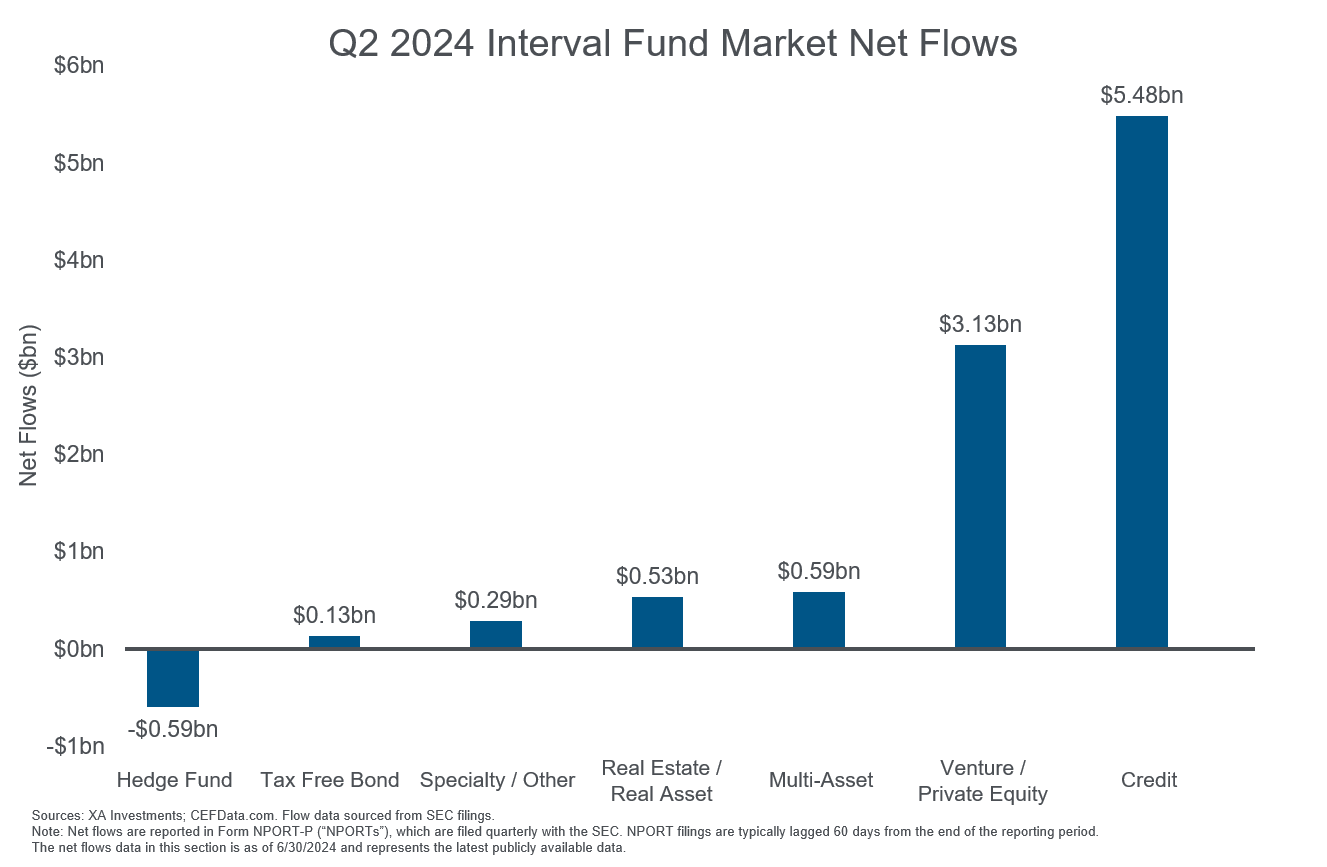

The credit asset class dominated net flows for interval funds in Q2 2024, comprising 57% of the market’s positive flows. Credit funds also outperformed other asset classes on a fund-by-fund level, generating the highest average and median net flow of ~$77mm and ~$19mm, respectively.

Note: Net flows are reported in Form NPORT-P (“NPORT”), which are filed quarterly with the SEC. NPORT filings are typically lagged 60 days from the end of the reporting period. The net flows data in this section is as of 6/30/2024 and represents the latest publicly available data.

11/19/2024

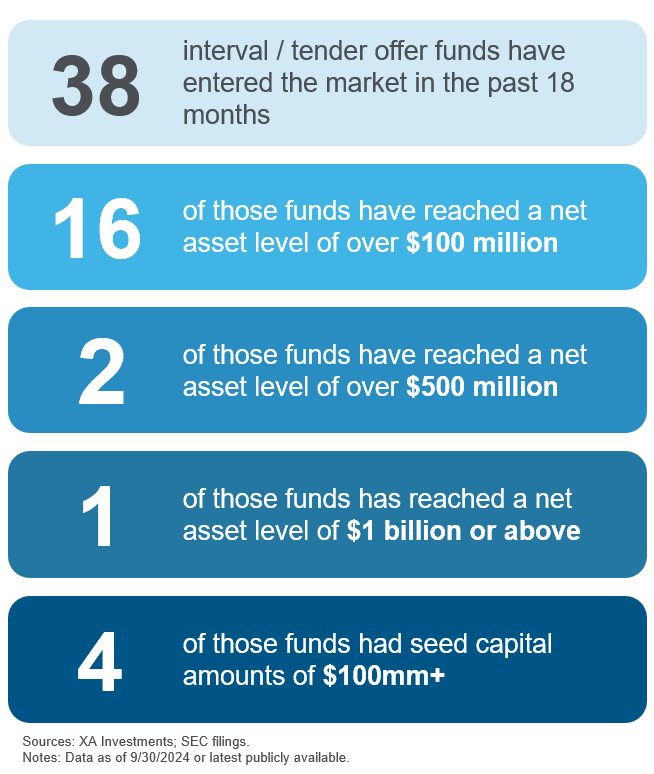

Interval Fund FAQ: What is the typical capital raised in the first year of operation for a new interval fund?

42% of interval funds launched in the last 18 months have met the $100 million asset level. Reaching the $100 million mark is important for new interval funds so they can better cover operating expenses.

