By Kimberly Flynn, CFA

President, XA Investments

May 5, 2025

Published by CityWire on May 6, 2025

The interval and tender offer fund market reached a new peak with 279 total funds and a combined $187bn in net assets as of the end of April.

In the first four months of 2025, 23 new funds entered the market as the pace of new fund launches accelerates. In total, there are now 149 unique fund sponsors in the interval and tender offer fund space. Among the new funds launched in 2025, there were nine new interval fund sponsors including, Coatue, HarbourVest, Gemcorp and Pop Venture Advisers.

The increasingly popular daily NAV interval fund structure has caught up to the total number of tender funds in the market (141 interval funds and 138 tender offer funds). Capital raising success for interval and tender offer funds tends to be driven by ease of use or convenience for financial advisors who are active interval fund users.

XA anticipates that the interval fund market will continue to grow at an accelerated pace in 2025. Per our research, there are now 54 funds in the registration process with the Securities and Exchange Commission (SEC). These include some recent filings from established interval fund sponsors to launch additional private markets evergreen funds. StepStone recently filed its initial prospectus for a private credit co-investment tender offer fund. Franklin Templeton and its affiliate Benefit Street Partners dropped an initial prospectus for a middle market debt focused interval fund.

The majority of net flows for 2024 (53%) went into daily NAV funds without suitability restrictions, while 26% went into funds limited to accredited investors, and 21% went into funds limited to qualified clients.

In aggregate, the 20 largest interval and tender offer funds experienced an increase in net flows year-over-year from 2023 to 2024 including many of the market leaders such as the Cliffwater Corporate Lending fund, Partners Group Private Equity (Master Fund), and ACAP Strategic fund. In addition, private credit funds continued to dominate capital raising in 2024, bringing in over $20bn in net assets, with the venture / private equity fund category coming in second, bringing in over $11bn in net assets.

Focus on asset-backed funds

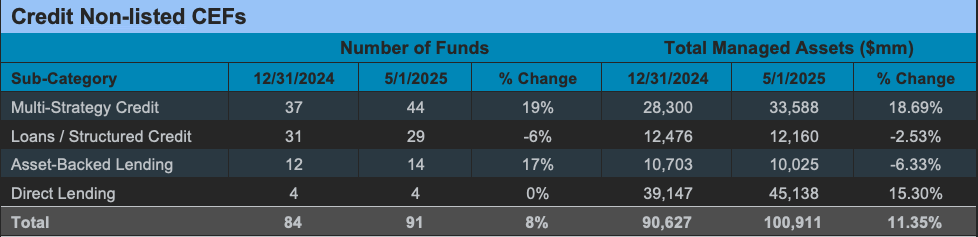

Private credit is the largest category of the interval and tender offer fund market with 91 total funds and $100.9bn in net assets which represents 54% of the market as of the end of April. A growing sub-category of the private credit market is asset-backed lending with 14 such funds in the market today and a further four funds in the SEC registration process that are expected to launch later in the year.

