News

XAI Octagon Floating Rate & Alternative Income Trust Will Host its Q3 2025 Quarterly Webinar on December 2, 2025

CHICAGO, Nov. 20, 2025 (GLOBE NEWSWIRE) -- XAI Octagon Floating Rate & Alternative Income Trust (NYSE: XFLT) (the “Trust”) today announced that it plans to host the Trust’s Quarterly Webinar on December 2, 2025, at 12:00 pm (Eastern Time). Kevin Davis, Managing Director at XA Investments (“XAI”) will moderate the Q&A style webinar with Kimberly Flynn, President at XAI, and Lauren Law, Senior Portfolio Manager at Octagon Credit Investors.

TO JOIN VIA WEB: Please go to the Knowledge Bank section of xainvestments.com or click here to find the online registration link.

TO USE YOUR TELEPHONE: After joining via web, if you prefer to use your phone for audio, you must select that option and call in using a number below, based on your current location.

Dial: (312) 626 6799 or (646) 558 8656 or (267) 831 0333 or (720) 928 9299 or (213) 338 8477

Webinar ID: 819 5592 7231

REPLAY: A replay of the webinar will be available in the Knowledge Bank section of xainvestments.com.

The investment objective of the Trust is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating rate credit instruments and other structured credit investments. There can be no assurance that the Trust will achieve its investment objective.

The Trust’s common shares are traded on the New York Stock Exchange under the symbol “XFLT,” and the Trust’s 6.50% Series 2026 Term Preferred Shares are traded on the New York Stock Exchange under the symbol “XFLTPRA.”

About XA Investments

XA Investments LLC (“XAI”) is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund, respectively the XAI Octagon Floating Rate & Alternative Income Trust, the XAI Madison Equity Premium Income Fund, and the Octagon XAI CLO Income Fund. In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including product development and market research, marketing and fund management. XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser. Octagon is a 30+ year old, $33.8B below-investment grade corporate credit investment adviser focused on leveraged loan, high yield bond and structured credit (collateralized loan obligation debt and equity) investments. Through fundamental credit analysis and active portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade asset classes, sectors and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable and scalable approach in its effort to generate attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Paralel Distributors, LLC - Distributor

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 312-374-6931

Email: kflynn@xainvestments.com

www.xainvestments.com

XAI Madison Equity Premium Income Fund Declares its Monthly Distribution of $0.060 per Share

November 3, 2025, Chicago – XAI Madison Equity Premium Income Fund (the “Fund”) has declared its regular monthly distribution of $0.060 per share on the Fund’s common shares (NYSE: MCN), payable on December 1, 2025, to common shareholders of record as of November 17, 2025, as noted below. The amount of the distribution represents no change from the previous month’s distribution amount of $0.060 per share.

As mentioned in previous distribution declarations, the Fund has changed its distribution frequency from quarterly to monthly, which went into effect with the April 1, 2025 declaration. XA Investments believes this change enables investors to better manage their cash flow needs.

The following dates apply to the declaration:

| Ex-Dividend Date | November 17, 2025 | |

| Record Date | November 17, 2025 | |

| Payable Date | December 1, 2025 | |

| Amount | $0.060 per share | |

| Change from Previous Month | No Change |

Common share distributions may be paid from net investment income (regular interest and dividends), capital gains and/or a return of capital. The specific tax characteristics of the distributions will be reported to the Fund’s common shareholders on Form 1099 after the end of the 2025 calendar year. Shareholders should not assume that the source of a distribution from the Fund is net income or profit. For further information regarding the Fund’s distributions, please visit www.xainvestments.com.

* * *

The Fund’s net investment income and capital gain can vary significantly over time; however, the Fund seeks to maintain more stable common share quarterly distributions over time. The Fund’s final taxable income for the current fiscal year will not be known until the Fund’s tax returns are filed.

As a registered investment company, the Fund is subject to a 4% excise tax that is imposed if the Fund does not distribute to common shareholders by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on December 31 of the calendar year (unless an election is made to use the Fund’s fiscal year). In certain circumstances, the Fund may elect to retain income or capital gain to the extent that the Board of Trustees, in consultation with Fund management, determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Fund for any particular period may be more than the amount of net investment income from that period. As a result, all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a common shareholder invested in the Fund, up to the amount of the common shareholder’s tax basis in their common shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the common shareholder’s potential gain, or reduce the common shareholder’s potential loss, on any subsequent sale or other disposition of common shares.

Future common share distributions will be made if and when declared by the Fund’s Board of Trustees, after the evaluation of several factors, including the Fund’s net investment income, financial performance and available cash. There can be no assurance that the amount or timing of common share distributions in the future will be equal or similar to that described herein or that the Board of Trustees will not decide to suspend or discontinue the payment of common share distributions in the future.

* * *

The Fund’s objective is to achieve a high level of current income and current capital gains, with long-term capital appreciation as a secondary objective. The Fund intends to pursue its objective by investing in a portfolio of common stocks and utilizing an option strategy, primarily by writing (selling) covered call options on a substantial portion of the common stocks in the portfolio in order to generate current income and gains from option writing premiums and, to a lesser extent, from dividends. Market action can impact dividend issuance as the Fund’s total assets affect the Fund’s future dividend prospects. The Fund provides additional information on its website at www.xainvestments.com.

About XA Investments

XA Investments LLC (“XAI”) serves as the Fund’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Madison Investments

Madison Investments is an independent investment management firm based in Madison, WI. The firm was founded in 1974, has approximately $29.6 billion in assets under management as of September 30, 2025, and is recognized as one of the nation’s top investment firms. Madison offers domestic fixed income, U.S. and international equity, covered call, multi-asset, insurance and credit union investment management strategies. For more information, please visit www.madisoninvestments.com.