11/15/2024

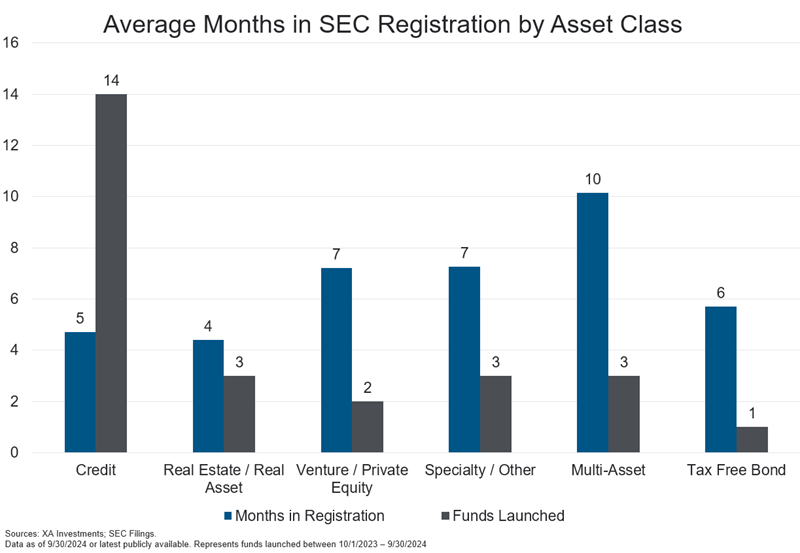

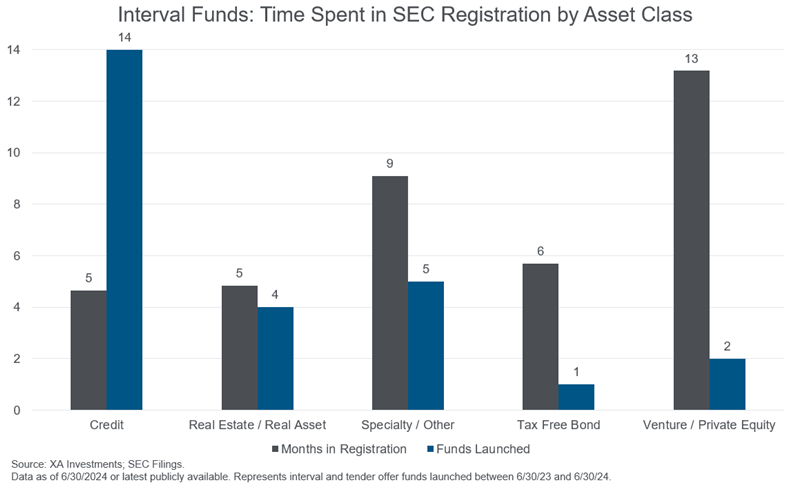

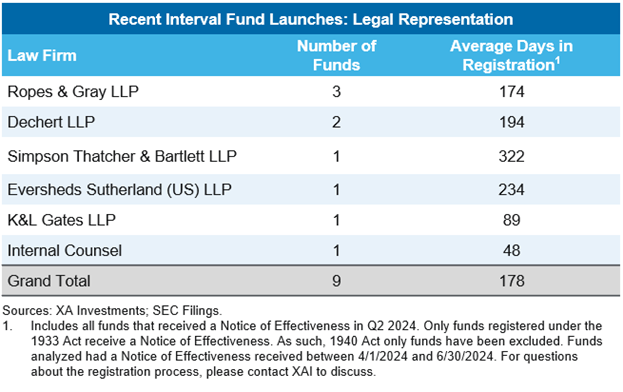

Launching an interval fund? Get ready for a lengthy SEC registration process. XAI observes Credit and Real Estate funds experience a shorter average review process of ~5 months, while Multi-Asset funds take an average of ~10 months.

(Data represents funds launched between October 1, 2023 and September 30, 2024)

11/13/2024

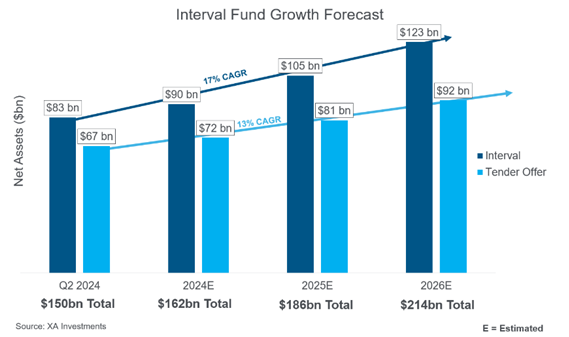

The non-listed CEF marketplace consists of 235 interval and tender offer funds with $162bn in net assets as of 9/30/24. Interval funds make up $89bn (55%) of net assets and tender offer funds make up $73bn (45%) in net assets.

11/08/2024

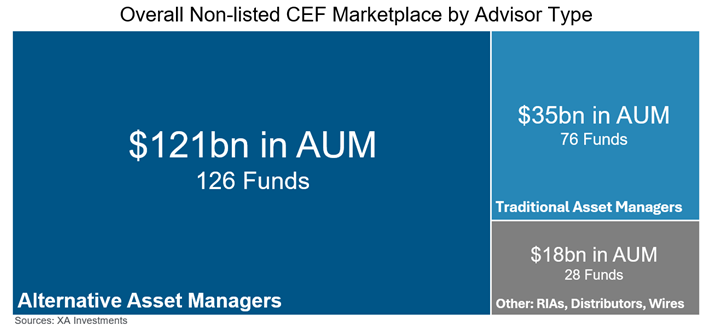

Alternative asset managers dominate the interval fund market in AUM and number of funds ($134bn in AUM and 129 funds) compared with traditional asset managers ($38bn in AUM and 77 funds) and other specialty firms ($19bn in AUM and 29 funds).

11/06/2024

The pipeline of new interval funds has grown to 53 Interval/Tender Offer funds in the SEC registration process (compared to 39 as of 12/31/23). In the pipeline, XAI observes 18 repeat sponsors including First Eagle, Nuveen, and PIMCO. New first-time fund sponsors include Russell Investment Management, Rockefeller Asset Management, and Global X. (Data as of 9/30/2024)

11/01/2024

Nearly half (46%) of interval/tender offer funds do not have any fund-level suitability restrictions; 31% are open to accredited investors, and 23% are open to qualified clients. Funds without suitability restrictions raise capital more effectively, accounting for 54% of YTD net flows.