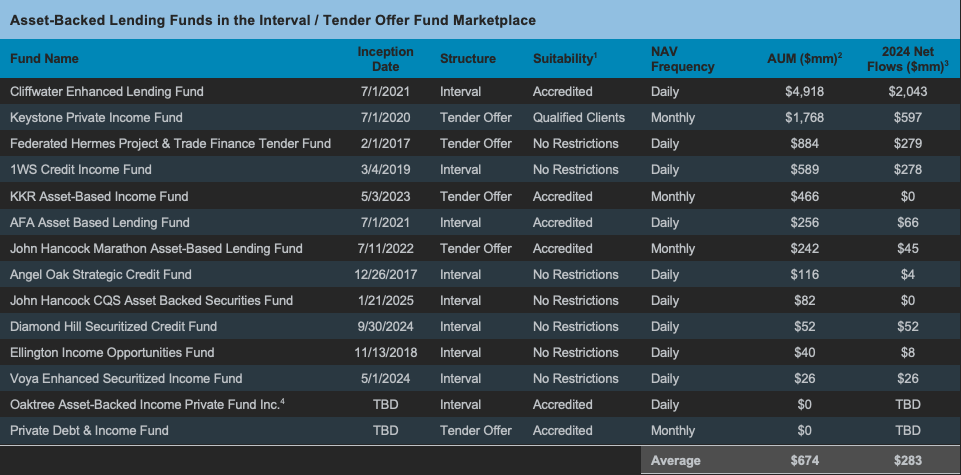

Current leaders in the asset-backed lending segment of the interval fund market include Cliffwater, Keystone, Federated Hermes, 1WS and KKR. See table below for the breakdown of the asset-backed lending sub-category. Other credit sub-categories have remained stable or decreased in their fund counts, with loans / structured credit decreasing by two funds and direct lending keeping the same fund count since 2024-year end. The multistrategy credit peer group has grown the most, adding seven funds in the first four months of 2025.

Chart 1: Private Credit

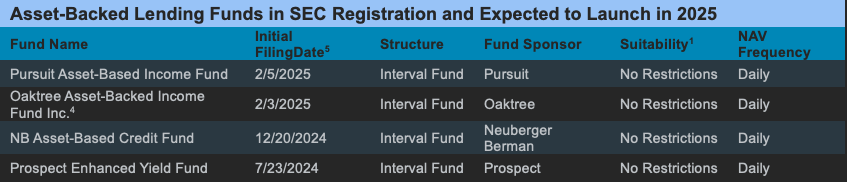

The four asset-backed lending funds expected to launch later this year are listed below. Notably, Oaktree and Neuberger Berman are both planning to launch interval funds around their asset-based lending capabilities.

Chart 2: Asset-Backed Lending Funds Expected to Launch in 2025

With more equity market volatility in recent weeks, it is not surprising to see so many new interval fund sponsors enter the marketplace with asset-backed lending funds. Asset-backed loans are secured by collateral that produce attractive cash flows. Investors appreciate the benefits of asset-backed lending in the portfolio because these investments can serve as a buffer against losses experienced during market downturns. With shorter loan durations, asset-backed lending may offer faster capital returns and greater flexibility than corporate loans.

Chart 3: Asset-Backed Lending Funds Active and Open to Investment

Source: CEFData.com; XA Investments; SEC filings; and fund websites.

Notes: Data as of 5/1/2025 or latest publicly available unless otherwise stated.

1. No Restrictions means no suitability restrictions at the fund level.

2. Funds are sorted in descending order by assets under management (AUM). AUM represents total managed assets and is inclusive of leverage.

3. Net flows are reported in Form NPORT-P (“NPORTs”), which are filed quarterly with the SEC. NPORT filings are typically lagged 60 days from the end of the reporting period. Net flows data is as of 12/31/2024 and represents the latest publicly available data.

4. Funds are sorted in descending order by Initial Filing Date.

5. The Oaktree Asset-backed Income funds are related and may later be merged.

Kimberly Flynn, CFA is President of XA Investments, a Chicago-based firm that provides investment fund structuring and consulting services focused on registered closed-end funds, among other things. XA Investments recently launched the XAI Interval Fund IndexTM (INTVL), a total return index that tracks the interval fund market, helping to address the lack of easily accessible information on the interval fund market. The firm publishes daily interval fund market observations on LinkedIn and produces an in-depth quarterly report on that market, which can be found at www.xainvestments.com

Sources: XA Investments; CEFData.com; SEC Filings.

Notes: All information as of 5/1/2025 unless otherwise noted. The non-listed CEF market is subject to lags in reporting and limited data availability. Data such as asset levels, net flows, and performance are delayed up to 90 days after quarter-end and are not available for all funds. All data in the report is the most current available. Please contact our team if you have any questions about the non-listed CEF marketplace.