Madison and/or Madison Investments is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC, and Madison Investment Advisors, LLC. Madison Funds are distributed by MFD Distributor, LLC. Madison is registered as an investment adviser with the U.S. Securities and Exchange Commission. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority www.finra.org.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Fund carefully before investing. For more information on the Fund, please visit the Fund’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

| NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 888-903-3358

Email: KFlynn@XAInvestments.com

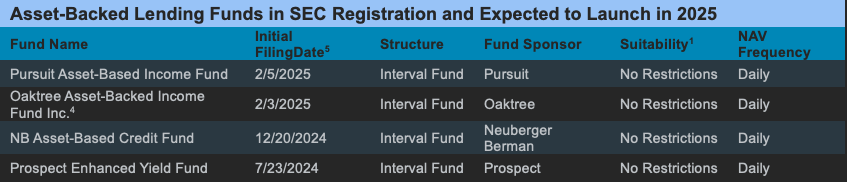

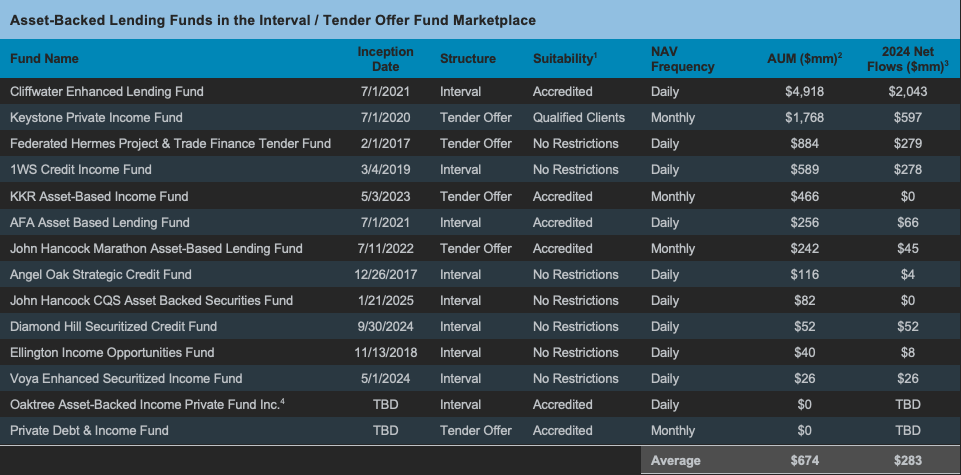

FundFire: Interval Fund Launches, Closed-End Fund Changes Hit Shutdown Speed Bump

Tony Rifilato reports on how the ongoing federal government shutdown is slowing the launch and modification of interval and closed-end funds aimed at retail investors.

A prolonged shutdown is delaying SEC reviews, pushing interval fund registration timelines from the typical six to seven months to as long as nine months. The bottleneck is creating challenges for asset managers eager to roll out new semi-liquid alternatives and adapt existing closed-end products following recent regulatory shifts expanding retail investor access.

Kimberly Flynn, President at XA Investments, noted that the timing couldn’t be worse for such an active segment of the market. “The interval fund area is a really active part of the market for asset managers – there’s a lot of new entrants,” she told FundFire. “People are eager to get going, and this is definitely going to slow that down.”

Flynn added that while SEC leadership has been supportive of expanding retail access to private markets, the shutdown is compounding existing resource constraints. “The disconnect here is that I think the SEC chairman is a lot more supportive for private market access... but the reality is that the resources at the SEC are constraining, and then the federal government shutdown sort of further exacerbates that problem,” she said.

The delays are hitting managers planning 2025 launches particularly hard, as they now face uncertainty around marketing timelines and co-investment relief requests that require SEC approval. “If [the shutdown] goes on much longer, they’re going to slow that down,” Flynn said.

XA Investments research highlights the strength of the interval and tender offer fund market despite near-term disruptions. The firm expects 75 or more new funds to launch in 2025—up from 50 in 2024—with 304 funds currently in the market across nearly 160 sponsors managing $252 billion in assets. Flynn said 41 new filings are already in the registration pipeline, alongside amendments from 16 existing funds removing accredited investor restrictions.

To read the full article: Click here

XAI Octagon Floating Rate & Alternative Income Trust Declares its Monthly Common Shares Distribution of $0.070 per Share

November 3, 2025, Chicago – XAI Octagon Floating Rate & Alternative Income Trust (the “Trust”) has declared its regular monthly distribution of $0.070 per share on the Trust’s common shares (NYSE: XFLT), payable on December 1, 2025, to common shareholders of record as of November 17, 2025, as noted below. The amount of the distribution represents no change from the previous month's distribution amount of $0.070 per share.

The following dates apply to the declaration:

| Ex-Dividend Date | November 17, 2025 | |

| Record Date | November 17, 2025 | |

| Payable Date | December 1, 2025 | |

| Amount | $0.070 per common share | |

| Change from Previous Month | No change |

Common share distributions may be paid from net investment income (regular interest and dividends), capital gains and/or a return of capital. The specific tax characteristics of the distributions will be reported to the Trust’s common shareholders on Form 1099 after the end of the 2025 calendar year. Shareholders should not assume that the source of a distribution from the Trust is net income or profit. For further information regarding the Trust’s distributions, please visit www.xainvestments.com.

The Trust’s net investment income and capital gain can vary significantly over time; however, the Trust seeks to maintain more stable common share monthly distributions over time. The Trust’s investments in CLOs are subject to complex tax rules and the calculation of taxable income attributed to an investment in CLO subordinated notes can be dramatically different from the calculation of income for financial reporting purposes under accounting principles generally accepted in the United States (“U.S. GAAP”), and, as a result, there may be significant differences between the Trust’s GAAP income and its taxable income. The Trust’s final taxable income for the current fiscal year will not be known until the Trust’s tax returns are filed.

As a registered investment company, the Trust is subject to a 4% excise tax that is imposed if the Trust does not distribute to common shareholders by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year (unless an election is made to use the Trust’s fiscal year). In certain circumstances, the Trust may elect to retain income or capital gain to the extent that the Board of Trustees, in consultation with Trust management, determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Trust for any particular period may be more than the amount of net investment income from that period. As a result, all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a common shareholder invested in the Trust, up to the amount of the common shareholder’s tax basis in their common shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the common shareholder’s potential gain, or reduce the common shareholder’s potential loss, on any subsequent sale or other disposition of common shares.

The distribution shall be paid on the Payment Date unless the payment of such distribution is deferred by the Board of Trustees upon a determination that such deferral is required in order to comply with applicable law to ensure that the Trust remains solvent and able to pay its debts as they become due and continue as a going concern, or to comply with the applicable terms or financial covenants of the Trust’s senior securities.

Future common share distributions will be made if and when declared by the Trust’s Board of Trustees, based on a consideration of number of factors, including the Trust’s continued compliance with terms and financial covenants of its senior securities, the Trust’s net investment income, financial performance and available cash. There can be no assurance that the amount or timing of common share distributions in the future will be equal or similar to that described herein or that the Board of Trustees will not decide to suspend or discontinue the payment of common share distributions in the future.