10/28/2024

The interval fund market now stands at 235 total funds with $162bn in net assets, reflecting a net gain of 23 funds and $36bn in net assets YTD.

10/25/2024

From a liquidity perspective, the interval fund market is healthy in most asset categories. Credit and Multi-Asset dominated the positive flows, with 85% and 88% of funds experiencing positive flows, respectively. Conversely, Hedge Fund and Real Estate / Real Asset categories continue to experience negative net flows.

Note: Net flows are reported in Form NPORT-P (“NPORT”), which are filed quarterly with the SEC. NPORT filings are typically lagged 60 days from the end of the reporting period.

10/11/2024

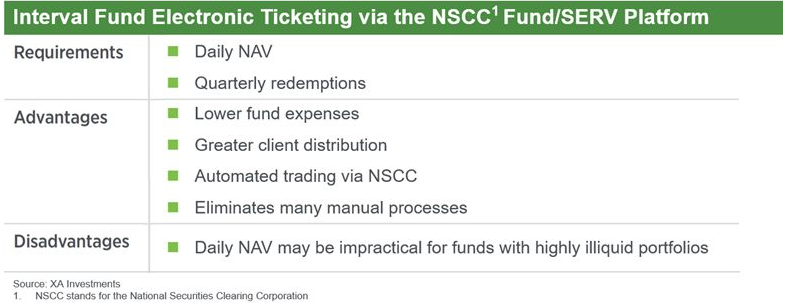

With the benefit of electronic ticketing, daily NAV interval funds are leading the way in capital raising. 113 interval and tender offer funds with daily NAVs have attracted $10.8bn in net flows for the period from 12/31/23 to 6/30/24, which represents the most recent publicly available data.

Note: Net flows are reported in Form NPORT-P (“NPORT”), which are filed quarterly with the SEC. NPORT filings are typically lagged 60 days from the end of the reporting period.

10/10/2024

More than half of all interval and tender offer funds in the marketplace have investment minimums that are below $25,000, making the funds accessible for a broad audience of retail investors.

10/04/2024

Collectively, the top 10 interval funds have reached record total managed assets of nearly $96 billion as of 9/30/24. This represents an 11.2% increase over the previous quarter’s results, with the top 10 interval funds each surpassing $4 billion in managed assets.

10/03/2024

Tender offer funds represent 52% of the 235 total non-listed CEF’s in the marketplace. Among the tender offer funds, Venture / Private Equity funds (44) are the most prevalent. Among the interval funds Credit funds (56) are the most prevalent.

09/27/2024

Interval Fund FAQ: Q: What is the main difference between an interval fund and a tender offer fund? A: Shareholder liquidity. Check out the table below to learn more about the structural differences between interval and tender offer funds.

09/25/2024

Over $37bn in net asset growth and 22 new funds have entered the interval fund market YTD (as of 8/31/2024). Other performance indicators, such as those shown below, continue to demonstrate strong growth and adoption by both managers and investors.

09/20/2024

Interval and tender offer fund strategies can impact the time spent in SEC registration. XAI observes, credit and real estate funds experience a shorter average review process of ~5 months, while private equity/venture capital funds take an average of ~13 months (data represents funds launched between June 30, 2023, and June 30, 2024).

09/18/2024

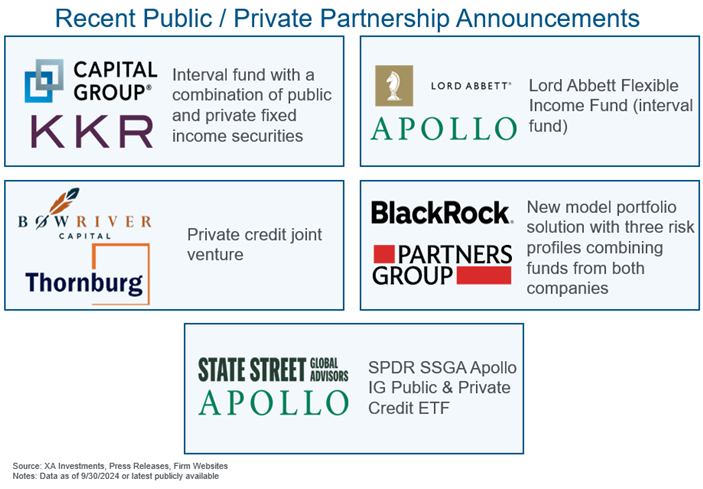

Public/private partnerships are transforming the asset management landscape, enabling firms to leverage each other’s expertise and deliver top-tier solutions to investors. Recently, five newsworthy new partnerships have been announced, each offering diverse strategies to meet evolving market demands.

09/13/2024

Anticipated interval fund market expansion: 51 new interval/tender offer funds filed their initial registration statement with the SEC in 2024 YTD. Credit funds account for 45% of the registrations.

09/10/2024

The interval fund market now stands at 234 funds with $192 billion in total managed assets as of 8/31/2024. Credit funds continue to lead the way in both the number of funds and total managed assets.

09/03/2024

The interval and tender offer fund market has continued to grow and mature. Of the 230 funds in the market, 83% have reached a 1-year track record, 60% have reached a 3-year track record. While 45% and 21% have reached a 5- and 10-year track record, respectively.

08/30/2024

Suitability restrictions among interval and tender offer funds vary based on a number of key factors. Currently, nearly half (47%) of funds do not have any fund-level suitability restrictions; 31% are open to accredited investors, and 22% are open to qualified clients.

08/29/2024

Strategies and fee structures play a crucial role in defining suitability restrictions for interval and tender offer funds. The chart below highlights the varying levels of suitability, ranging from no restrictions to limitations based on accredited investor or qualified client status.

08/26/2024

The pipeline of new interval funds has grown to 50 Interval/Tender Offer funds in the SEC registration process (compared to 39 as of 12/31/23). In the pipeline, XAI observes several repeat sponsors including First Eagle, Nuveen, and PIMCO. New first-time fund sponsors include HarbourVest, Gemcorp, and Diamond Hill. (Data as of 6/30/2024)

08/23/2024

Net flows for the 20 largest interval and tender offer funds increased by 41% from Q4 of 2023 to Q1 2024. These 20 funds account for 53% of net flows in the entire non-listed CEF universe in Q1 2024.

08/19/2024

In the Interval/Tender Offer fund marketplace, there are 130 unique sponsors for a total of 230 funds. Out of the 130 sponsors, 41 have two or more funds. (Data as of 6/30/2024)

08/16/2024

The interval fund marketplace includes 230 Interval and Tender Offer funds with $150bn in net assets, reflecting a net gain of 18 funds to the market in the YTD. (Data as of 6/30/2024)

08/14/2024

Interval fund management fees are an important consideration for both investors and advisers. For this universe of registered funds, base management fees range from 1.00% to 1.50%, with an average fee of 1.19%.

08/09/2024

On average, new interval funds make three N-2 and/or N-2/A filings and spend an average of 178 days (or ~6 months) in the SEC registration process. Experienced law firms such as Dechert, Clifford Chance, Faegre Drinker, Simpson Thatcher, and Ropes & Gray can help non-listed CEF sponsors manage the legal aspects of the fund formation process.

08/05/2024

In the non-listed interval fund market, 23% of funds are subject to income incentive or performance fees. Breaking it down:

1. Credit funds make up 84% (21 funds) of funds charging income incentive fees.

2. Specialty and venture/private equity funds account for 79% (22 funds) of funds charging total return or net profit fees.

Fee combinations from recent entrants are aligning with these market trends.

08/02/2024

The 20 largest interval and tender offer funds each have over $2bn in total managed assets and together comprise 73% of the interval/tender offer fund market by total assets. The market leaders include Cliffwater, Partners Group, Alkeon Capital Management and PIMCO.

08/01/2024

Comparing interval and tender offer funds, interval funds lead in total managed assets with nearly $102 billion compared to tender offer funds with nearly $73 billion in total managed assets.

07/26/2024

XAI predicts that 235 – 255 interval/tender offer funds will be launched this year, and the net assets market wide will be $160 – $170bn by the end of 2024. Thus far in 2024, the market is poised to meet this expectation as 230 interval/tender offer funds with $150bn in net assets are currently in operation.

07/25/2024

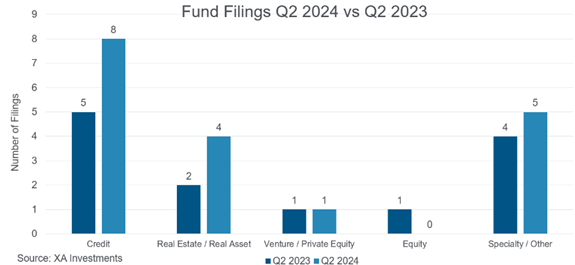

The pace of new interval and tender offer fund filings with the SEC has quickened. New fund filings are up 38% in Q2 2024 compared to Q2 2023.

07/19/2024

The interval fund marketplace continues to grow with private credit funds leading the way. Out of the 10 funds launched this past quarter, 7 have been private credit. XAI observes that over half of these launched funds do not have a fund website. We recommend sponsors create dedicated fund websites to provide important fund information, such as portfolio holdings and current distribution rates.

07/18/2024

Alternative asset managers dominate the market in AUM and number of funds ($121bn in AUM and 126 funds) compared with traditional asset managers ($35bn in AUM and 76 funds) and other specialty firms ($18bn in AUM and 28 funds). Source: XA Investments. Note: Data as of 6/30/2024.

07/10/2024

Morningstar recently published a whitepaper titled Morningstar’s Essential Guide to Interval Funds. The white paper describes the history of the interval fund product structure (not tender offer funds), provides analysis on the current state of the market, and discusses key considerations investors need to make before investing. Kimberly Flynn spoke with Morningstar on background as they developed this paper to help address questions and concerns about the interval fund structure. Click HERE to read the full white paper.