* * *

The investment objective of the Trust is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating rate credit instruments and other structured credit investments. There can be no assurance that the Trust will achieve its investment objective.

The Trust’s common shares are traded on the New York Stock Exchange under the symbol “XFLT,” and the Trust’s 6.50% Series 2026 Term Preferred Shares are traded on the New York Stock Exchange under the symbol “XFLTPRA”.

XA Investments LLC (“XAI”) serves as the Trust’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser. Octagon is a 30+ year old, $33.8B below-investment grade corporate credit investment adviser focused on leveraged loan, high yield bond and structured credit (CLO debt and equity) investments. Through fundamental credit analysis and active portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade asset classes, sectors and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable and scalable approach in its effort to generate attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Paralel Distributors, LLC - Distributor

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 888-903-3358

Email: KFlynn@XAInvestments.com

First time hearing about retail 3(c)(7) funds? It won’t be your last

First time hearing about retail 3(c)(7) funds? It won’t be your last

Retail 3(c)(7) funds will compete alongside interval funds and be of particular interest to cross-border managers.

By Kimberly Flynn, CFA

President, XA Investments

October 22, 2025

The new kid on the evergreen alts block is the retail 3(c)(7) fund.

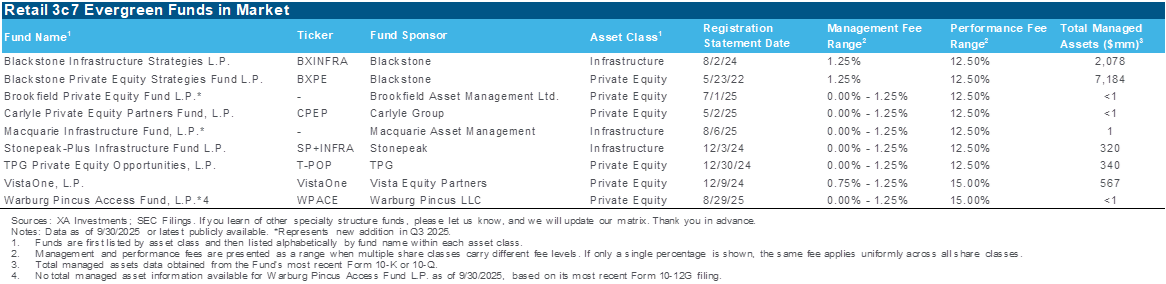

My team and I at XA Investments have observed a surge over the last year in launches of this type of specialty fund by leading alternative managers with ambitions to distribute products across the globe. Fund sponsors with new retail 3(c)(7) funds include Blackstone, Vista Equity Partners, and Stonepeak, among others.

These firms and others are turning to the retail 3(c)(7) evergreen structure to design their next private equity and infrastructure products for wealthy individuals to invest alongside family offices and institutional investors.

But, before we go any further, you might ask – what is a retail 3(c)(7) fund?

A retail 3(c)(7) fund refers to a private fund that files with the Securities and Exchange Commission (SEC) under the Exchange Act of 1934 to become a public filing entity and then reports to shareholders on Forms 10-Q, 10-K and 8-K. As such, a retail 3(c)(7) fund can be sold to an unlimited number of qualified purchasers. The ‘evergreen’ nature of the retail 3(c)(7) fund means that it is open-ended and shares some features with the interval fund, such as periodic liquidity. Most of the retail 3(c)(7) funds in the market today have monthly valuations and quarterly liquidity.

A strong appeal to investment managers of retail 3(c)(7) funds is the near-unlimited flexibility the structure allows for investment assets and strategies. In particular, and depending on their investment mandate, these funds can invest in asset classes ranging from private equity and private credit to direct cryptocurrency and luxury goods.

While interval funds have been leading the way in the evergreen democratization of alternatives trend, we expect asset growth in retail 3(c)(7) funds as well. As of September 30, the interval and tender offer fund market reached a new peak with 304 total funds and a combined $215bn in net assets. In total, there are 157 unique fund sponsors in the interval and tender offer fund market.

In the retail 3(c)(7) fund space, there are nine funds managed by eight unique fund sponsors with $10.4bn in combined assets. Blackstone leads the pack with two retail 3(c)(7) funds and dominates the assets with $9.3bn per the most recent SEC filings.

In 2025, we observed four new funds enter the retail 3(c)(7) fund market – including powerhouse firms such as Brookfield, Carlyle, Macquarie and Warburg Pincus. The newest crop of retail 3(c)(7) funds to launch is listed in the table below.

For the most part all these fund have management fees of up to 1.25, depending on share classes, and performance fees of 12.5%, with the exception of VistaOne and Warburg Pincus Access, which are 15%.

Based on XA Investment’s research with leading alternative asset managers, we expect the retail 3(c)(7) fund market to double in size in 2026. For some alternative investment boutiques, the launch of an interval fund may seem too large of a step for the organization. For firms with only drawdown funds, the evergreen retail 3(c)(7) fund may be viewed as an interim step that solves for broader access to a new audience of investors.

Underscoring the growth of these retail 3(c)(7) funds, certain wealth management businesses like JP Morgan, Citi, Goldman and UBS want alternative investment products built for sale inside and outside of the US. For fund sponsors with global distribution footprints, the retail 3(c)(7) fund can help facilitate sales and distribution efforts in the US and Europe. The retail 3(c)(7) funds can be particularly flexible when paired with offshore feeders to solve various distribution and sales challenges that ex-US registered fund structures, such as Ucits, may not be attuned to solve.

Around the world, a new crop of regulated investment funds have come to market to allow individual investors to access private market investments. In the US., there are interval and tender offer funds. In the UK, there are LTAFs – Long-Term Asset funds. Elsewhere in Europe, there are ELTIFs – European Long-Term Investment funds.

Similar to other private funds, retail 3(c)(7) funds can be set up to be sold broadly and across borders with often only disclosure obligations being localized. If this is your first time reading about retail 3(c)(7) funds, it will not be your last as we anticipate continued growth in this part of the evergreen alts market.

XAI Madison Equity Premium Income Fund Will Host its Q3 2025 Quarterly Webinar on November 6, 2025

October 23, 2025 Chicago – XAI Madison Equity Premium Income Fund (NYSE: MCN) (the “Fund”) today announced that it plans to host the Fund’s Quarterly Webinar on November 6, 2025 at 11:00 am (Eastern Time). Jared Hagen, Vice President at XA Investments (“XAI”) will moderate the Q&A style webinar with Kimberly Flynn, President at XAI, and Ray Di Bernardo, Portfolio Manager at Madison Investments.