07/09/2024

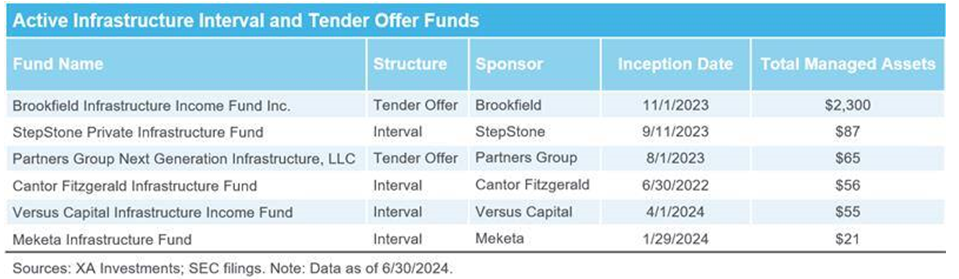

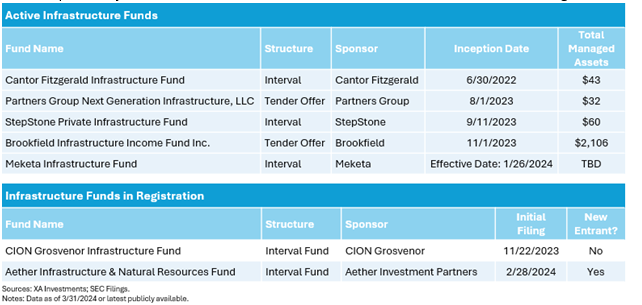

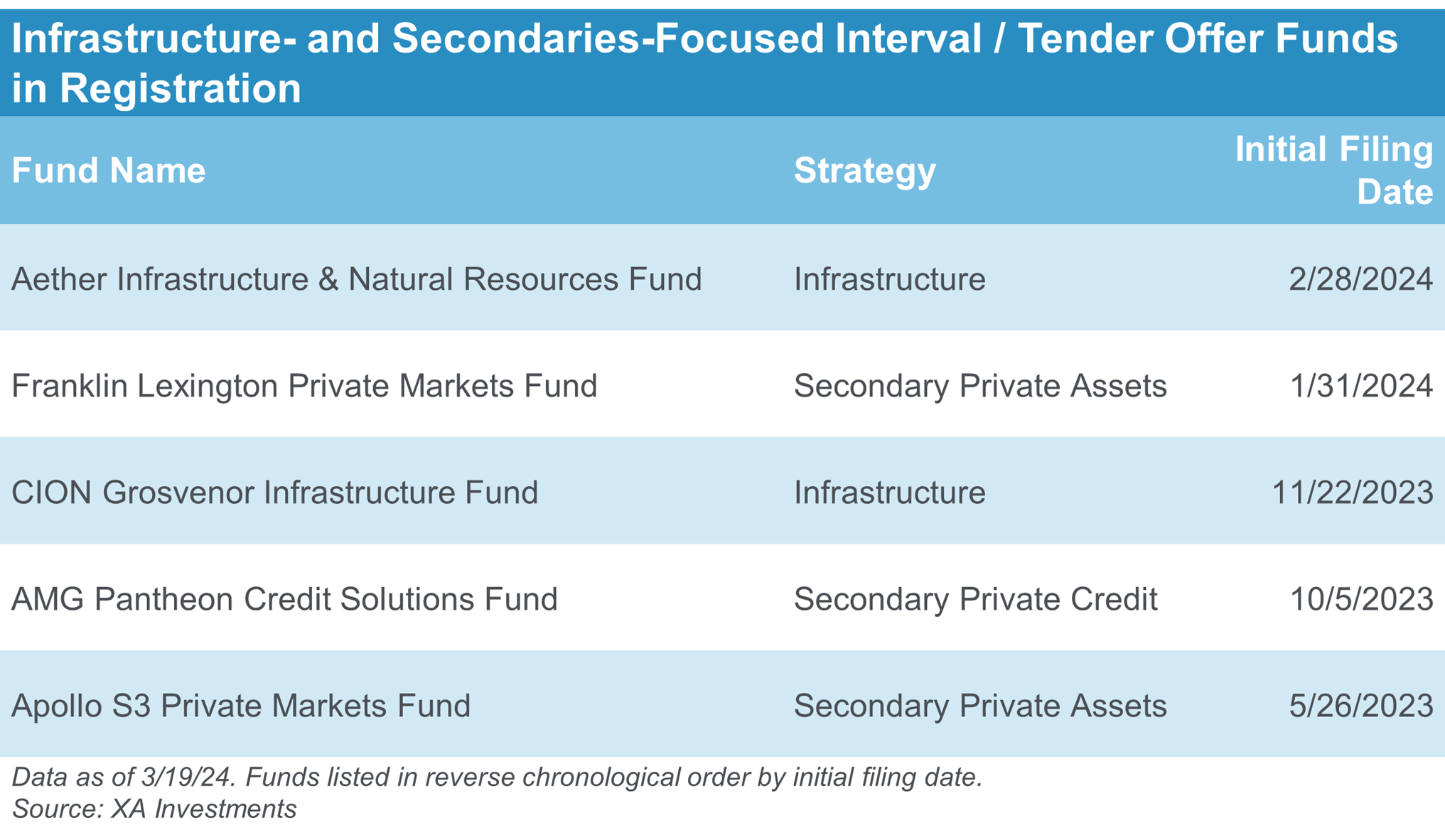

The number of infrastructure-focused interval and tender offer funds continues to grow. Currently, there are 6 active infrastructure-focused interval / tender offer funds and an additional 5 in the SEC registration process. This trend has been accelerating with 3 of those 5 funds filing their initial registration statements this month.

06/28/2024

On average, new interval funds make three N-2 and/or N-2/A filings and spend an average of 172 days (or ~6 months) in the SEC registration process. Experienced law firms such as Clifford Chance, Dechert, Faegre Drinker, Simpson Thatcher, and Ropes & Gray can help non-listed CEF sponsors manage the legal aspects of the fund formation process.

06/24/2024

XAI has partnered with Cerulli Associates and Closed-End Fund Advisors (CEFdata.com) to improve net flows tracking for the non-listed CEF market. We would like to thank the sponsors already sharing data and encourage others to participate. To participate or for further questions please contact Daniil Shapiro at dshapiro@cerulli.com.

06/17/2024

As of 5/31/2024, there are 227 interval/tender offer funds in the market with $168bn in AUM. Credit funds lead the market in both number of funds and AUM.

06/13/2024

XAI has continued to see an increase in the number of new interval and tender offer fund filings. So far in 2024, 26 interval/tender offer funds have filed their initial registration statement with the SEC. Data as of 5/31/2024.

06/05/2024

Prospective interval fund sponsors often ask us about the top launch challenges. While the top obstacles to launch typically vary by investment strategy, a few we see frequently include valuation, liquidity, and fees/expenses. For additional information on how to best address or avoid some of these obstacles, read our white paper below or contact us at info@xainvestments.com.

Launching an Interval Fund: Clear-eyed approach critical to a successful launch

05/31/2024

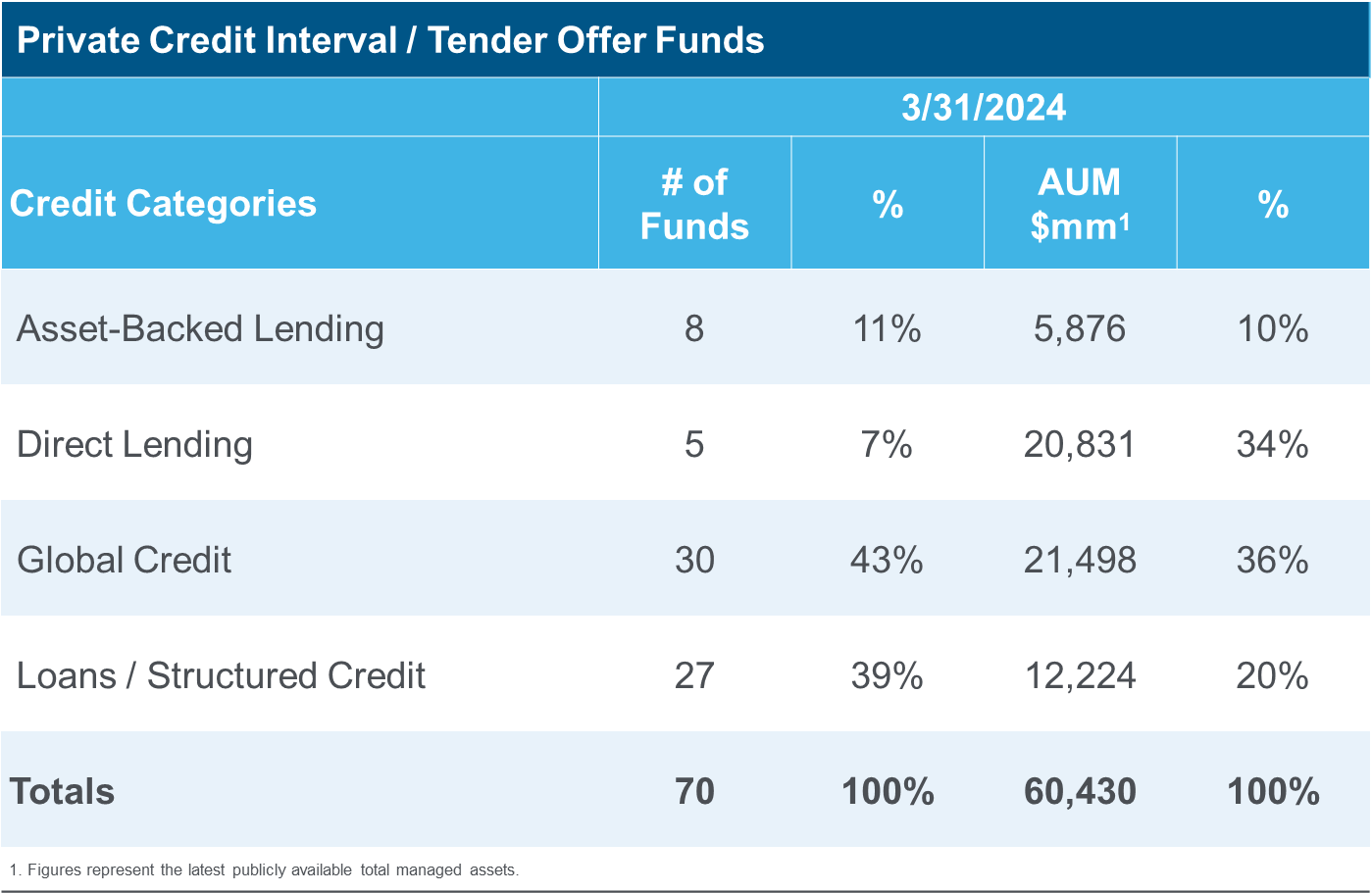

Due to the growth in the credit category, XAI has established 4 sub-categories within private credit and categorized funds according to strategy: asset-backed lending, direct lending, global credit, and loans/structured credit. The table below summarizes each category.

05/28/2024

A growing number of interval and tender offer funds celebrated their 3-year, 5-year and 10-year anniversaries in Q1 2024. 39% of the market comprises newer funds that have yet to develop a 3-year track record. Longer firm-specific track records are necessary for key RIA and wirehouse platform approvals.

05/24/2024

Industry improvement idea: XAI observes that many non-listed CEFs do not have dedicated fund websites. We encourage fund sponsors to create dedicated fund websites to provide important fund information, such as portfolio holdings and current distribution rates.

05/23/2024

XA Investments is now able to provide clients with independent 15(c) reports to support fund board approvals and renewals of investment advisory agreements. The SEC’s Division of Examinations recently issued its 2024 examination priorities, and fund advisory fees, including fund boards’ processes for assessing and approving advisory fees, are highlighted as a key focus for the SEC in 2024. Our reports include detailed advisory fee, performance, and operating expense analysis and comparisons with independently determined peer funds. For more information on custom 15(c) reports for registered closed-end funds, please contact us.

05/20/2024

How accessible are alternative investments in the interval fund market? Currently, 46% of non-listed CEFs do not have any fund level suitability restrictions for investors; 32% are available to accredited investors, and 22% are available to qualified clients. Data as of 3/31/24.

05/17/2024

The number of interval and tender offer funds in SEC registration has increased from 38 in Q4 2023 to 42 at the end of Q1 2024.

05/15/2024

There are 28 different interval and tender offer funds available on wirehouse platforms, and the majority are private credit-focused. Morgan Stanley has the most interval and tender offer funds (22) on its platform followed by UBS (13) and Merrill Lynch (10) and Wells Fargo (6). Wirehouse gatekeepers have stated their intentions to onboard more alternative fund options for high-net-worth investors.

05/13/2024

Market leading interval funds continue to grow assets. The largest 20 interval / tender offer funds have all scaled up beyond $2bn in AUM. XA Investments observes that the interval fund market tends to be more democratic for fundraising for new entrants when compared with the non-listed REIT and non-listed BDC markets. Data as of 3/31/24.

05/10/2024

The interval fund marketplace consists of 220 interval and tender offer funds with $140bn in net assets and includes 128 unique fund sponsors, with 38 firms having two or more funds. There are also 42 interval and tender offer funds currently in the SEC registration process. Data as of 3/31/24.

05/09/2024

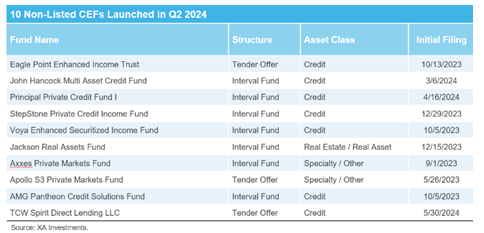

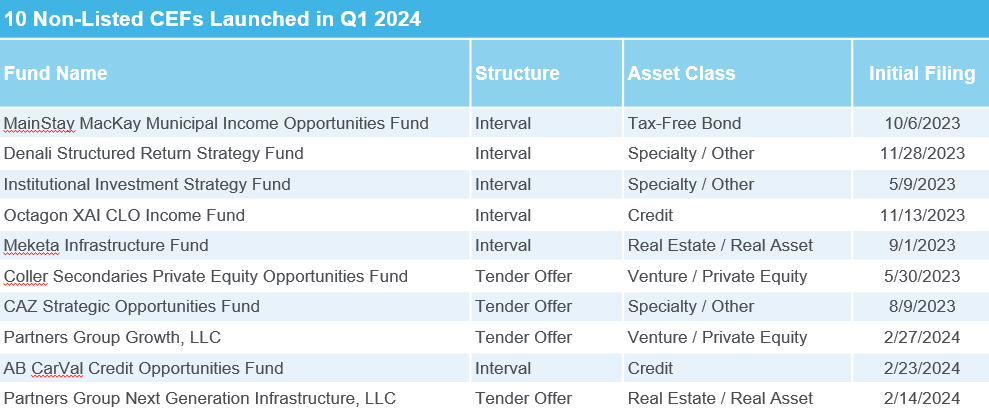

The interval fund market continues to exhibit strong growth. 10 non-listed closed-end funds launched in Q1 2024 and spent an average of 6 months in registration with the SEC.