TO JOIN VIA WEB: Please go to the Knowledge Bank section of xainvestments.com or click here to find the online registration link.

TO USE YOUR TELEPHONE: After joining via web, if you prefer to use your phone for audio, you must select that option and call in using a number below, based on your current location.

Dial: (312)-626-6799 or (646)-558-8656 or (267)-831-0333 or (720)-928-9299 or

(213)-338-8477

Webinar ID: 816 6845 2994

REPLAY: A replay of the webinar will be available in the Knowledge Bank section of xainvestments.com.

* * *

The Fund's primary investment objective is to provide a high level of current income and gains, with a secondary objective of capital appreciation. The Fund pursues its investment objectives by investing in a portfolio consisting primarily of high quality, large and mid-capitalization stocks that are, in the view of the Fund's Investment sub-adviser, selling at a reasonable price in relation to their long-term earnings growth rates. The Fund will, on an ongoing and consistent basis, sell covered call options on its portfolio stocks to seek to generate current earnings from option premiums. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s common shares are traded on the New York Stock Exchange under the symbol MCN.

About XA Investments

XA Investments LLC (“XAI”) is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund, respectively the XAI Octagon Floating Rate & Alternative Income Trust, the XAI Madison Equity Premium Income Fund, and the Octagon XAI CLO Income Fund. In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including product development and market research, marketing and fund management. XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Madison Investments

Madison Investments (Madison) is an independent investment management firm based in Madison, Wisconsin. The firm was founded in 1974, has approximately $29.6 billion in assets under management as of September 30, 2025, and is recognized as one of the nation’s top investment firms. The firm has managed covered call strategies for over 20 years through various market cycles. Madison offers domestic fixed income, U.S. and international equity, covered call, multi-asset, insurance, and credit union investment management strategies. For more information, please visit www.madisonfunds.com.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

| NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

Paralel Distributors, LLC - Distributor

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 312-374-6931

Email: kflynn@xainvestments.com

XA Investments Reports a Record 300+ Interval / Tender Offer Funds in its Third Quarter 2025 Market Update

Interval and Tender Offer Fund Market Reaches New Milestones, Sees Interval Fund Dominance and Shift Toward Greater Investor Accessibility

CHICAGO, October 16, 2025 – XA Investments LLC (“XAI”), an alternative investment management and consulting firm, announced the publication of its latest research report, the XAI Non-Listed Closed-End Fund Third Quarter 2025 Market Update. The report covers interval fund market trends and notes that marketwide fund counts exceed 300 funds, a milestone that shows the dominance of daily valued interval funds due to demand for greater investor accessibility.

“The interval and tender offer fund market reached a major milestone of 304 funds, showing the increased popularity of interval and tender offer funds in recent years” stated Kimberly Flynn, the president of XAI. “As more assets continue to flow into the interval / tender offer fund market, we believe the market's trajectory will remain positive, with significant opportunities for expansion throughout the rest of the year and in 2026,” she added.

XAI’s market update is a comprehensive research report detailing current market trends and industry highlights. The non-listed closed-end fund (CEF) market includes all interval and tender offer funds. The report highlights new fund sponsors entering the interval fund market and gives a comprehensive market update.

The non-listed CEF market now stands at a combined net assets of $215 billion and $252 billion in total managed assets, inclusive of leverage, as of September 30, 2025. The market includes 158 interval funds which comprise 58% of the total managed assets at $145.9 billion and 146 tender offer funds which comprise the other 42% with $105.7 billion in total managed assets. Market-wide net assets increased $19 billion in Q3 2025 from the prior quarter.

Daily valued interval funds have now overtaken the number of tender offer funds in the market, because of strong investor preference for electronic ticketing. In Q3 2025, 20 new funds entered the market, 70% of which were interval funds. Among the new funds launched in Q3 2025, there were seven new fund sponsors, including Adams Street Partners, Blue Owl, and Coatue.

Alternative investment firms continue to dominate the interval fund market with 69% market share. In total, there are 157 unique fund sponsors in the interval and tender offer fund space, with 57 fund sponsors that have two or more interval and/or tender offer funds currently in the market. Twenty new funds launched this quarter, with the most, 11 funds, launching in the credit category. Newly launched non-listed CEFs spent around seven months in the SEC registration process.

“The number of funds in the SEC registration process decreased by 10 funds from 51 at the end of Q2 2025 to 41 at the end of Q3 2025. This is due to the high number of funds launching and the slowing number of new registrations,” Flynn noted. “With the recent government shutdown, the time spent in the SEC registration process will likely increase, as initial registration statements will not be reviewed and Statements of Effectiveness will not be issued. New funds also cannot secure EDGAR codes and therefore must wait to file with the SEC.” she added.

As the interval fund market expands and diversifies, the market share of the top 20 funds continues to decrease, falling to 58% in Q3 2025 from 59% in Q2 2025. In aggregate, the top 20 largest interval/tender offer funds accounted for 38% of total net flows including many of the market leaders such as the Cliffwater Corporate Lending Fund, Partners Group Private Equity, LLC, and ACAP Strategic Fund.