05/06/2024

Real estate-focused interval and tender offer funds faced challenges attracting net flows in 2023. The category saw an 82% drop in net flows compared to 2022 from $7.6bn to $1.4bn.

05/02/2024

Two interval funds, the Nuveen Enhanced Floating Rate Income Fund and the Oaktree Diversified Income Fund Inc., have either applied for or been granted exemptive relief to offer monthly repurchases. Monthly repurchases would require shorter notification periods to shareholders and may pose challenges for fund service providers. More importantly, it might lead shareholders to believe that the underlying investments of the fund are more liquid than they are.

04/30/2024

Over the past two years, infrastructure-focused interval and tender offer funds have emerged as a new sub-category within the real estate asset / real asset class. Currently, there are five active infrastructure-focused funds, with an additional two funds in the registration process.

04/29/2024

The Brookfield Luxembourg infrastructure fund was reorganized into the Brookfield Infrastructure Income Fund on 11/1/23. The new fund, a tender offer fund, received in-kind capital contributions of net assets valued at approximately $1.5bn from the predecessor fund in exchange for Class I Shares. With strong global demand for infrastructure, the tender offer fund now has over $2.1bn in assets as of 3/31/24.

04/12/2024

In McKinsey & Company’s new report, Global Private Markets Review 2024: Private markets in a slower era, the firm highlighted the strong performance of private debt in 2023. The report states that “during a turbulent year for private markets, private debt was a relative bright spot, topping private markets asset classes in terms of fundraising growth, AUM growth, and performance.” XA Investments LLC observed the strength of private debt in the interval and tender offer fund market with private credit funds attracting the majority of net flows and being among the top performers compared to other asset classes.

To read the full report, click the link below. For more information on interval and tender offer funds, visit the XAI Knowledge Bank.

McKinsey Report: https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review

XAI Knowledge Bank: https://xainvestments.com/knowledge-bank/

04/04/2024

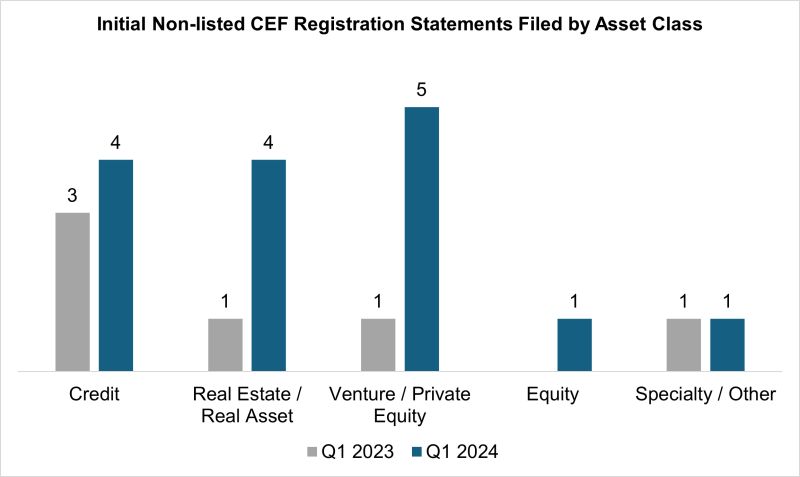

The pace of new interval and tender offer fund registration statement filings increased in Q1 2024: 15 funds filed in Q1 2024 as compared to just 6 in Q1 2023. The increase in fund filings reflects a combination of activity from established interval fund sponsors and new market participants.

04/02/2024

Interval management fees are an important consideration for both investors and sponsors. Most non-listed CEFs have management fees in the range of 1.00% to 1.50% with a market average management fee of 1.19% (as of 12/31/23). Market leader Cliffwater Corporate Lending Fund charges a management fee on the low end of the range.

03/28/2024

XAI observed M&A activity for several new interval fund market sponsors in 2023. Acquiring companies were motivated to obtain investment expertise from boutique alternatives managers, expand their sales and distribution reach, or gain entry to the non-listed CEF market. For example, Polen Capital acquired DDJ Capital Management in January 2022 before launching its first interval fund, the Polen Credit Opportunities Fund, in August 2023.

03/25/2024

Even though there are only five dedicated insurance-linked securities (ILS) interval funds in the market, two ILS funds made their way into the 2023 list of top 15 performers (as of 12/31/23). Because ILS earn the risk-free rate in addition to reinsurance premiums, ILS can benefit from higher interest rates.

03/22/2024

Strong demand for secondaries and infrastructure has driven product development in the interval fund market. Highlighted below are several interval / tender offer funds in each category that are in the SEC registration process now.

03/19/2024

Asset class appears to be the main driver for the length of the SEC review process, with credit and real estate funds launching faster on average compared to PE/VC funds.

03/11/2024

Market leaders in the alts space are using a variety of structures including non-listed REITs, non-listed BDCs, and non-listed CEFs. Notable examples include Apollo, Ares, Blackstone, Brookfield, and Nuveen.

03/08/2024

XA Investments and Pine Advisor Solutions (PINE)* found that 36% of the interval and tender offer funds in the market use an outsourced chief compliance officer, while only 15% use an outsourced principal financial officer/treasurer. New entrants and firms with a single fund were more likely to outsource these critical functions.

*PINE is a leading advisory support firm focused on advisor compliance support, outsourced CCO/PFO support, distribution services, and operations support. XAI is not affiliated with PINE, but it receives certain services for which it compensates PINE.

03/07/2024

New funds sponsored by KKR, Pender Capital, and Redwood brought in $853mm in net flows after launching in 2023. The KKR fund focuses on asset-backed lending; the Pender and Redwood funds pursue real estate income strategies. Both Pender and Redwood are first-time interval fund sponsors.

02/29/2024

How democratic is fundraising in the interval fund market? The top 20 interval / tender offer funds (by assets) have all scaled up beyond $1.5bn in AUM as of 12/31/23.

02/23/2024

Approximately half of new fund launches in 2023 were private credit funds. Many of these funds feature investor-friendly features such as daily NAV, low suitability restrictions, and low minimum investments.

02/13/2024

For the 12-month period ending 9/30/23, some of the largest interval funds experienced moderating levels of net flows as compared to the same period one year ago. The top 20 funds (ranked by net flows) have seen a combined 15% decrease in net flows over same period.

02/09/2024

Alternative asset managers dominate the interval fund market in AUM and number of funds, with $107bn in AUM and 102 funds, compared with traditional asset managers (with $31bn in AUM and 72 funds) and other specialty firms (with $7bn in AUM and 25 funds).

02/08/2024

The top 15 interval funds all have a 12-month net return of 13.68% or greater (for the period ended 9/30/23). Strong performance in the interval / tender offer fund market continues to encourage growth in existing funds and attract new entrants.

01/29/2024

As the interval fund market continues to grow, more funds are meeting track records thresholds. While only 45% of funds have a 5-year track record, 59% of funds have a 3-year track record, and 84% of funds have a complete 1-year track record.

01/26/2024

XAI has partnered with Cerulli Associates and Closed-End Fund Advisors (CEFData.com) to improve net flows tracking for the non-listed CEF market. We would like to thank the sponsors already sharing data and encourage others to participate. To participate or for further questions please contact Daniil Shapiro at dshapiro@cerulli.com.

01/25/2024

New interval funds on average make three N-2 and/or N-2/A filings and spend an average of 197 days or ~7 months in the SEC registration process. Experienced law firms with several non-listed CEF clients such as Dechert, Faegre Drinker, Simpson Thatcher, Ropes & Gray can help non-listed CEF sponsors manage the time and / or expense of the fund formation process.

01/23/2024

In 2023, new entrants accounted for the majority of fund launches (16 of 25 new funds or 64% of total). Of the funds launched during the year, 12 were Credit-focused, 4 were Real Estate / Real Asset-focused, 6 were Specialty / Other-focused, and 3 were Venture / Private Equity-focused.

01/22/2024

Many prospective interval fund sponsors ask us if the market has become too saturated; As we continue to see the emergence of new asset classes and investor bases in the interval fund market, we believe that there is significant room for additional growth in the interval fund market.

01/19/2024

Did you know that interval funds can be structured as a REIT for tax purposes? The interval/tender offer fund market now has 8+ funds that invest primarily in real estate debt and/or equity securities and are structured as REITs for tax purposes instead of regulated investment companies (RICs). For example, the Clarion Partners Real Estate Income Fund, is a tender offer fund that is a REIT for tax purposes. The Clarion RE tender offer fund was launched in Sept 2019 and currently has $739mm in total managed assets (as of December 2023).

01/18/2024

The pipeline of new interval funds is large with 39 interval/tender offer funds in the SEC registration process as of 12/31/23 (compared with 29 as of 9/30/23). In the pipeline, XAI observes several repeat issuers with fund sponsors including Stone Ridge, PIMCO, and John Hancock in queue. New first-time fund sponsors including Jackson National, Cadre and Alternative Investment Resources.

01/17/2024

Income incentive fees are increasingly being used by credit-focused interval funds to align performance incentives between portfolio managers and investors. 11 of the 20 total interval funds that have income incentive fees have been launched in the last 2 years.

01/08/2024

What does it cost to launch an interval fund? Organizational and offering expenses for a new interval fund are typically paid out-of-pocket by the fund sponsor. Such org/offering costs can vary by asset class and by service providers selected with the bulk of the expense being legal. XAI estimates that org/offering expenses for an interval fund will range from $500,000 to $750,000. Let us know if we can help with your economic modeling and break-even analysis.

01/05/2024

Turnkey platforms with existing fund boards in place are becoming increasingly popular for interval fund sponsors who are looking to save time and money in launching their first interval fund. Firms like RRB, UMB, and Ultimus can be great partners in the interval fund formation process. Let us know if you need more information on the benefits of a turnkey platform with a shared fund board and service providers.

01/03/2024

Did you know? XAI has a diverse database of experienced fund board candidates for new interval fund boards. Reach out if you are looking to stand up a new board and want to interview professionals with alternative investments and registered fund expertise.

12/29/2023

Secondaries-focused interval funds are expected to gather assets in 2024, with several interesting funds in the registration now including Apollo S3 Private Markets Fund, Coller Secondaries Private Equity Fund and the AMG Pantheon Credit Solutions Fund.

12/27/2023

Launched in 2009, the Partners Group Private Equity Fund is the largest tender offer fund with $14bn+ in AUM. This market leading tender offer fund is available on several different wirehouse platforms including Merrill Lynch, Morgan Stanley and Wells Fargo.

12/21/2023

Interval and tender offer funds that invest more than 15% in private funds have been subject to the SEC’s controversial limit on sales to accredited investors. The fund-of-funds category of the interval fund marketplace has been growing as more alternative managers and institutional consultants enter the marketplace with private markets and private equity focused strategies.

12/19/2023

Tender offer funds represent the majority of non-listed CEFs in the marketplace. Interestingly, tender offer funds have seen a surge in new fund formations in 2023.

12/08/2023

Daily NAV interval funds are leading the way in terms of net flows due to the ease of use of electronic ticketing through the mutual fund Fund/SERV platform.

11/30/2023

In 2023, the private credit interval fund category led the way in terms of net flows. But if we removed the market leader, Cliffwater, from the net flow calculations, the private equity interval fund category took the lead in terms of net flows.

11/29/2023

A feasibility study or product viability study can be a great way to assess your firm’s interval fund strategy for commercial success. Many new interval funds sponsors contact us after they file their N-2 and indicate they wish they had reached out sooner.

11/28/2023

There are 23 different interval and tender offer funds available on wirehouse platforms, and the majority are private credit or municipal bond focused. Morgan Stanley has the most interval funds (16) on platform followed by UBS (12) and Merrill Lynch (9) and Wells Fargo (5).

11/22/2023

The 30 largest interval and tender offer funds have a 75% market share. The market leaders include Cliffwater, Partners Group, Alkeon Capital Management and Bluerock.

11/20/2023

The interval fund marketplace includes 196 interval and tender offer funds with $122bn in net assets as of 9/30/23. There are 125 unique interval/tender offer fund sponsors, and 34 firms have 2 or more funds.