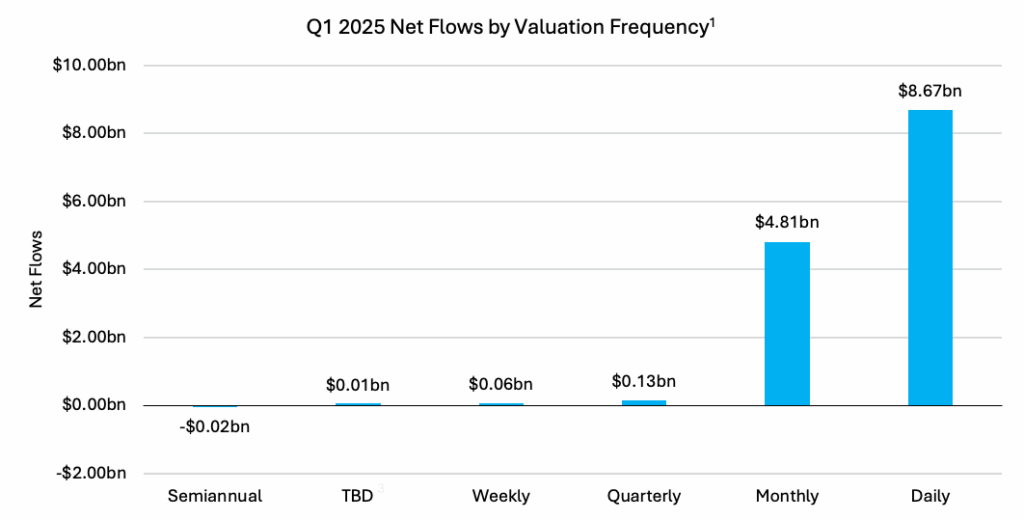

In the report, XAI covers the Q2 2025 net flows which are lagged by reporting cycles. Interval and tender offer funds had positive net flows, totaling over $13 billion, with 63% of funds reporting positive net flows. Funds with a monthly net asset value (NAV) performed well in Q2 2025, accounting for 49% of net flows, up from 37% in Q1 2025. Daily NAV funds continued to perform well in Q2 2025, also accounting for 49% of net flows.

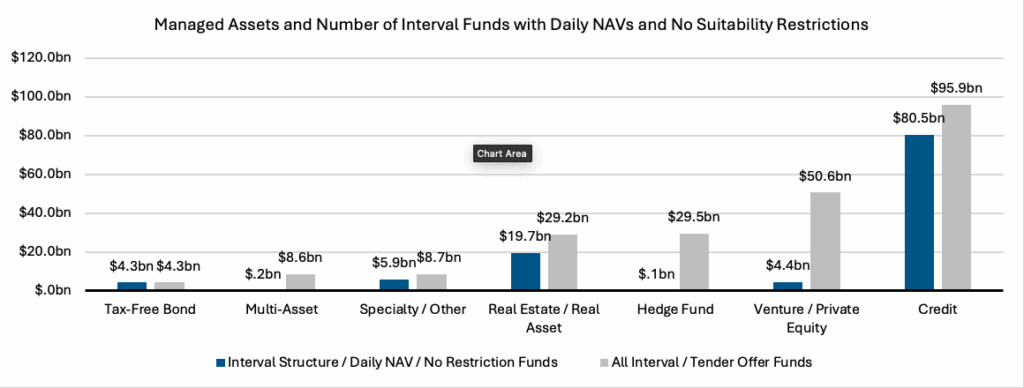

At 55%, the majority of interval and tender offer funds do not have any suitability restrictions for investors imposed at the fund level with 26% of funds available to accredited investors and 19% only available to qualified clients. Since the change in a SEC staff position in Q2 2025, 16 funds have filed prospectus supplements removing accredited investor requirements. As the accredited investor designation is now largely self-imposed, XAI expects to see the number of funds with accredited investor limitations to decrease and the number of funds with no suitability restrictions to increase.

According to Flynn, “We expect more funds to reduce their suitability requirements in the next six months and for many new funds filed to forgo accredited investor requirements.” Alternative funds without suitability restrictions also prove to be more accessible and have gathered more assets at $147.7 billion in managed assets or 59% of market-wide assets.

For more information on the interval fund market and to read our full quarterly report on non-listed CEFs, please visit the CEF Market research page linked here and click ‘Subscribe’ for access to XA Investments’ online research portal and pricing information. In addition, please contact info@xainvestments.com or 888-903-3358 with questions.

About XA Investments

XA Investments LLC (“XAI”) is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund, respectively the XAI Octagon Floating Rate & Alternative Income Trust, the XAI Madison Equity Premium Income Fund, and the Octagon XAI CLO Income Fund. In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including product development and market research, marketing and fund management. XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. For more information, please visit www.xainvestments.com.

CONTACT: Kim Shepherd

312-623-5123

Ignites: ProShares Launches First Interval Fund with ETF, PE Exposure

October 6, 2025

David Isenberg of Ignites reports that ProShares, long recognized for its ETF innovation, is launching its first interval fund — a vehicle that will allocate at least 80% to private equity strategies such as buyout, growth, and secondaries.

XA Investments President Kimberly Flynn commented that while ProShares is a well-known ETF sponsor, “we do not see many ETF-focused firms in the interval fund market,” noting that “the interval fund sales process is radically different than the ETF sales process.”

Flynn added that scaling these products can be challenging — funds often need to reach about $100 million in assets before breaking even — and expects the ETF allocation mentioned in the filing to be “modest,” with most exposure coming from direct private equity investments via secondaries and primaries.

ProShares’ launch highlights a continued trend of asset managers expanding into the semi-liquid private markets space, leveraging interval funds to provide broader investor access to alternatives.

To read the full article: Click here

XAI Madison Equity Premium Income Fund Declares its Monthly Distribution of $0.060 per Share

October 1, 2025, Chicago – XAI Madison Equity Premium Income Fund (the “Fund”) has declared its regular monthly distribution of $0.060 per share on the Fund’s common shares (NYSE: MCN), payable on November 3, 2025, to common shareholders of record as of October 15, 2025, as noted below. The amount of the distribution represents no change from the previous month’s distribution amount of $0.060 per share.

As mentioned in previous distribution declarations, the Fund has changed its distribution frequency from quarterly to monthly, which went into effect with the April 1, 2025 declaration. XA Investments believes this change enables investors to better manage their cash flow needs.

The following dates apply to the declaration:

Ex-Dividend Date October 15, 2025

Record Date October 15, 2025

Payable Date November 03, 2025

Amount $0.060 per share

Change from Previous Month No Change

Common share distributions may be paid from net investment income (regular interest and dividends), capital gains and/or a return of capital. The specific tax characteristics of the distributions will be reported to the Fund’s common shareholders on Form 1099 after the end of the 2025 calendar year. Shareholders should not assume that the source of a distribution from the Fund is net income or profit. For further information regarding the Fund’s distributions, please visit www.xainvestments.com.

* * *

The Fund’s net investment income and capital gain can vary significantly over time; however, the Fund seeks to maintain more stable common share quarterly distributions over time. The Fund’s final taxable income for the current fiscal year will not be known until the Fund’s tax returns are filed.

As a registered investment company, the Fund is subject to a 4% excise tax that is imposed if the Fund does not distribute to common shareholders by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on December 31 of the calendar year (unless an election is made to use the Fund’s fiscal year). In certain circumstances, the Fund may elect to retain income or capital gain to the extent that the Board of Trustees, in consultation with Fund management, determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Fund for any particular period may be more than the amount of net investment income from that period. As a result, all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a common shareholder invested in the Fund, up to the amount of the common shareholder’s tax basis in their common shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the common shareholder’s potential gain, or reduce the common shareholder’s potential loss, on any subsequent sale or other disposition of common shares.

Future common share distributions will be made if and when declared by the Fund’s Board of Trustees, after the evaluation of several factors, including the Fund’s net investment income, financial performance and available cash. There can be no assurance that the amount or timing of common share distributions in the future will be equal or similar to that described herein or that the Board of Trustees will not decide to suspend or discontinue the payment of common share distributions in the future.

* * *

The Fund’s objective is to achieve a high level of current income and current capital gains, with long-term capital appreciation as a secondary objective. The Fund intends to pursue its objective by investing in a portfolio of common stocks and utilizing an option strategy, primarily by writing (selling) covered call options on a substantial portion of the common stocks in the portfolio in order to generate current income and gains from option writing premiums and, to a lesser extent, from dividends. Market action can impact dividend issuance as the Fund’s total assets affect the Fund’s future dividend prospects. The Fund provides additional information on its website at www.xainvestments.com.

About XA Investments

XA Investments LLC (“XAI”) serves as the Fund’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Madison Investments

Madison Investments is an independent investment management firm based in Madison, WI. The firm was founded in 1974, has approximately $29.3 billion in assets under management as of June 30, 2025, and is recognized as one of the nation’s top investment firms. Madison offers domestic fixed income, U.S. and international equity, covered call, multi-asset, insurance and credit union investment management strategies. For more information, please visit www.madisoninvestments.com.

Madison and/or Madison Investments is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC, and Madison Investment Advisors, LLC. Madison Funds are distributed by MFD Distributor, LLC. Madison is registered as an investment adviser with the U.S. Securities and Exchange Commission. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority www.finra.org.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Fund carefully before investing. For more information on the Fund, please visit the Fund’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 888-903-3358

Email: KFlynn@XAInvestments.com

XAI Octagon Floating Rate & Alternative Income Trust Declares its Monthly Common Shares Distribution and Quarterly Preferred Shares Dividend

October 1, 2025, Chicago – XAI Octagon Floating Rate & Alternative Income Trust (the “Trust”) has declared its regular monthly distribution of $0.070 per share of the Trust’s common shares (NYSE: XFLT). The Trust also declared preferred dividends for the quarter of $0.40625 per share of the Trust’s 6.50% Series 2026 Term Preferred Shares (NYSE: XFLTPRA).

The following dates apply to each declaration:

| Share Class | Ex-Dividend Date | Record Date | Payable Date | Amount | Change from Previous Declaration |

| XFLT | October 15, 2025 | October 15, 2025 | November 3, 2025 | $0.070 | No Change |

| XFLTPRA | October 15, 2025 | October 15, 2025 | October 31, 2025 | $0.40625 | No Change[1] |

[1] The Trust’s 6.50% Series 2026 Term Preferred Shares dividend is calculated based on the preferred shares Liquidation Preference of $25.00 per share and the fixed dividend rate of 6.50%.

Common share distributions may be paid from net investment income (regular interest and dividends), capital gains and/or a return of capital. The specific tax characteristics of the distributions will be reported to the Trust’s common shareholders on Form 1099 after the end of the 2025 calendar year. Shareholders should not assume that the source of a distribution from the Trust is net income or profit. For further information regarding the Trust’s distributions, please visit www.xainvestments.com.

The Trust’s net investment income and capital gain can vary significantly over time; however, the Trust seeks to maintain more stable common share monthly distributions over time. The Trust’s investments in CLOs are subject to complex tax rules and the calculation of taxable income attributed to an investment in CLO subordinated notes can be dramatically different from the calculation of income for financial reporting purposes under accounting principles generally accepted in the United States (“U.S. GAAP”), and, as a result, there may be significant differences between the Trust’s GAAP income and its taxable income. The Trust’s final taxable income for the current fiscal year will not be known until the Trust’s tax returns are filed.

As a registered investment company, the Trust is subject to a 4% excise tax that is imposed if the Trust does not distribute to common shareholders by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on January 31 of the calendar year (unless an election is made to use the Trust’s fiscal year). In certain circumstances, the Trust may elect to retain income or capital gain to the extent that the Board of Trustees, in consultation with Trust management, determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Trust for any particular period may be more than the amount of net investment income from that period. As a result, all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a common shareholder invested in the Trust, up to the amount of the common shareholder’s tax basis in their common shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the common shareholder’s potential gain, or reduce the common shareholder’s potential loss, on any subsequent sale or other disposition of common shares.

Preferred shareholders are entitled to receive cumulative cash dividends and distributions on the Trust’s 6.50% Series 2026 Term Preferred Shares, when, as and if declared by, or under authority granted by, the Board of Trustees of the Trust out of funds legally available for distribution and in preference to dividends and distributions on common shares. If the Trust is unable to distribute the full dividend amount due in a dividend period on the Trust’s 6.50% Series 2026 Term Preferred Shares, the dividends will be distributed on a pro rata basis among the preferred shareholders.

Distributions and dividends shall be paid on the Payable Date listed above unless the payment of such distribution or dividend is deferred by the Board of Trustees upon a determination that such deferral is required in order to comply with applicable law, to ensure that the Trust remains solvent and able to pay its debts as they become due and continue as a going concern or, with regard to the Trust’s regular monthly distribution to common shareholders, to comply with the applicable terms or financial covenants of the Trust’s senior securities.

Future common share distributions will be made if and when declared by the Trust’s Board of Trustees, after the evaluation of several factors, including the Trust’s continued compliance with terms and financial covenants of its senior securities, the Trust’s net investment income, financial performance and available cash. There can be no assurance that the amount or timing of common share distributions in the future will be equal or similar to that described herein or that the Board of Trustees will not decide to suspend or discontinue the payment of common share distributions in the future.

* * *

The investment objective of the Trust is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating rate credit instruments and other structured credit investments. There can be no assurance that the Trust will achieve its investment objective.

The Trust’s common shares are traded on the New York Stock Exchange under the symbol “XFLT,” and the Trust’s 6.50% Series 2026 Term Preferred Shares are traded on the New York Stock Exchange under the symbol “XFLTPRA.”

About XA Investments

XA Investments LLC (“XAI”) serves as the Trust’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser. Octagon is a 30+ year old, $33.0B below-investment grade corporate credit investment adviser focused on leveraged loan, high yield bond and structured credit (CLO debt and equity) investments. Through fundamental credit analysis and active portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade asset classes, sectors and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable and scalable approach in its effort to generate attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Paralel Distributors, LLC - Distributor

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 888-903-3358

Email: KFlynn@XAInvestments.com

XAI Octagon Floating Rate & Alternative Income Trust Announces Private Placement of $73 Million of Mandatory Redeemable Preferred Shares

CHICAGO, Illinois – October 1, 2025 – XAI Octagon Floating Rate & Alternative Income Trust (the “Trust”) (NYSE: XFLT), a diversified, closed-end management investment company with an investment objective to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle, has reached an agreement with certain institutional investors for the purchase and sale of 7,300,000 shares of the Trust’s 5.92% Series A Mandatory Redeemable Preferred Shares due January 31, 2031 (the “Mandatory Redeemable Preferred Shares”), liquidation preference $10.00 per share. The Trust expects to receive net proceeds (before expenses) from the sale of the Mandatory Redeemable Preferred Shares of approximately $71.5 million. The investors have agreed to purchase the Mandatory Redeemable Preferred Shares, at one or more closings on or before December 18, 2025.

The Mandatory Redeemable Preferred Shares pay a quarterly dividend at a fixed annual rate of 5.92% of the liquidation preference, or $0.5920 per share, per year.

The Trust will be required to redeem, out of funds legally available therefor, all outstanding Mandatory Redeemable Preferred Shares on January 31, 2031, or the “Term Redemption Date,” at a price equal to the liquidation preference plus an amount equal to accumulated but unpaid dividends and distributions, if any, on such shares (whether or not earned or declared, but excluding interest on such dividends) to, but excluding, the Term Redemption Date.

Moelis & Company LLC acted as the exclusive placement agent for the offering.

At any time on or after the first issuance of Mandatory Redeemable Preferred Shares, at the Trust’s sole option, the Trust may redeem, from time to time, the Mandatory Redeemable Preferred Shares in whole or in part, out of funds legally available for such redemption, at a price per share equal to the sum of the liquidation preference, subject to payment of a make-whole premium, plus an amount equal to accumulated but unpaid dividends, if any, on such shares (whether or not earned or declared, but excluding interest on such dividends) to, but excluding, the date fixed for such redemption.

Net proceeds will be used to refinance existing leverage and for general corporate purposes.

Closing of this transaction is subject to completion of legal documentation and other standard closing conditions.

Additional information regarding the Mandatory Redeemable Preferred Shares will be included in a Current Report on Form 8-K to be filed with the U.S. Securities and Exchange Commission (“SEC”).

The Mandatory Redeemable Preferred Shares are being issued in reliance upon an exemption from registration under the Securities Act of 1933 (the “Securities Act”) and have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration with the SEC or an applicable exemption from such registration requirements.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy the Mandatory Redeemable Preferred Shares, nor shall there be any sale of Mandatory Redeemable Preferred Shares in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction.

About XA Investments

XA Investments LLC (“XAI”) serves as the Trust’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser. Octagon is a 30+ year old, $33.0B below-investment grade corporate credit investment adviser focused on leveraged loan, high yield bond and structured credit (CLO debt and equity) investments. Through fundamental credit analysis and active portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade asset classes, sectors and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable and scalable approach in its effort to generate attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

* * *

Media Contact:

Kimberly Flynn, President

XA Investments LLC

Phone: 888-903-3358

Email: kflynn@XAInvestments.com

www.xainvestments.com

Ignites: SEC Probes Interval Fund Valuation, Liquidity

September 29, 2025

Sabrina Kharrazi reports on the SEC’s ongoing examinations of interval funds, which are focusing on valuation practices, repurchase-offer materials, board governance procedures, and other compliance documentation. The heightened scrutiny comes amid the sector’s rapid expansion, with regulators signaling greater oversight as more retail investors gain access to alternative strategies through ’40 Act vehicles.

The SEC has issued broad exam requests covering fees, expenses, co-investments, cross-trades, client account data, and detailed valuation policies. These inquiries reflect the regulator’s growing focus on ensuring that interval fund sponsors adhere to proper governance and valuation standards as retail access expands. According to XA Investments’ research 50 interval and tender offer funds launched in 2024, the surge in interval funds making the sector a natural area for heightened regulatory attention.

Benjamin McCulloch, Managing Director, General Counsel and Chief Compliance Officer at XA Investments, underscored that valuations are emerging as the key pressure point. “It really seems like the core focus of the SEC and industry discussions is on valuations: how firms implement and document the process to make sure it stands up to scrutiny,” he said.

The SEC’s document requests have also extended to annual compliance officer reports, internal audit reviews, valuation testing, co-investment records, and fund board minutes. While some experts suggested the breadth of the requests aligns with standard SEC exam procedures, the intensity underscores that interval funds—given their rapid growth and retail orientation—are squarely in the regulator’s sights.

To read the full article: Click here

Ignites: Access Isn’t Enough – Interval Funds Enter ‘Outcome’ Era

Brian Ponte reports on the evolution of the $227 billion interval and tender offer fund market, which is shifting from a focus on simple access to alternative assets toward an emphasis on outcomes. While investors have flocked to private credit, issuers are increasingly exploring differentiated strategies and hybrid approaches to maintain growth and relevance.

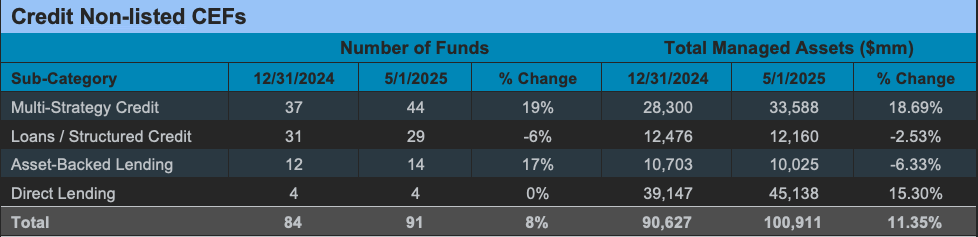

There are now 288 interval and tender offer funds in the market, including 46 launched in the past year, according to XA Investments data. Of those new funds, 46% are focused on private credit. First-quarter flows underscore the trend, with $3.6 billion directed to direct lending funds and another $3 billion to multi-strategy credit and asset-backed lending vehicles, XA Investments research shows.

Fund managers are beginning to diversify beyond credit. Kimberly Flynn, president at XA Investments, noted that private equity and hedge fund replication strategies are growing. She also pointed to “white space” opportunities in sector-specific or thematic funds, highlighting recent filings for products targeting robotics, AI, and sports media.

Despite innovation, fees remain high. The average management fee for non-listed closed-end funds is 123 basis points, and the average net expense ratio is 244 basis points, according to XA Investments data. Credit remains the largest segment of the market, with $95.9 billion in assets across 96 funds, XA Investments research shows.

To read the full article: Click here

FundFire: Is Robinhood’s Venture Fund an Outlier or Semi-Liquid Market Rival?

Tom Stabile reports on Robinhood’s filing for its first venture capital fund, structured as a listed closed-end fund, which departs from the dominant non-traded semi-liquid models. The strategy aims to provide individual investors with access to high-profile private companies, while raising questions about valuation, premiums, and investor protections.

The Robinhood Ventures Fund I would list on the NYSE and invest in a concentrated portfolio of private growth companies. Unlike interval or tender offer funds, it would not run redemption mechanisms or daily NAV strikes, instead trading on the exchange with a quarterly NAV calculation.

Kimberly Flynn, president at XA Investments, noted the unique fundraising dynamics of Robinhood’s approach. Because most capital is likely to come directly from Robinhood users, the fund may initially trade at a sizable premium. “It’s one thing to innovate, but we have to appreciate when listed CEFs are successful, what makes them successful,” she said.

Flynn also cautioned about trading volatility. “This one may trade at a good premium at first, but that could become a massive discount,” she said.

The article further cited XA Investments research into similar closed-end fund launches. Destiny XYZ’s Destiny Tech100 fund, for example, listed at a massive premium to NAV—up to 25 times—before falling sharply, leaving early investors with significant losses. According to an XA analysis, the fund still trades at a 4-times premium but far below its peak valuation.

Flynn added that Robinhood’s direct-to-investor distribution model sets it apart from traditional listed CEF launches, which typically go through underwriters and financial advisors. That uniqueness may influence both adoption and price volatility in the secondary market.

To read the full article: Click here

XAI Octagon Floating Rate & Alternative Income Trust Declares its Monthly Common Shares Distribution of $0.070 per Share

September 2, 2025, Chicago – XAI Octagon Floating Rate & Alternative Income Trust (the “Trust”) has declared its regular monthly distribution of $0.070 per share on the Trust’s common shares (NYSE: XFLT), payable on October 1, 2025, to common shareholders of record as of September 16, 2025, as noted below. The amount of the distribution represents no change from the previous month's distribution amount of $0.070 per share.

The following dates apply to the declaration:

Ex-Dividend Date September 16, 2025

Record Date September 16, 2025

Payable Date October 1, 2025

Amount $0.070 per common share

Change from Previous Month No change

Common share distributions may be paid from net investment income (regular interest and dividends), capital gains and/or a return of capital. The specific tax characteristics of the distributions will be reported to the Trust’s common shareholders on Form 1099 after the end of the 2025 calendar year. Shareholders should not assume that the source of a distribution from the Trust is net income or profit. For further information regarding the Trust’s distributions, please visit www.xainvestments.com.

* * *

The Trust’s net investment income and capital gain can vary significantly over time; however, the Trust seeks to maintain more stable common share monthly distributions over time. The Trust’s investments in CLOs are subject to complex tax rules and the calculation of taxable income attributed to an investment in CLO subordinated notes can be dramatically different from the calculation of income for financial reporting purposes under accounting principles generally accepted in the United States (“U.S. GAAP”), and, as a result, there may be significant differences between the Trust’s GAAP income and its taxable income. The Trust’s final taxable income for the current fiscal year will not be known until the Trust’s tax returns are filed.

As a registered investment company, the Trust is subject to a 4% excise tax that is imposed if the Trust does not distribute to common shareholders by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year (unless an election is made to use the Trust’s fiscal year). In certain circumstances, the Trust may elect to retain income or capital gain to the extent that the Board of Trustees, in consultation with Trust management, determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Trust for any particular period may be more than the amount of net investment income from that period. As a result, all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a common shareholder invested in the Trust, up to the amount of the common shareholder’s tax basis in their common shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the common shareholder’s potential gain, or reduce the common shareholder’s potential loss, on any subsequent sale or other disposition of common shares.

The distribution shall be paid on the Payment Date unless the payment of such distribution is deferred by the Board of Trustees upon a determination that such deferral is required in order to comply with applicable law to ensure that the Trust remains solvent and able to pay its debts as they become due and continue as a going concern, or to comply with the applicable terms or financial covenants of the Trust’s senior securities.

Future common share distributions will be made if and when declared by the Trust’s Board of Trustees, based on a consideration of number of factors, including the Trust’s continued compliance with terms and financial covenants of its senior securities, the Trust’s net investment income, financial performance and available cash. There can be no assurance that the amount or timing of common share distributions in the future will be equal or similar to that described herein or that the Board of Trustees will not decide to suspend or discontinue the payment of common share distributions in the future.

* * *

The investment objective of the Trust is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating rate credit instruments and other structured credit investments. There can be no assurance that the Trust will achieve its investment objective.

The Trust’s common shares are traded on the New York Stock Exchange under the symbol “XFLT,” and the Trust’s 6.50% Series 2026 Term Preferred Shares are traded on the New York Stock Exchange under the symbol “XFLTPRA”.

XA Investments LLC (“XAI”) serves as the Trust’s investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in 2016. XAI serves as the investment adviser for two listed closed-end funds and an interval closed-end fund. The listed closed-end funds, the XAI Octagon Floating Rate & Alternative Income Trust and XAI Madison Equity Premium Income Fund both trade on the New York Stock Exchange and the interval fund, Octagon XAI CLO Income Fund is available via direct subscription and through select broker/dealers and wealth management platforms.

In addition to investment advisory services, the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet institutional client needs. XAI offers custom product build and consulting services, including development and market research, sales, marketing, and fund management.

XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information, please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent, financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser. Octagon is a 25+ year old, $32.6B below-investment grade corporate credit investment adviser focused on leveraged loan, high yield bond and structured credit (CLO debt and equity) investments. Through fundamental credit analysis and active portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade asset classes, sectors and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable and scalable approach in its effort to generate attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

* * *

XAI does not provide tax advice; please consult a professional tax advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum tax.